November 2025

Market Update

Transportation Trends

General Outlook

- Shippers should prepare for potential disruptions and increased rates as we head into the Holiday season.

- Demand will remain stable to slightly down until we get closer to the Holiday season.

- Retail sales rose 0.6% in October, and 5% year-over-year.

- Tariff-related delays may impact production, putting pressure on prices.

- The Middle East tension has pushed some concerns around the oil volatility in the market.

- Labor market: Private employers added 42,000 jobs in October; this is a rebound of 2 consecutive months of decline.

- Unemployment at 4.36%, up 4.14% a year ago.

- 30-year fixed mortgage is at 6.27% in October.

- 15-year fixed mortgage is at 5.58%.

LTL

- Current Market

- LTL is still experiencing a soft market; the down market is reflective based on lower manufacturing and more cautious consumer spending.

- Even with demand being down, soft carrier capacity is slowly leaving the market, which could have an effect on continued price increases.

- LTL carriers have implemented GRI’s (General Rate Increases) around 4-7% despite the down market.

- NMFC reclassification updates are changing the LTL pricing is shifting to more of a density-based program.

- It is very important to get a better understanding of your dimensions to avoid additional cost.

- Key Takeaways

- Look to lock in contractual pricing were appropriate.

- Review your packaging and dimensions to take advantage of the density-based pricing.

- Continue to build carrier relationships as the market continues to make changes.

- Invest or partner with a company to better utilize automation to help control cost.

Truckload

- Current Market

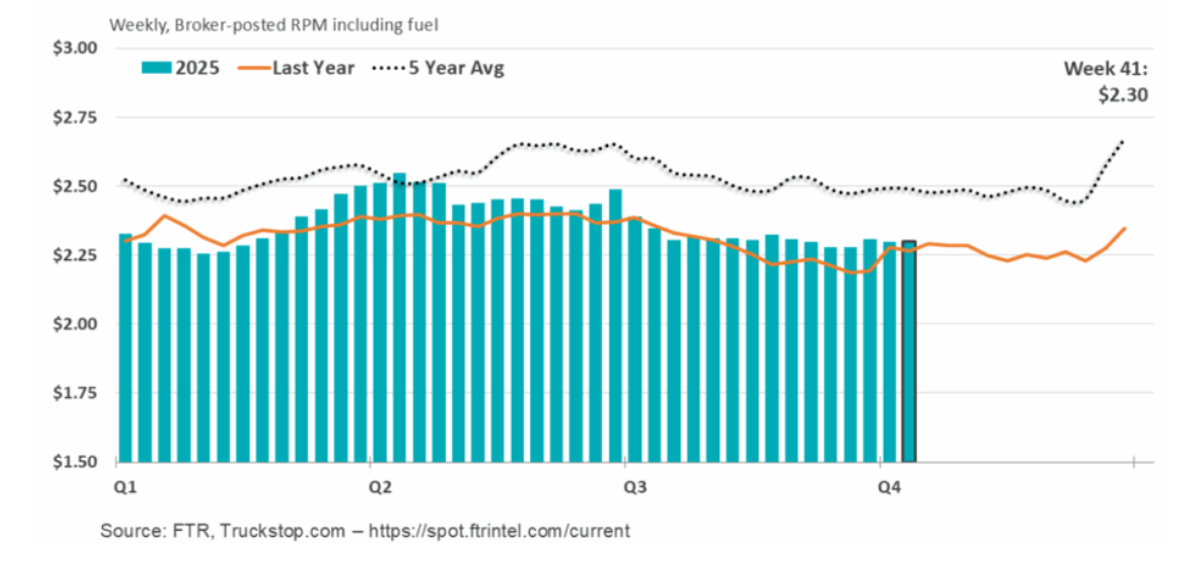

- Carrier continues to grow tighter even as we see the outbound tender volume decrease.

- Regulatory changes, such as the new CDL rule, and increased operating cost for carriers, we expect capacity to continue to tighten in 2026.

- Tariffs on truck parts and as well as imported goods are raising cost for truckload fleets.

- Factors on increased carrier costs which is influencing the smaller carrier pushing them out of the market.

- Driver wages up 7.6%

- Insurance up 12.5%

- Equipment costs up 8.8%

- Factors on increased carrier costs which is influencing the smaller carrier pushing them out of the market.

