February 2026

Market Update

Transportation Trends

General Outlook

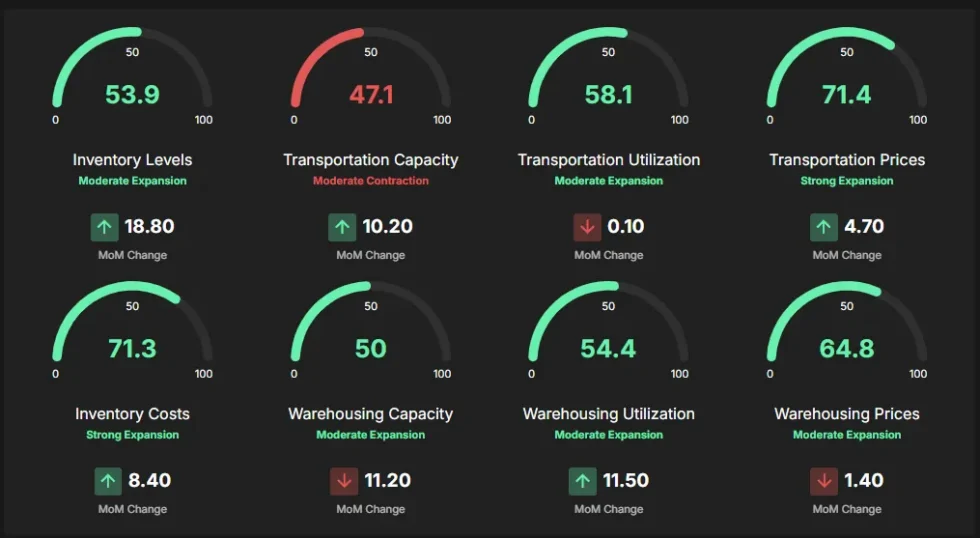

- February 2026 continues to reflect a market looking to shift from historical trends.

- Capacity constraints along with harsh weather conditions continue to have an impact on the freight market.

- Tariffs continue to create uncertainty in the market causing an impact to freight flows.

- Retail spending has flattened as the industry has moved past the Holiday push.

- Labor market:

- Unemployment rate currently stands at 4.43% in February 2026.

LTL

- Current Market

- The LTL market in February 2026 remains stable but growing tighter in some key markets.

- Volume remains soft based on a slower replenishment in the retail industry.

- Larger LTL carriers are looking to excess additional terminal capacity to capture more volume based on the soft market.

- LTL pricing remains firm and disciplined by the LTL carriers despite the declining volumes.

- NMFC reclassification updates are changing the LTL pricing is shifting to more of a density-based program.

- It is very important to get a better understanding of your dimensions to avoid additional cost.

- The LTL market in February 2026 remains stable but growing tighter in some key markets.

- Key Takeaways

- Demand remains soft, with no clear signs of a change in the market.

- Pricing remains disciplined with the LTL carriers.

- Capacity is available, but we are starting to see disruptions in more of the regional market.

- Review your packaging and dimensions to take advantage of the density-based pricing

- Continue to build carrier relationships as the market continues to make changes

- Invest or partner with a company to better utilize automation to help control cost.

Truckload

- Current Market

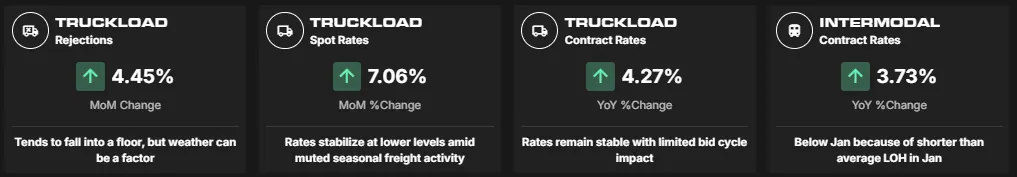

- Capacity and rates continue to remain high.

- Carrier Rejections continue to tighten for the TL market.

