December 2025

Market Update

Transportation Trends

General Outlook

- Colder weather and the Christmas season will have an impact on the freight market.

- Capacity continues to tighten.

- Tariff-related delays may impact production, putting pressure on prices.

- Retail spending up to 4.53%

- Labor market:

- Unemployment increased to 4.46% in November.

- Healthcare and social assistance sectors remain strong.

- 30-year fixed mortgage is at 6.26% in December.

- 15-year fixed mortgage is at 5.37%-5.63%.

LTL

- Current Market

- ODFL experienced a drop of 10% in tonnage in November, XPO was down 5.4%.

- Saia and ABF reported modest increases of 1.8% and 3%.

- Demand is still having an impact on outbound volume, however many carriers like ODFL and ABF maintain strict yield strategies.

- NMFC reclassification updates are changing the LTL pricing is shifting to more of a density-based program.

- It is very important to get a better understanding of your dimensions to avoid additional cost.

- Key Takeaways

- Look to lock in contractual pricing were appropriate.

- Review your packaging and dimensions to take advantage of the density-based pricing.

- Continue to build carrier relationships as the market continues to make changes.

- Invest or partner with a company to better utilize automation to help control cost.

Truckload

- Current Market

- Capacity continues to tighten for the TL market.

- Tender Rejection by Mode:

