January 2026

Market Update

Transportation Trends

General Outlook

- Colder weather is here, and snowstorms across the country are causing issues.

- Plan, secure capacity sooner, & add transit days to buffer delays

- Capacity remains relatively high coming off the Holidays.

- July 22nd market gained relief after President Trump withdrew his threat to impose sweeping tariffs.

- Retail spending rose in December 0.6% vs. November.

- Labor market:

- Unemployment fell to 4.40% in December.

- Forecasts predict unemployment to peak near 4.5% in early 2026.

- 30-year fixed mortgage ranges from 5.99%-6.13%

- 15-year fixed mortgage ranges from 5.37%-5.57%

LTL

- Current Market

- Despite a weak demand the LTL industry will still see rate increases in 2026.

- Costs continue to increase for carriers causing an adjustment on rates.

- Record high LTL rates in Q4 of 2025, cost per shipment remains 40% above 2018 levels.

- LTL carriers are focused on network discipline rather than volume.

- A. Duie Pyle expands with an LTL hub near Port of Virginia

- NMFC reclassification updates are changing the LTL pricing is shifting to more of a density-based program.

- It is very important to get a better understanding of your dimensions to avoid additional cost.

- Despite a weak demand the LTL industry will still see rate increases in 2026.

- Key Takeaways

- Demand remains weak, keeping volume soft for LTL carriers.

- Rates will continue to rise.

- LTL market is stable but weak heading into 2026.

- Review your packaging and dimensions to take advantage of the density-based pricing

- Continue to build carrier relationships as the market continues to make changes

- Invest or partner with a company to better utilize automation to help control cost.

Truckload

- Current Market

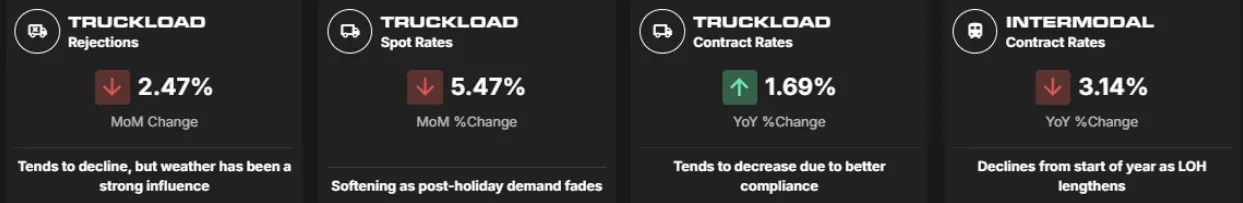

- Demand is still weak in the TL market but showing early signs of stabilizing.

- Capacity continues to tighten for the TL market.

- Tender Rejection by Mode:

- Van – Current Rejection rate is 9.1%

- Reefer – Current Rejection rate is 15.3%

- Flatbed – Current Rejection rate 18.2%$

- Tender Rejection by Mode:

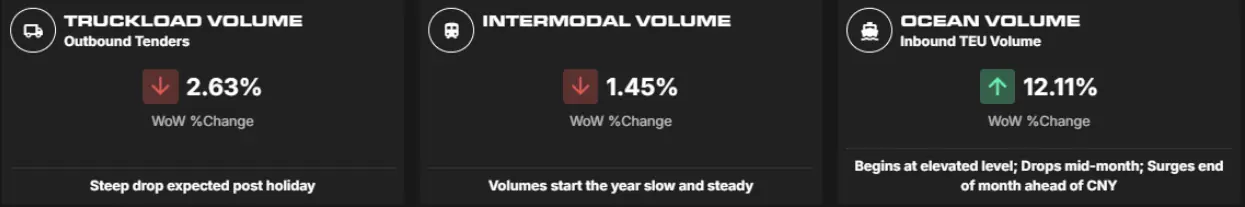

- Freight volume remains down as we kick off 2026.

- Capacity remains tight, increasing the spot rates in the market.

- Contracted pricing begins to shift as the carriers start chasing the higher spot rates.