- Tender Rejection by Mode:

- Van – Current Rejection rate is 13%

- Reefer – Current Rejection rate is 20%

- Flatbed – Current Rejection rate 24%

- Tender Rejection by Mode:

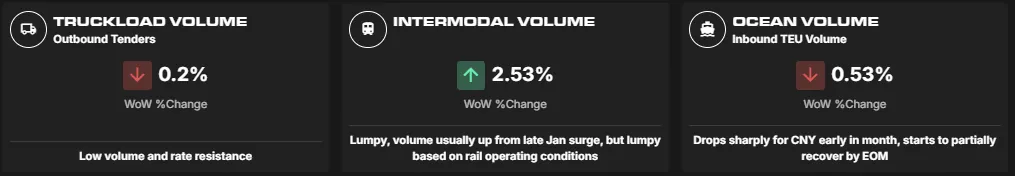

- Freight volume remains down as we kick off 2026.

- Capacity remains tight, increasing the spot rates in the market.

- Contracted pricing begins to shift as the carriers start chasing the higher spot rates.

- Key Takeaways

- Overall demand is soft as contracted volumes trend below the past 2 years.

- Spot rates continue to rise as capacity and weather cause disruptions.

- Technology will be key to driving compliance with core carriers.

- Start your planning now! Find a partner that can provide you with technology, visibility, and sustainability in a volatile market.

SONAR

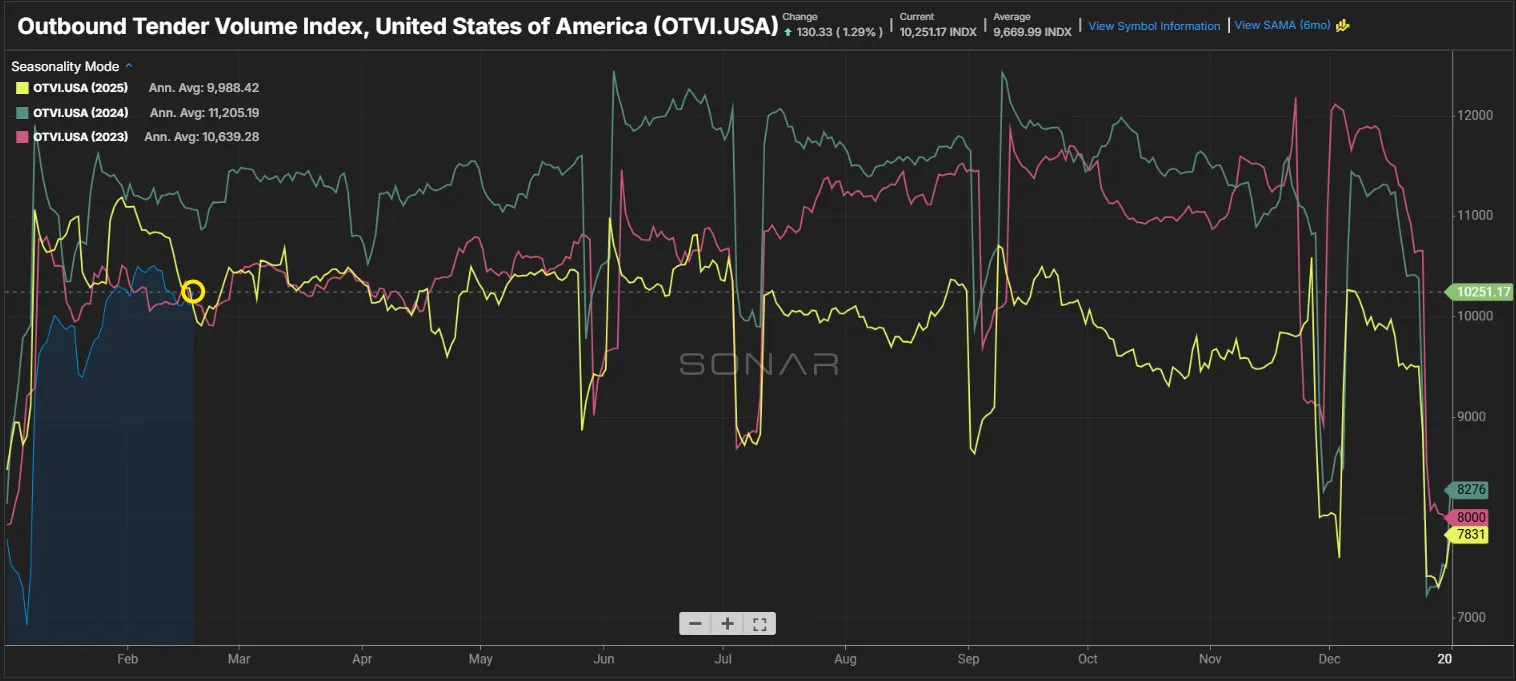

Outbound Tender Volume - All Modes

- Outbound tender volumes starts to come back after the dip in late January. Volume exceeds 2025 slightly for the first time this year.