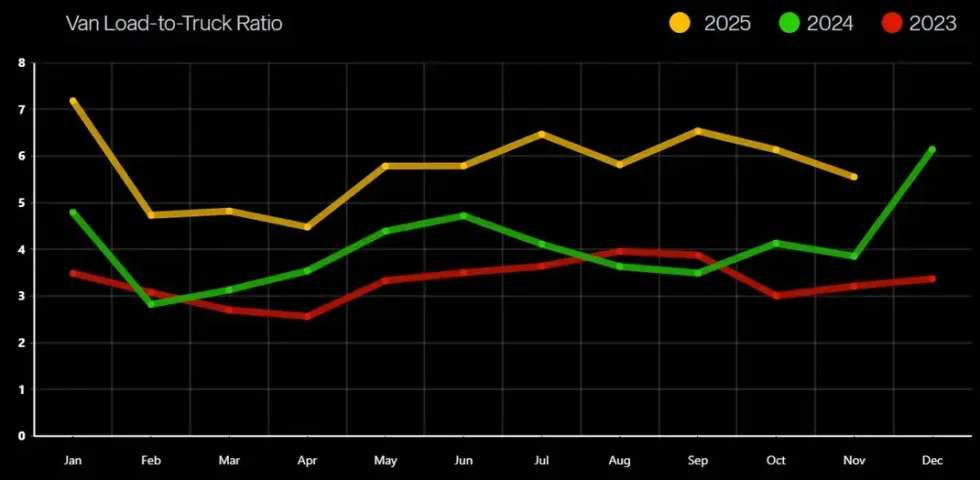

- Van rose 7%

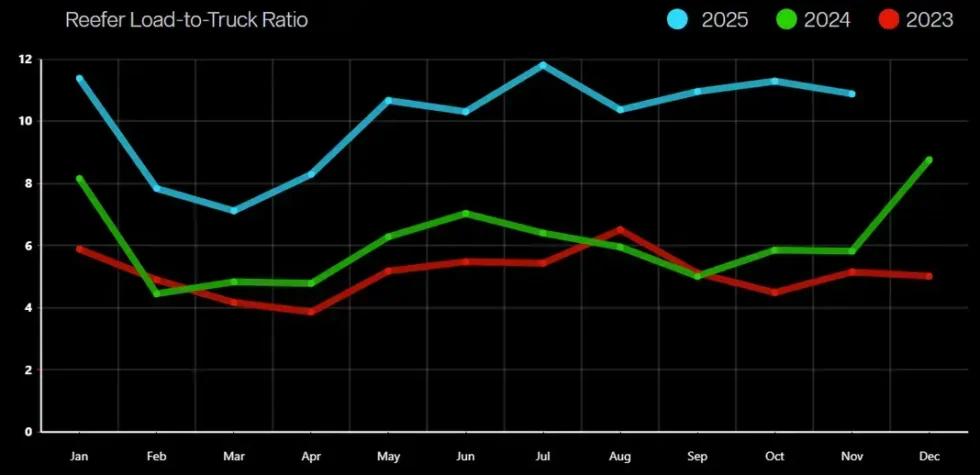

- Reefer rose 14-15%

- Flatbed rose 13-14%

- Freight volume down 6% in 2025 and 4% in December.

- Rates continue to remain strong based on the capacity in the market.

- Tender Rejection by Mode:

- Capacity continues to tighten for the TL market.

- Key Takeaways

- The TL market is at risk due to increased costs and lack of capacity.

- Technology will be key to driving compliance with core carriers.

- Start your planning now! Find a partner that can provide you with technology, visibility, and sustainability in a volatile market.

SONAR

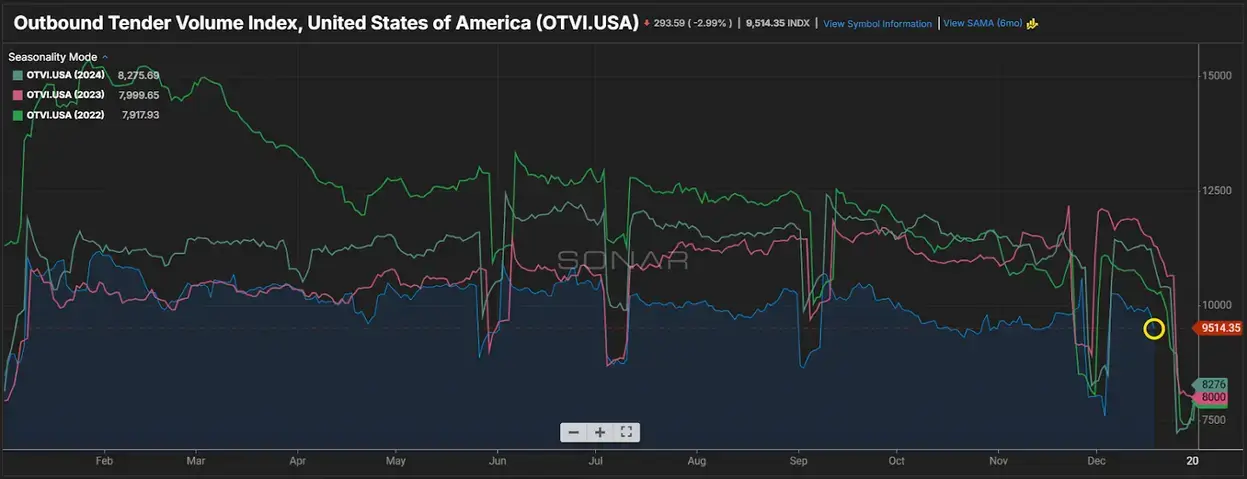

Outbound Tender Volume - All Modes

- Outbound tender volume drop, but capacity remains tight in the market. Volume continues to ride below historic trends.