- Key Takeaways

- Demand is soft but not collapsing

- Capacity is shrinking quickly

- Spot rates continue to rise.

- Technology will be key to driving compliance with core carriers.

- Start your planning now! Find a partner that can provide you with technology, visibility, and sustainability in a volatile market.

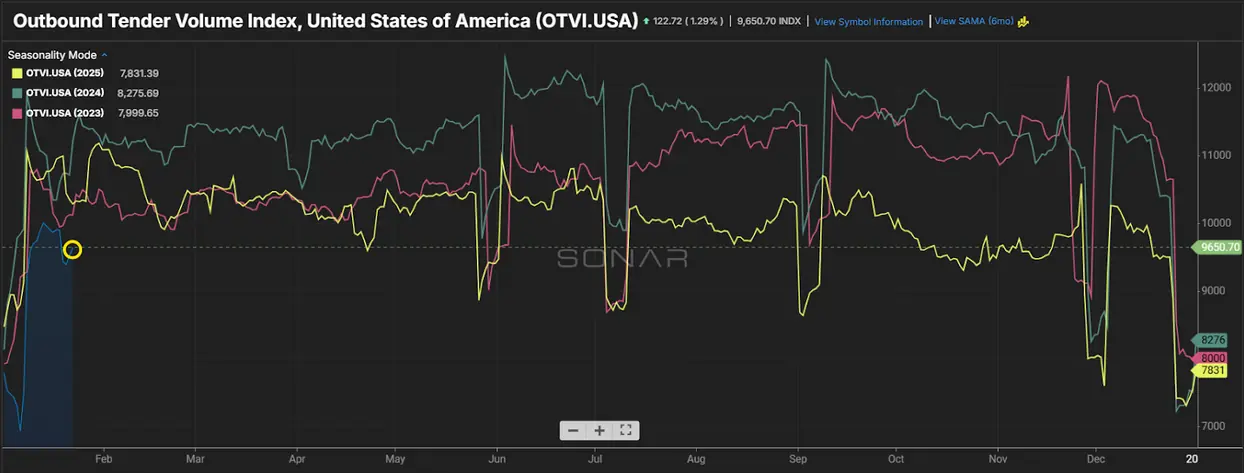

SONAR

Outbound Tender Volume - All Modes

- Outbound tender volume jumps back up in January, but still down vs. this same time last year.

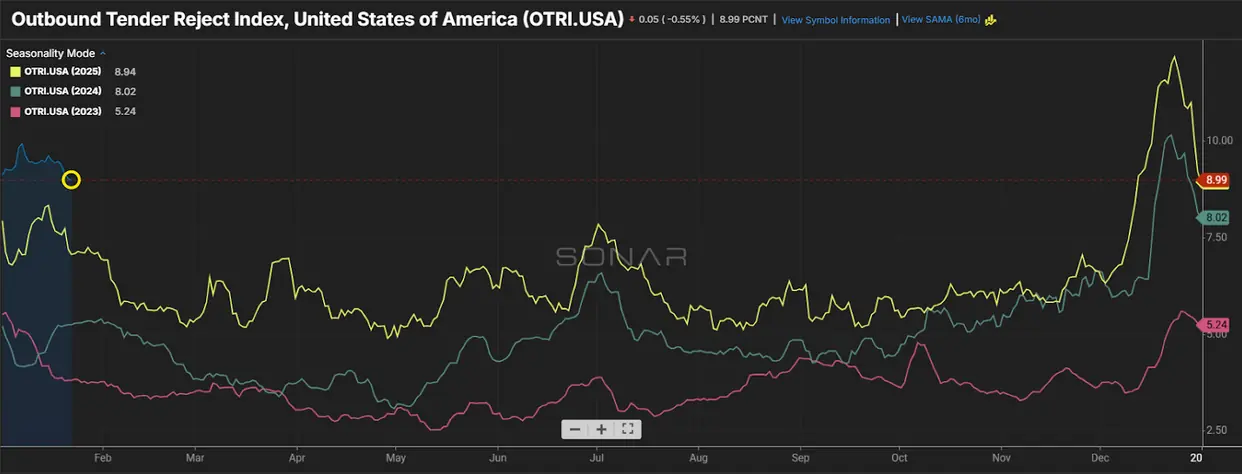

Outbound Tender Reject - All Modes

- Overall Rejections remain high as we head into 2026.