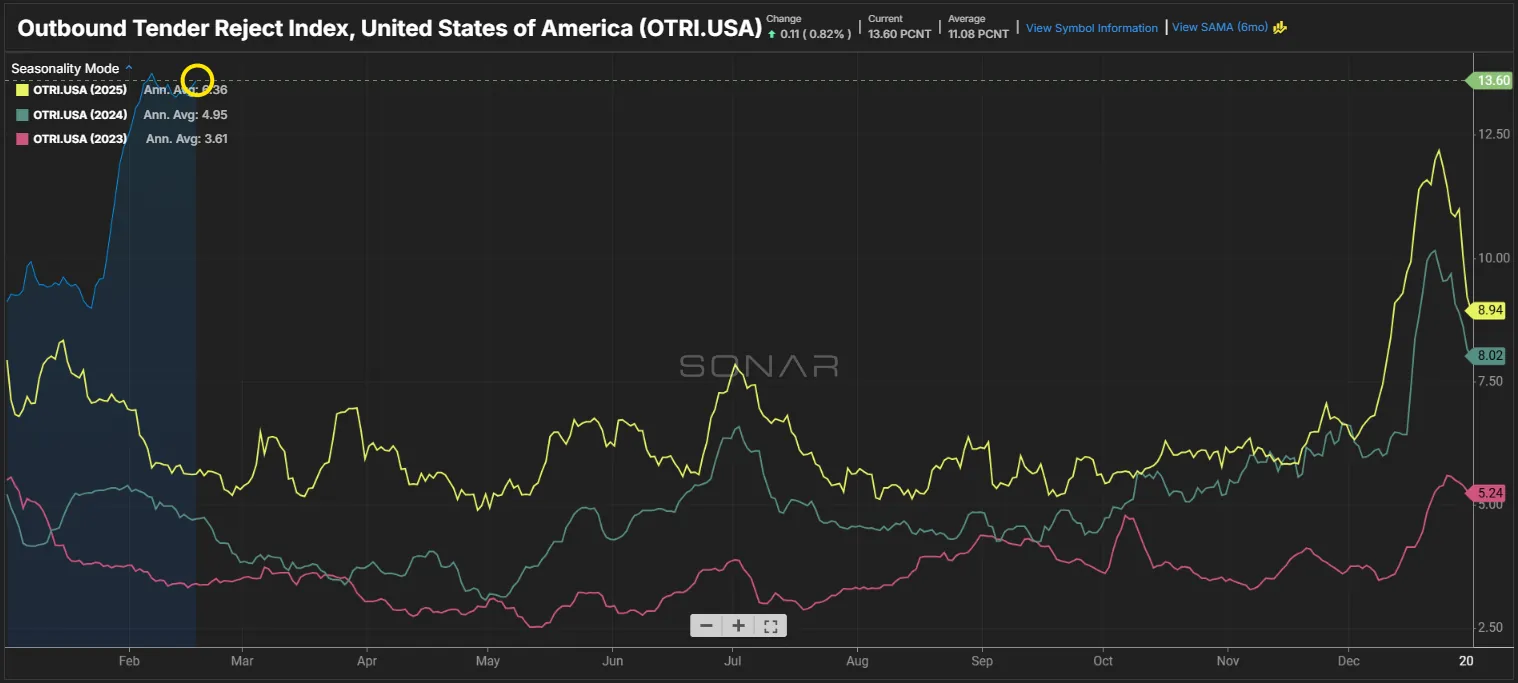

Outbound Tender Reject - All Modes

- Overall Rejections remain high as we head into 2026.

- Capacity remains the number one reason for the rejections across all modes.