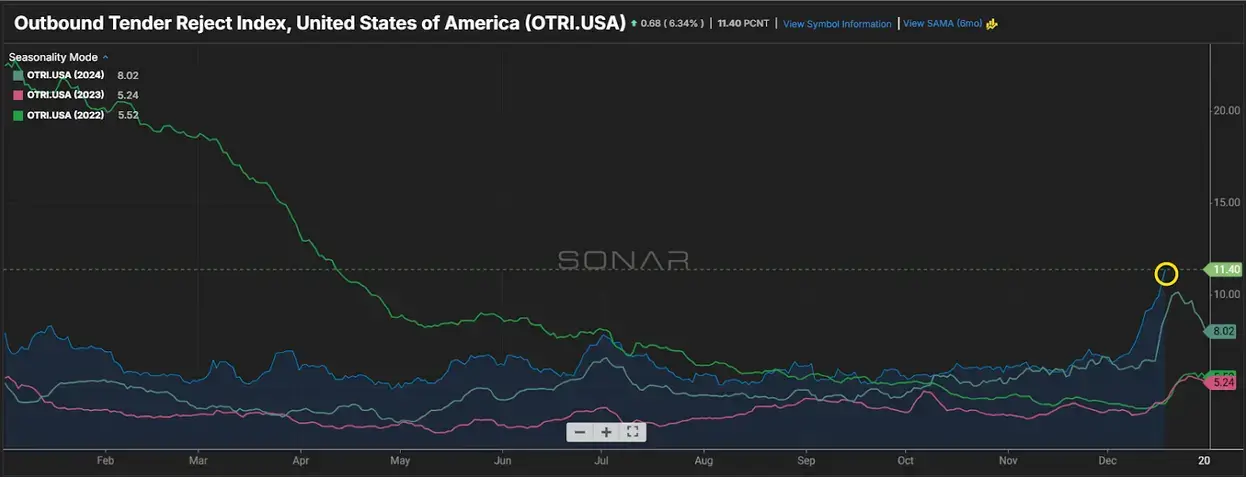

Outbound Tender Reject - All Modes

- Overall Rejects spike as we head into the final weeks of December.

- Capacity has had a large impact on the rejections, despite the overall volume in 2025 being down vs. historical trends.