- Capacity remains the number one reason for the rejections across all modes.

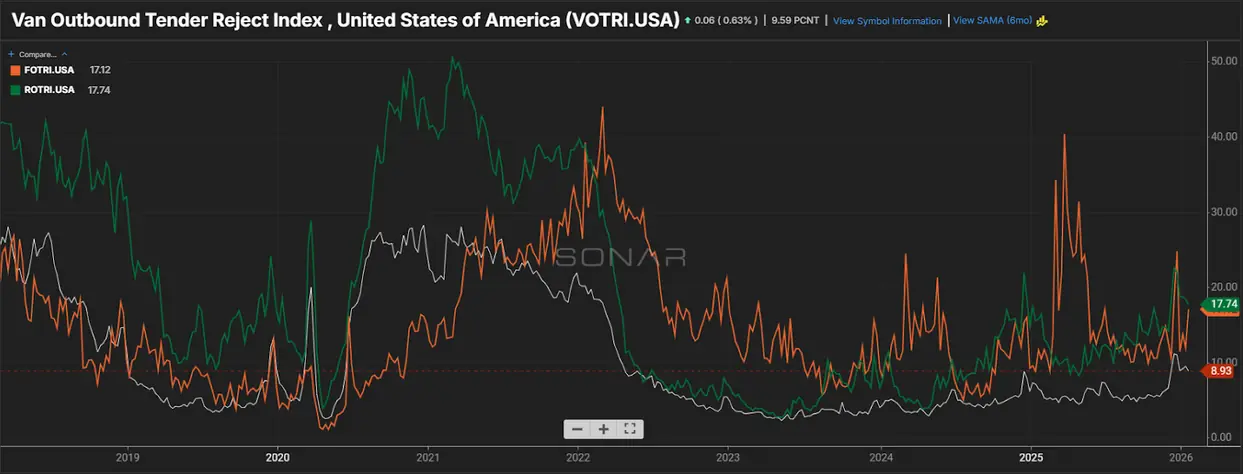

Outbound Tender Reject – by Mode

- Orange Line – Flatbed: Rejections up vs. this same time last year.

- Very important to keep a close eye on the overall outbound volume to ensure you are securing capacity in this market.

- Green line – Reefer: Rejections for Reefer up significantly this month vs. last month.

- Similar to flatbed, increased outbound volume will have a significant impact on capacity in the Reefer space.

- White line – Van: Van Rejections come back down slightly vs. last month but remain up vs. this same time last year.

- Rejections are forecasted to remain higher this year based on the lack of capacity in the market.