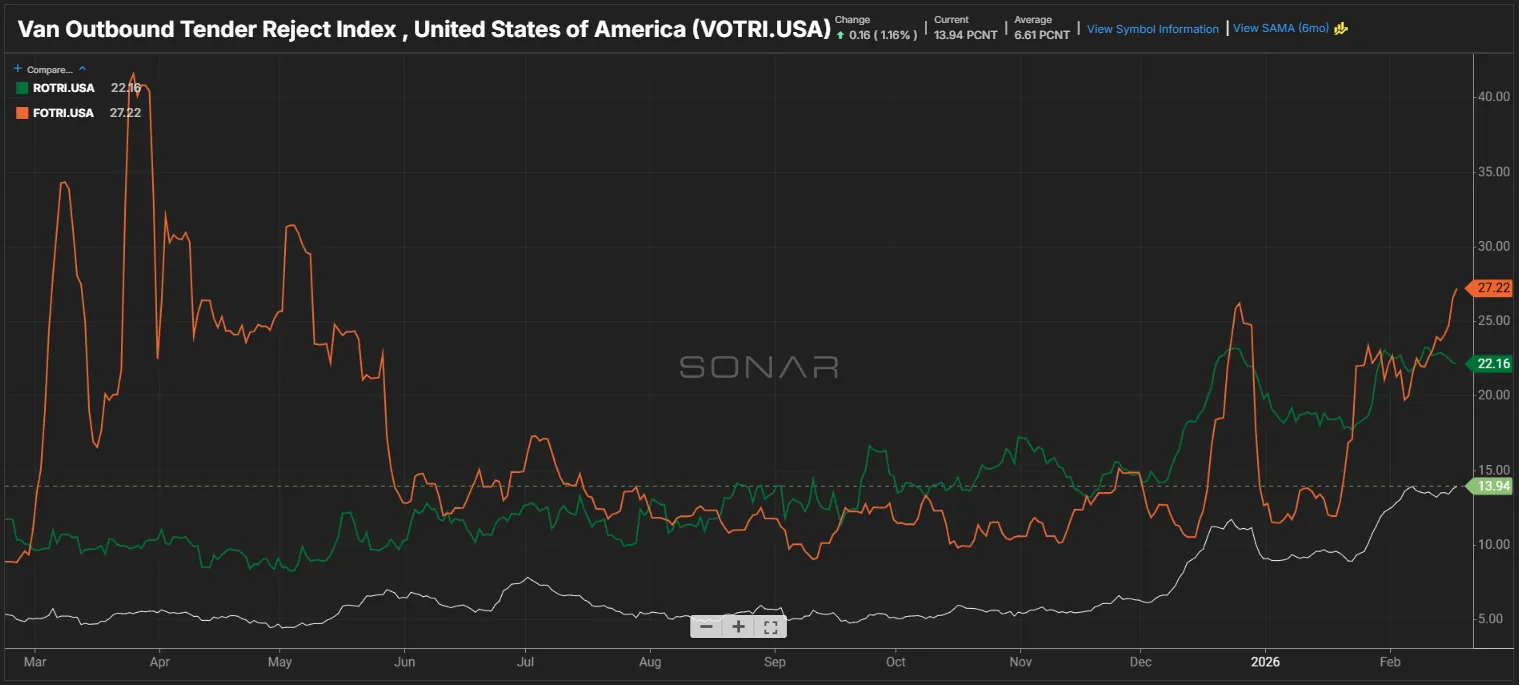

Outbound Tender Reject – by Mode

- Orange Line – Flatbed: Rejections up vs. this same time last year.

- Green line – Reefer: Rejections for Reefer remain up and have been impacting spot rates across the county.

- White line – Van: Van Rejections flatten out vs. last month but remain up vs. this same time last year.

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Authorities increased this month vs. last month. Demand in the market is allowing carriers to come back into the TL space.