- Carrier continues to grow tighter even as we see the outbound tender volume decrease.

- Key Takeaways

- The TL market is at risk due to increased costs and lack of capacity.

- Technology will be key to driving compliance with core carriers.

- Start your planning now! Find a partner that can provide you with technology, visibility, and sustainability in a volatile market.

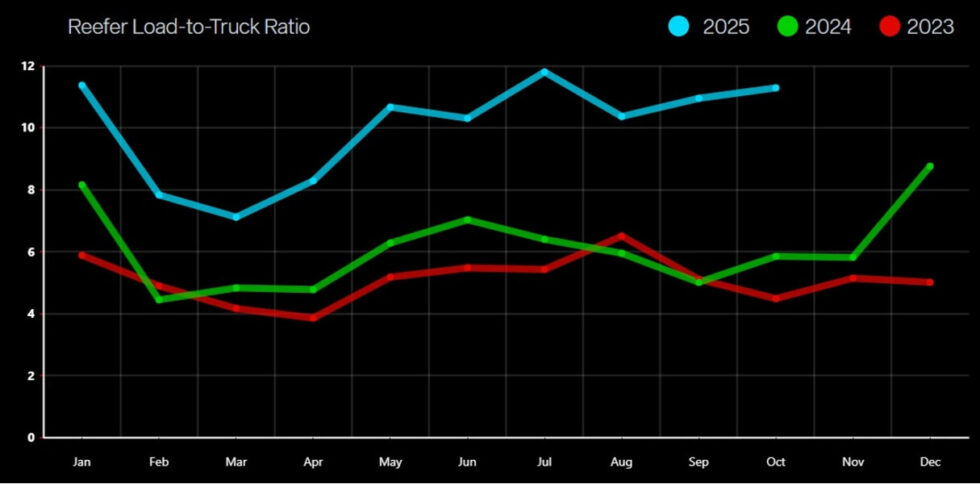

Reefer rates rise ahead of Thanksgiving