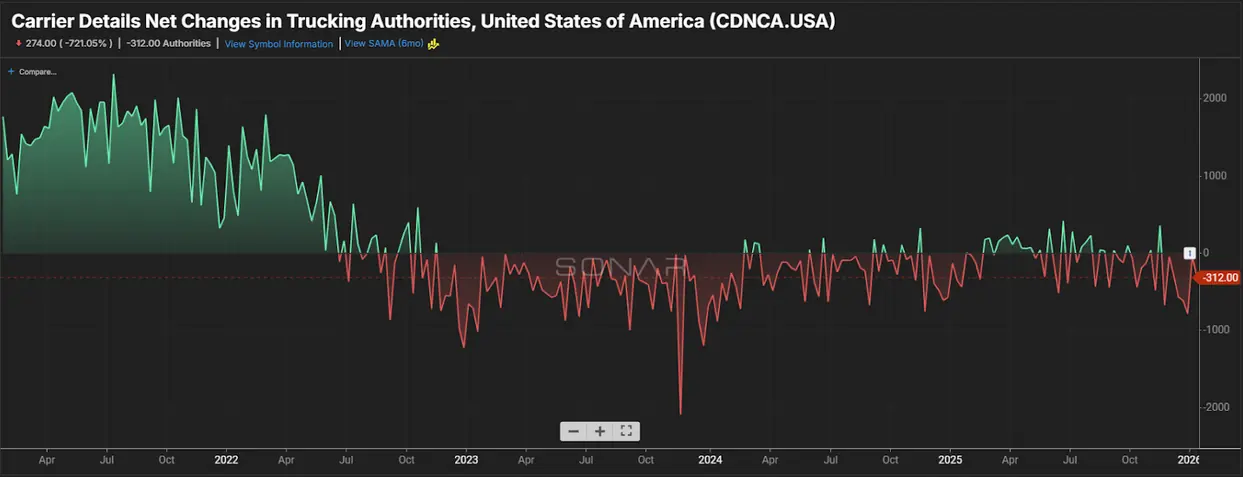

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Authorities continue to drop which is causing rejections to increase despite the overall volume decrease compared to 2025.