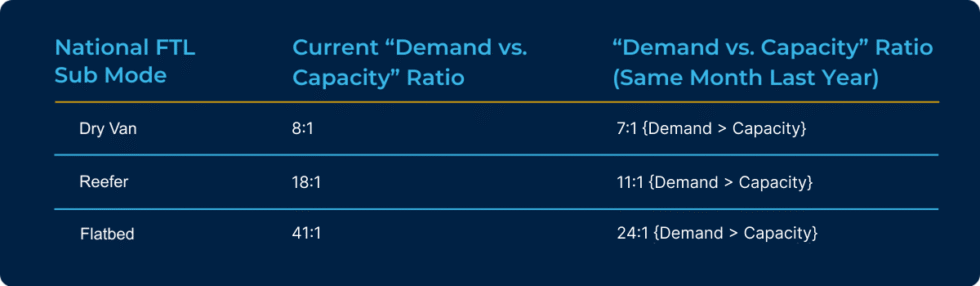

Demand vs. Capacity Metrics - January 2026

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

International

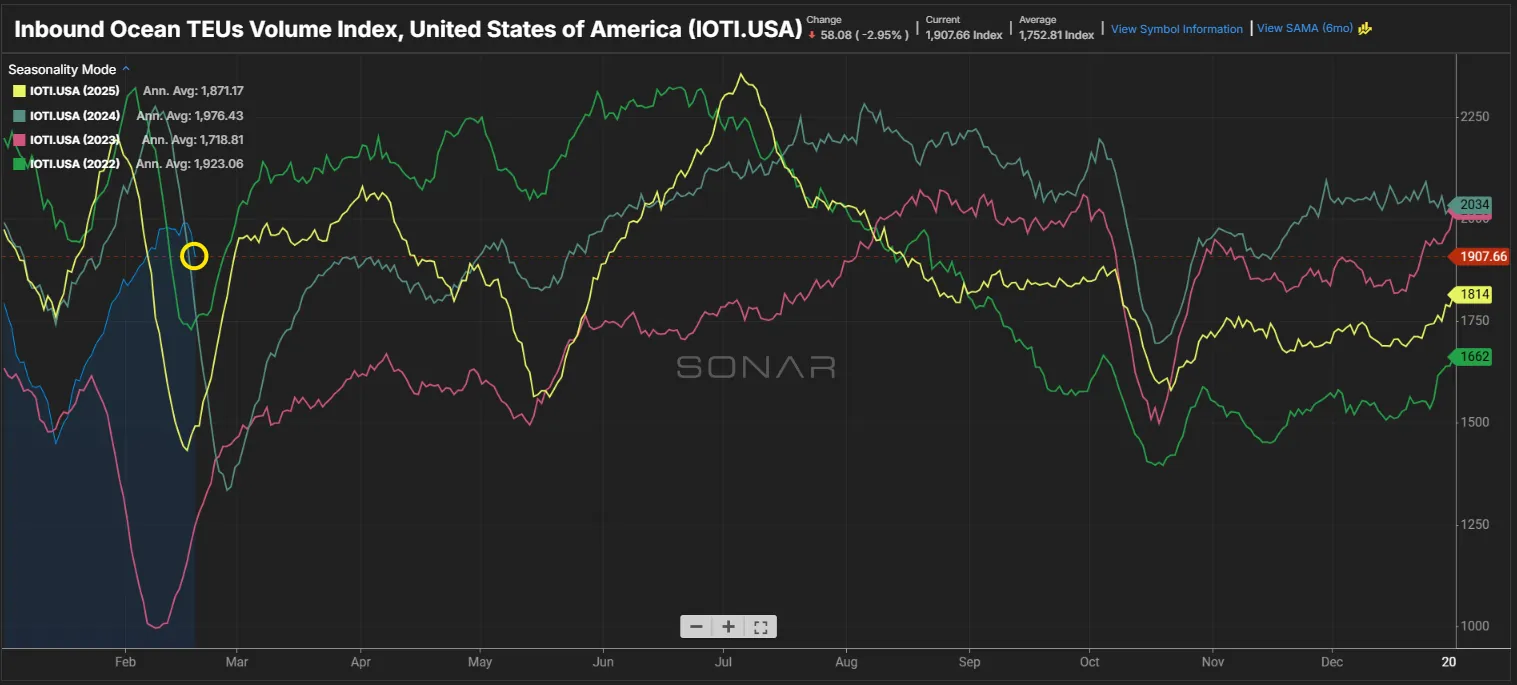

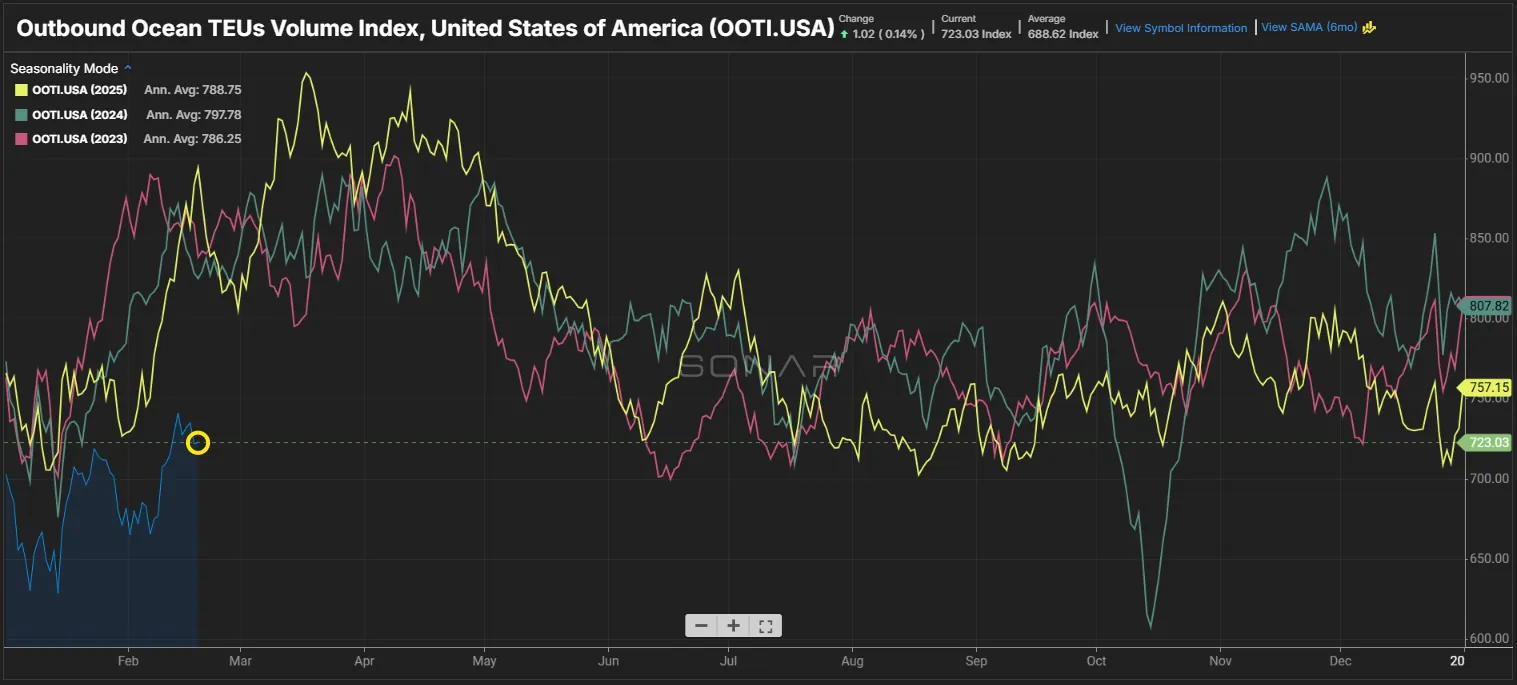

- Current Market

- Ocean spot rates fell sharply in February.

- Carriers are prioritizing network utilization over price increases currently.

- Despite soft volumes, overcapacity still remains a long-term problem.

- Inbound TEUs up vs. this same time last year.

- Outbound TEUs down vs. this same time last year.

- Overall, both inbound and outbound TEUs are down 14%

- Ocean spot rates fell sharply in February.

- Key Takeaways

- TEU demand remains weak, with no rebound signals

- Capacity continues to pull back.

- Rates are down 40% YoY

- Consider mini bids to help control the volatility of the market.

- Factors in tariff-driven cost that are having an impact on heavy international lanes