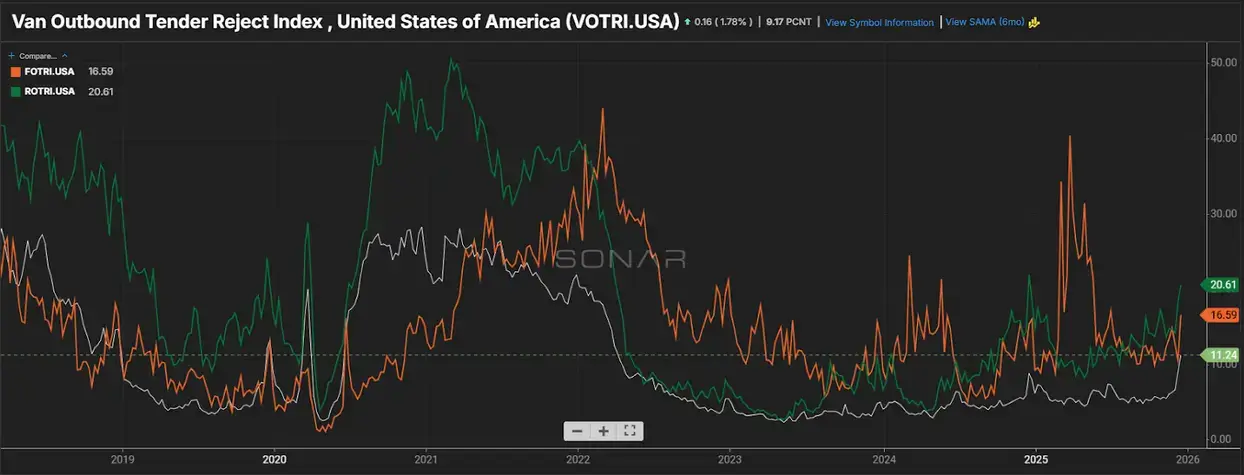

Outbound Tender Reject – by Mode

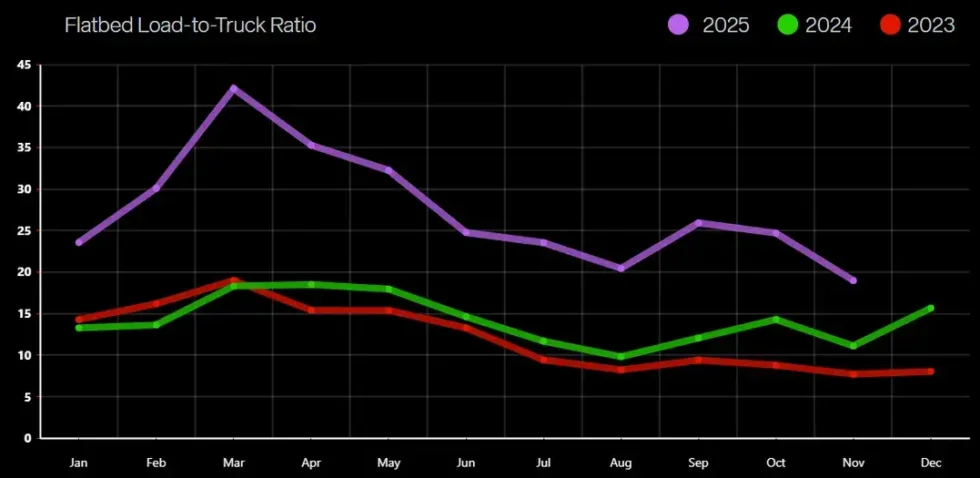

- Orange Line – Flatbed: Rejections up vs. this same time last year.

- Very important to keep a close eye on the overall outbound volume to insure you are securing capacity in this market.

- Green line – Reefer: Rejections for Reefer up significantly this month vs. last month.

- Similar to flatbed, increased outbound volume will have a significant impact on capacity in the Reefer space.

- White line – Van: Van Rejections remain up this month vs. last month.

- Rejections continue to fluctuate month- over-month but remain flat since the start of this year.

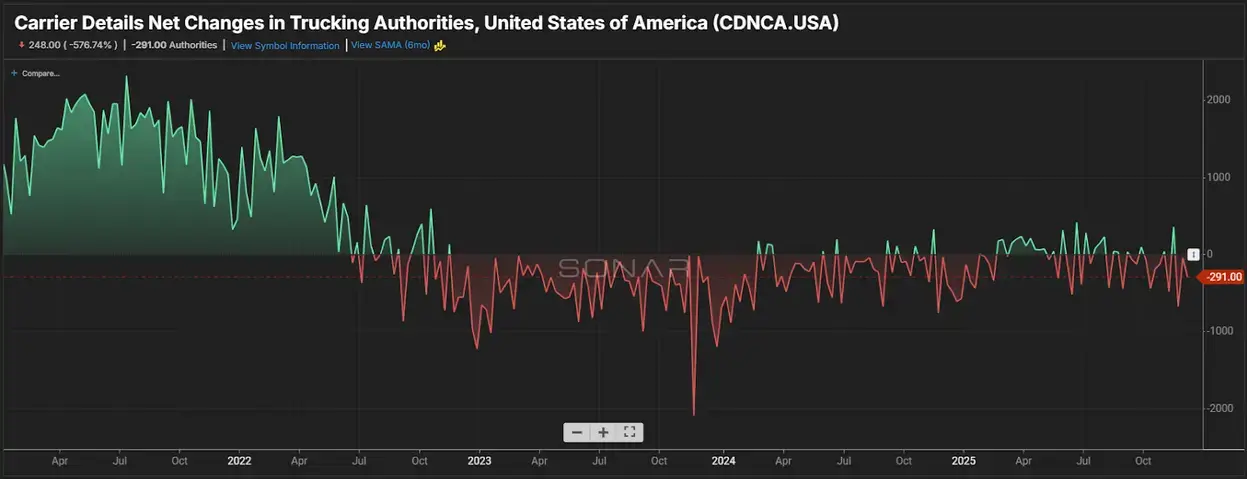

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Authorities continue to drop which is causing rejections to increase despite the overall volume decrease compared to 2024.