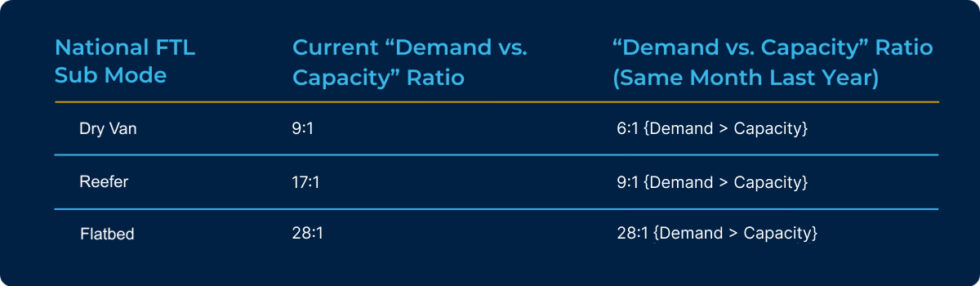

Demand vs. Capacity Metrics - October 2025

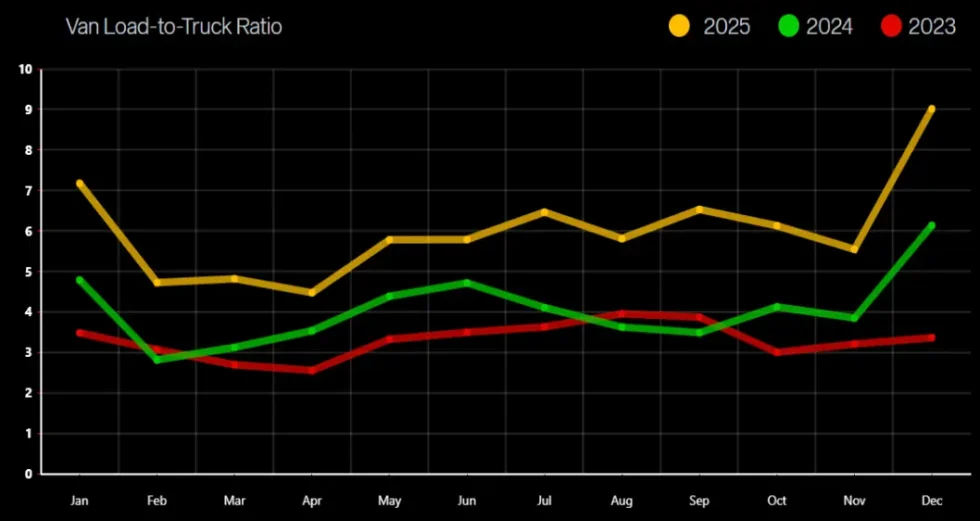

Van Load-to-Truck Ratio

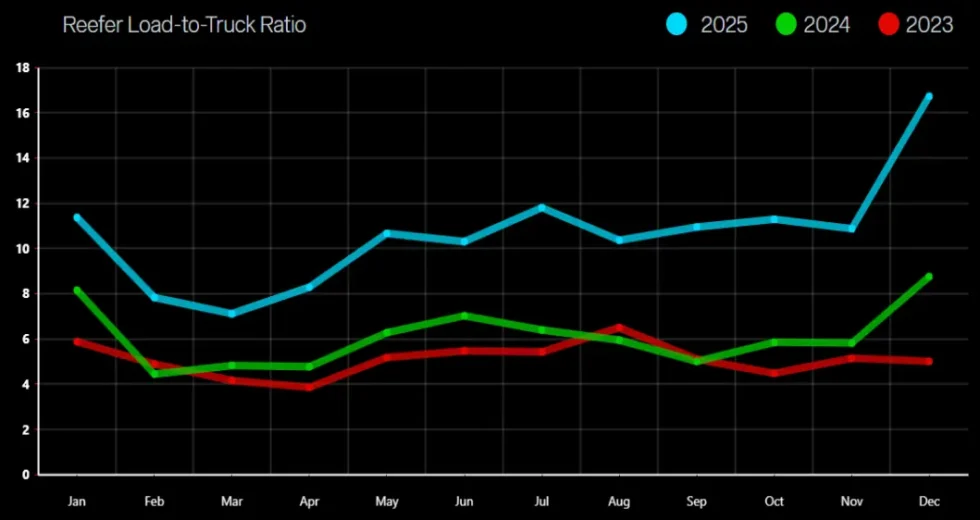

Reefer Load-to-Truck Ratio

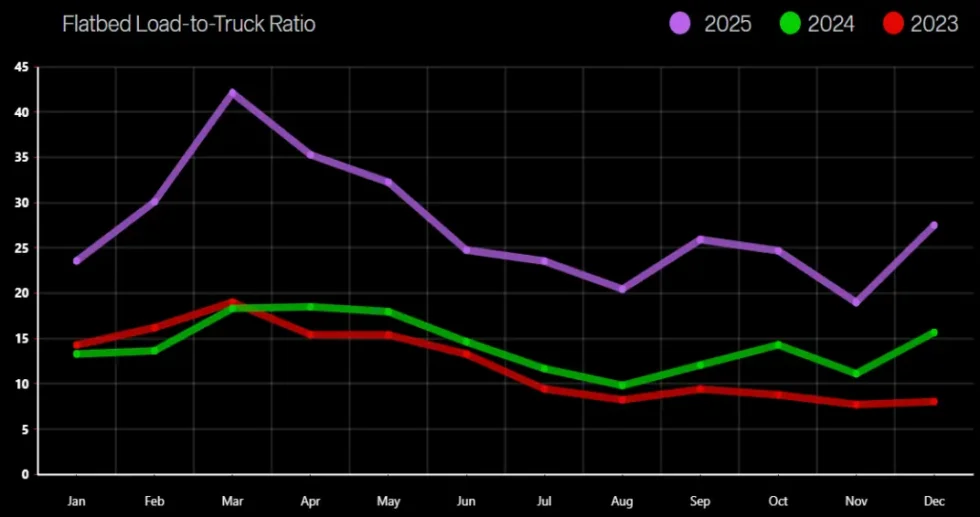

Flatbed Load-to-Truck Ratio

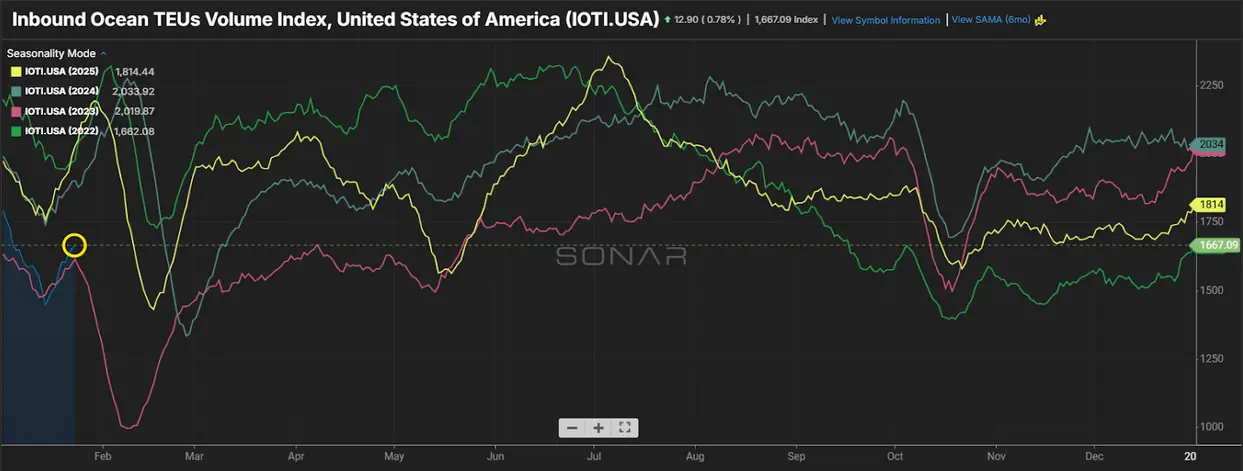

International

- Current Market

- Ocean rates started high as we came into 2026 but have started to come back down.

- Despite soft volumes, overcapacity still remains a long-term problem.

- U.S. container imports are projected to hit 2.1M TEU’s in January of 2026.

- 2025 total U.S. Container imports were 0.4% lower than 2024.

- Key Takeaways

- Secure space early when moving ocean freight to help control the cost.

- Consider mini bids to help control the volatility of the market.

- Factors in tariff-driven cost that are having an impact on heavy international lanes

- Secure space early when moving ocean freight to help control the cost.