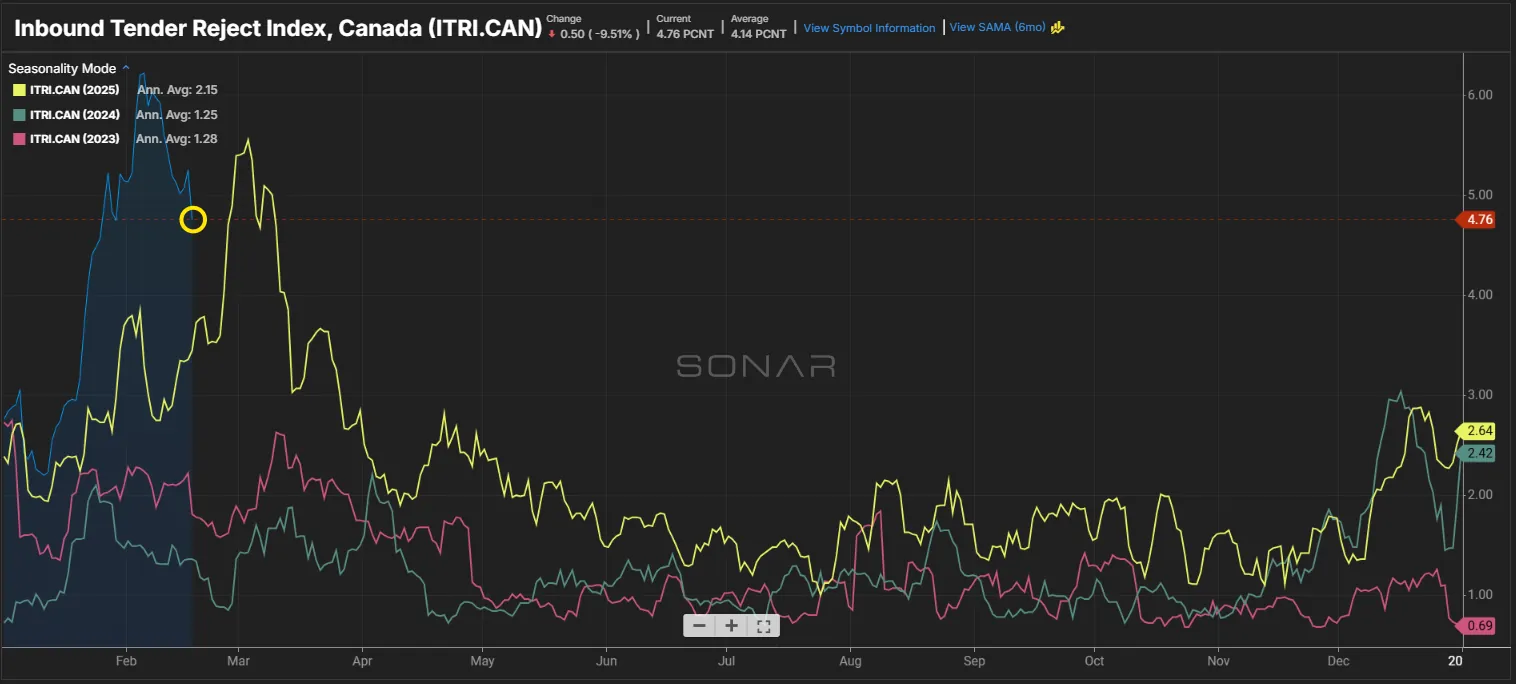

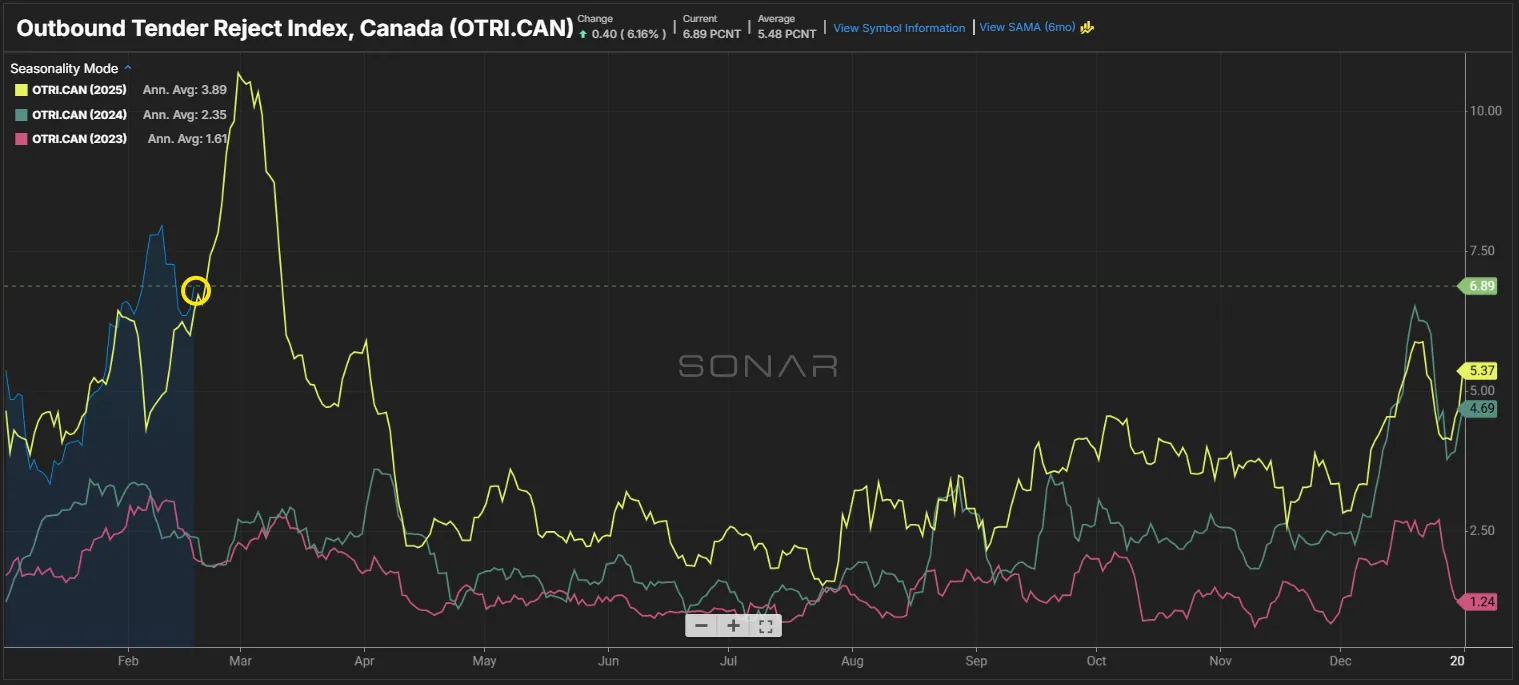

Cross Border

- Rejection rates remain high, particularly in Laredo and the South Texas Border.

- North bound volumes remain steady into the U.S.

- Capacity on cross-boarder lanes continues to tighten as carriers leave the market.

- Cargo theft continues to rise on U.S.-Mexico lanes

- Rejection rates in Canada remain high but less extreme than Mexico.