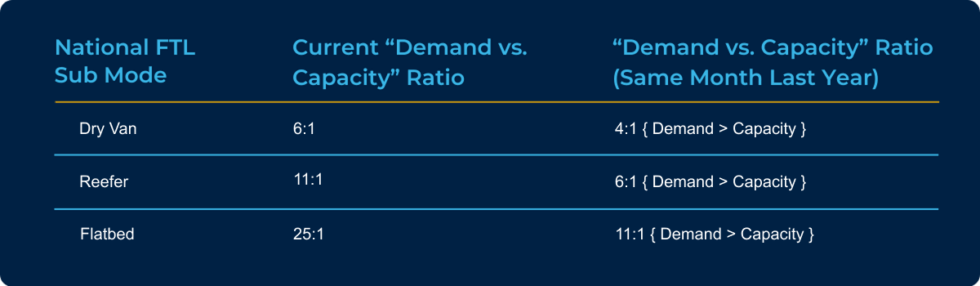

Demand vs. Capacity Metrics - October 2025

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

International

- Current Market

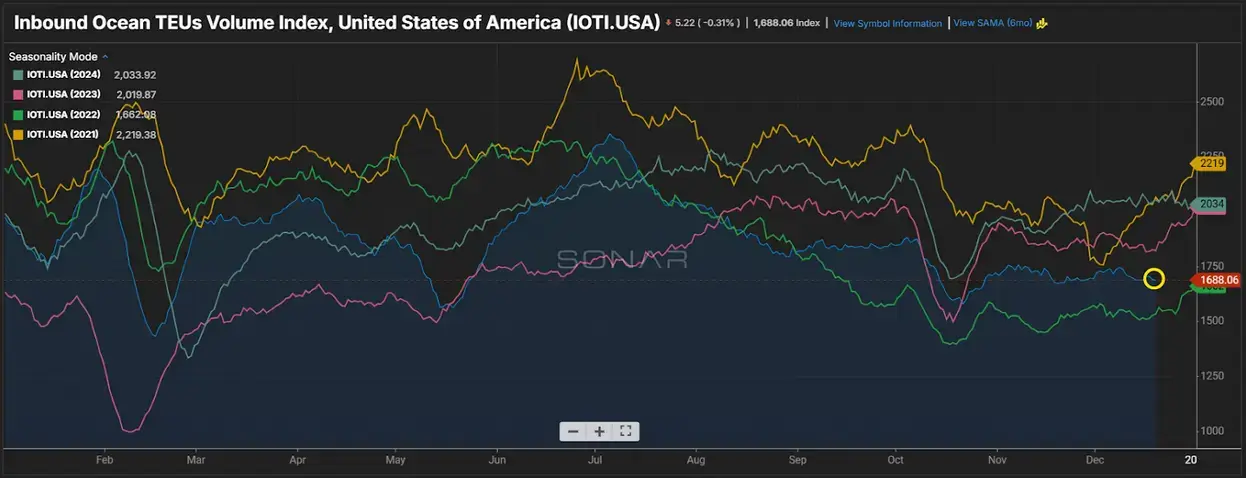

- Overall global demand remained weak across most major trade lanes.

- Inbound ocean rates remain soft as outbound rates see a slight uplift.

- U.S. container imports reached its lowest level since mid-2023 in December.

- Tariffs remain the uncertainty in this space causing the drop.

- Key Takeaways

- Secure space early when moving ocean freight to help control the cost.

- Consider mini bids to help control the volatility of the market.

- Factor in tariff-driven cost that are having an impact on heavy international lanes.

- Secure space early when moving ocean freight to help control the cost.