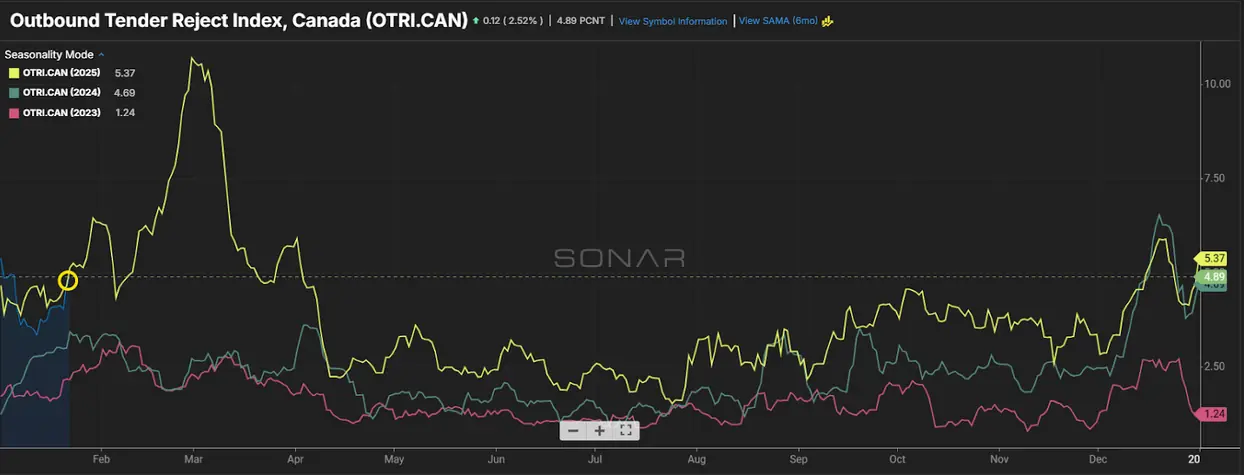

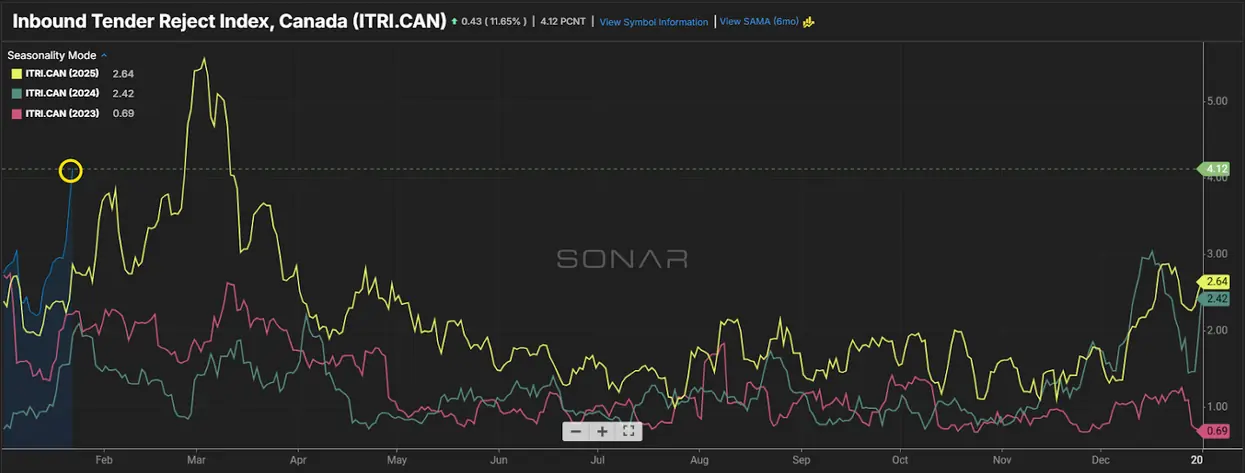

Cross Border

- Mexican exports will remain strong in 2026.

- Capacity on cross-boarder lanes continues to tighten as carriers leave the market.

- Cargo theft continues to rise on U.S.-Mexico lanes.

- Canada imposed tariffs could have an impact on export volume into the U.S. in 2026.

- Canadian rates remain stable but can increase as Canadian carrier deal with harsh winter weather.

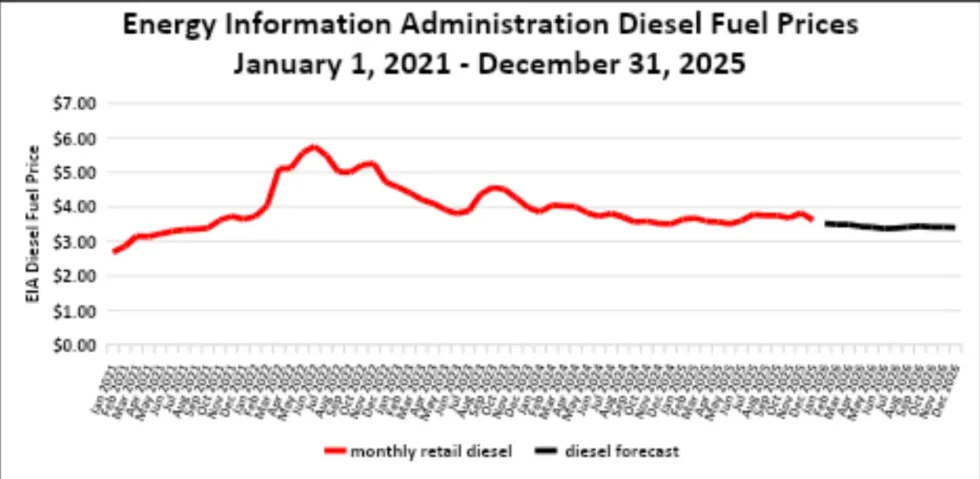

Fuel Forecast - DOE

- 2024 diesel fuel retail prices averaged $3.761/gallon through Q4 2024 and Q1 2025 finished lower at an average $3.631/gallon, and Q2 finished at $3.555/gallon.

- Fuel for Q3 finished at $3.757/gallon and Q4 finished at $3.705/gallon to close out 2025.

Energy Information Administration Diesel Fuel Prices January 1, 2021 - December 31, 2025