- Winter weather will continue to have an impact on both capacity and rates.

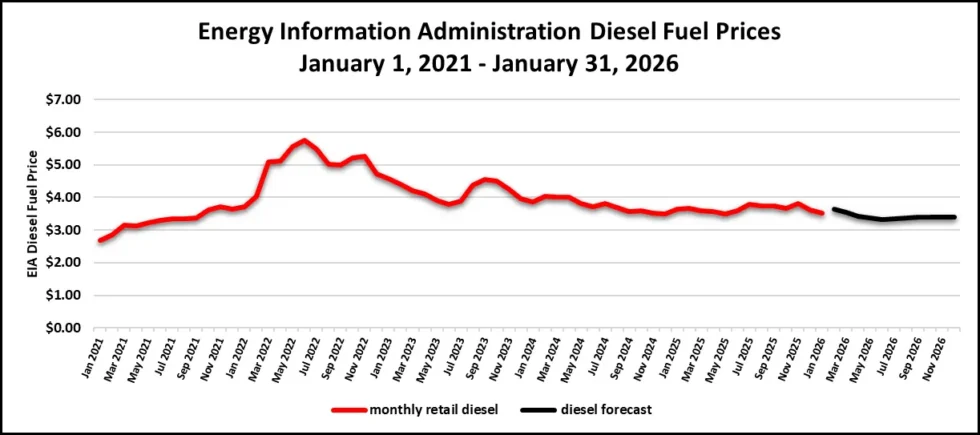

Fuel Forecast - DOE

- 2025 diesel fuel retail prices averaged $3.662/gallon.

- Fuel for Q1 2026 is forecasted at $3.566/gallon, Q2 is forecasted at $3.372/gallon, Q3 is forecasted at $3.372/gallon, and Q4 is forecasted at $3.400/gallon.

Energy Information Administration Diesel Fuel Prices January 1, 2021 - December 31, 2025