- Current Market

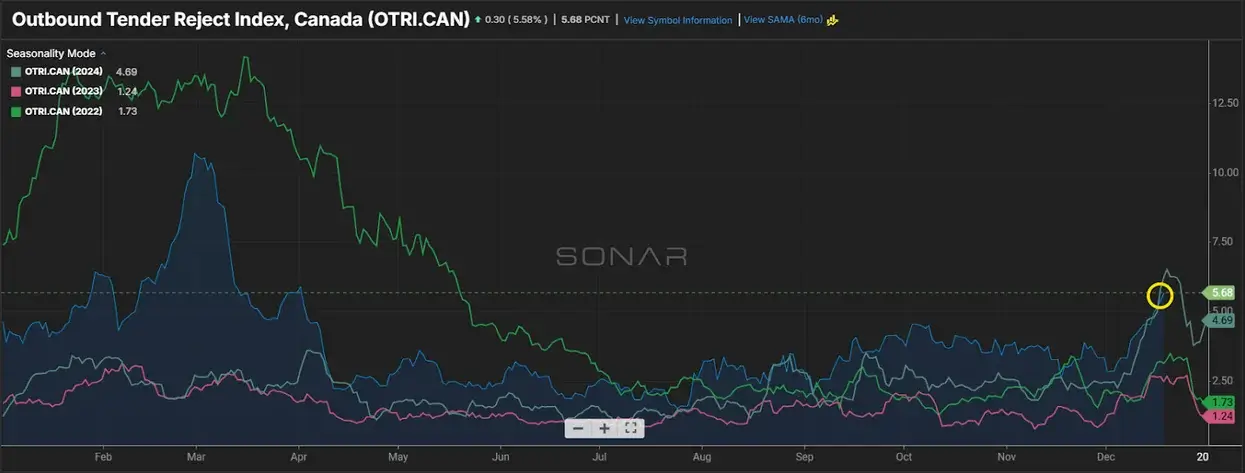

Cross Border

- Major road closures across 17 states in Mexico causing disruptions in freight corridors.

- Freight rates remain stable overall despite the issues in Mexico.

- Weather in Canada causing issues on the rail and slower traffic in general.

- Canadian cross board freight despite the weather remains steady.

- Rates generally stable but U.S. capacity issues could have an impact on pricing as we head into the end of the year.

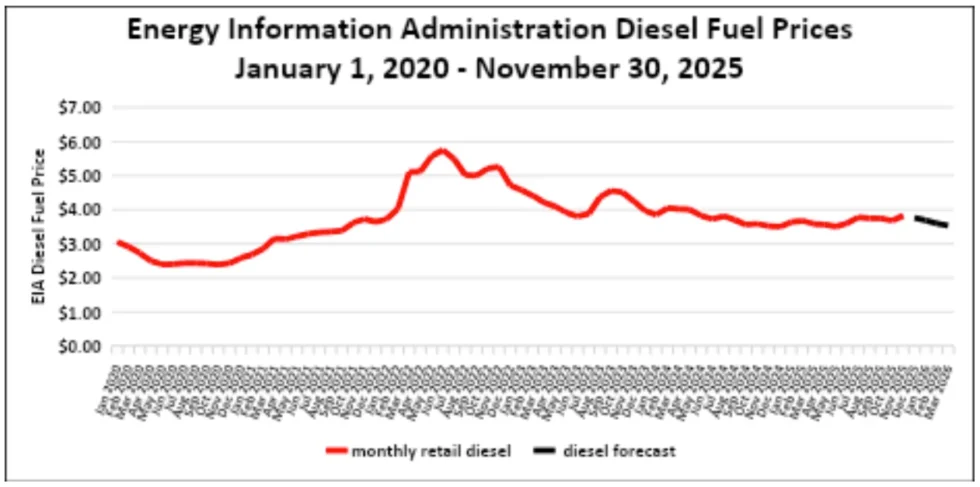

Fuel Forecast - DOE

- 2024 diesel fuel retail prices averaged $3.761/gallon through Q4 2024 and Q1 2025 finished lower at an average $3.631/gallon, and Q2 finished at $3.555/gallon.

- Fuel for Q3 finished at $3.757/gallon and Q4 is tracking $3.753/gallon to close out 2025.

Energy Information Administration Diesel Fuel Prices January 1, 2020 - November 30, 2025