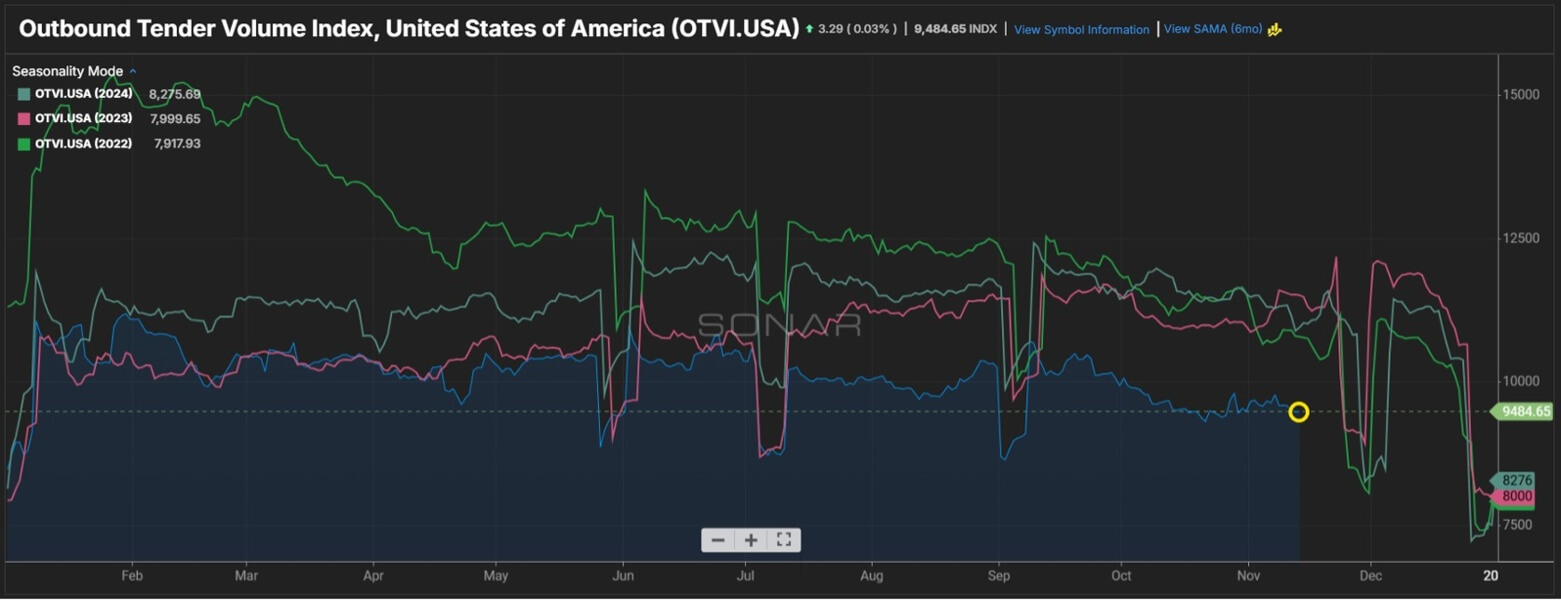

Outbound Tender Volume - All Modes

- Outbound tender volume remains relatively flat as we get closer to Thanksgiving. Outbound volume continues to trend down vs. previous years.

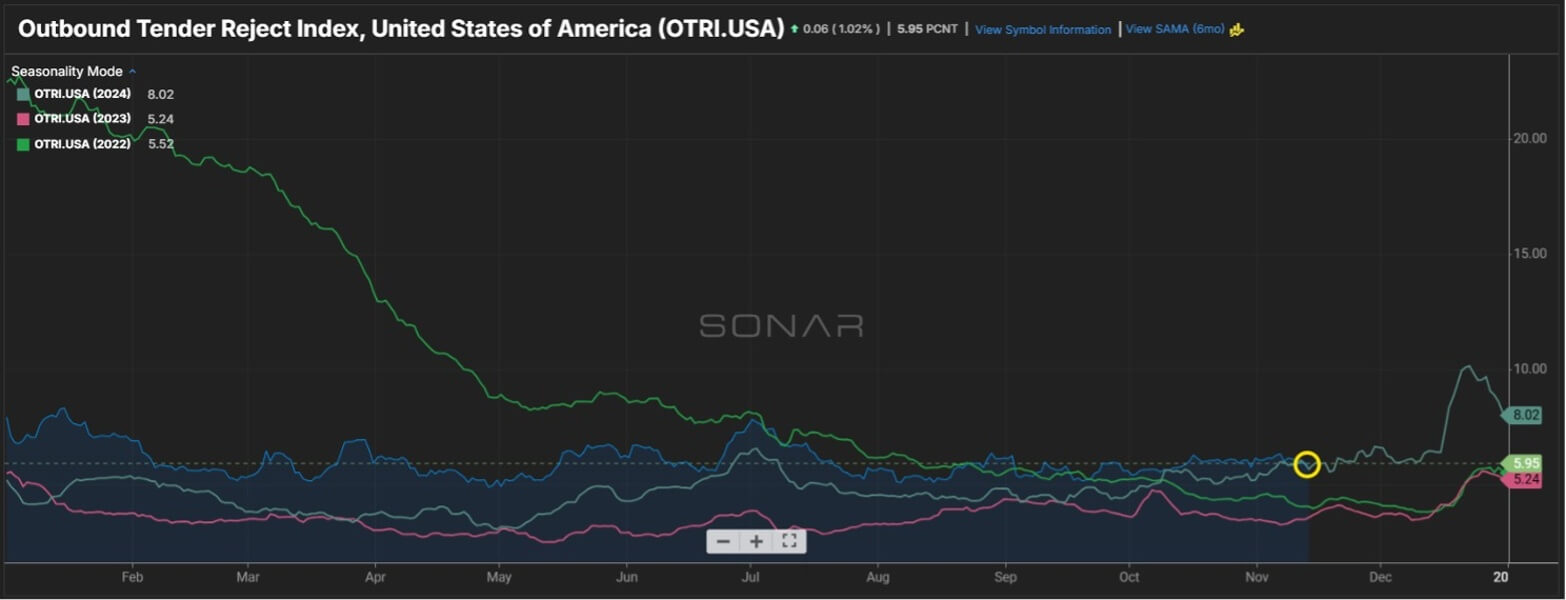

Outbound Tender Reject - All Modes

- Overall Rejects still slightly up vs. last year even with less outbound volume.

- Capacity sill playing a large role in the overall rejections remaining higher in 2025.

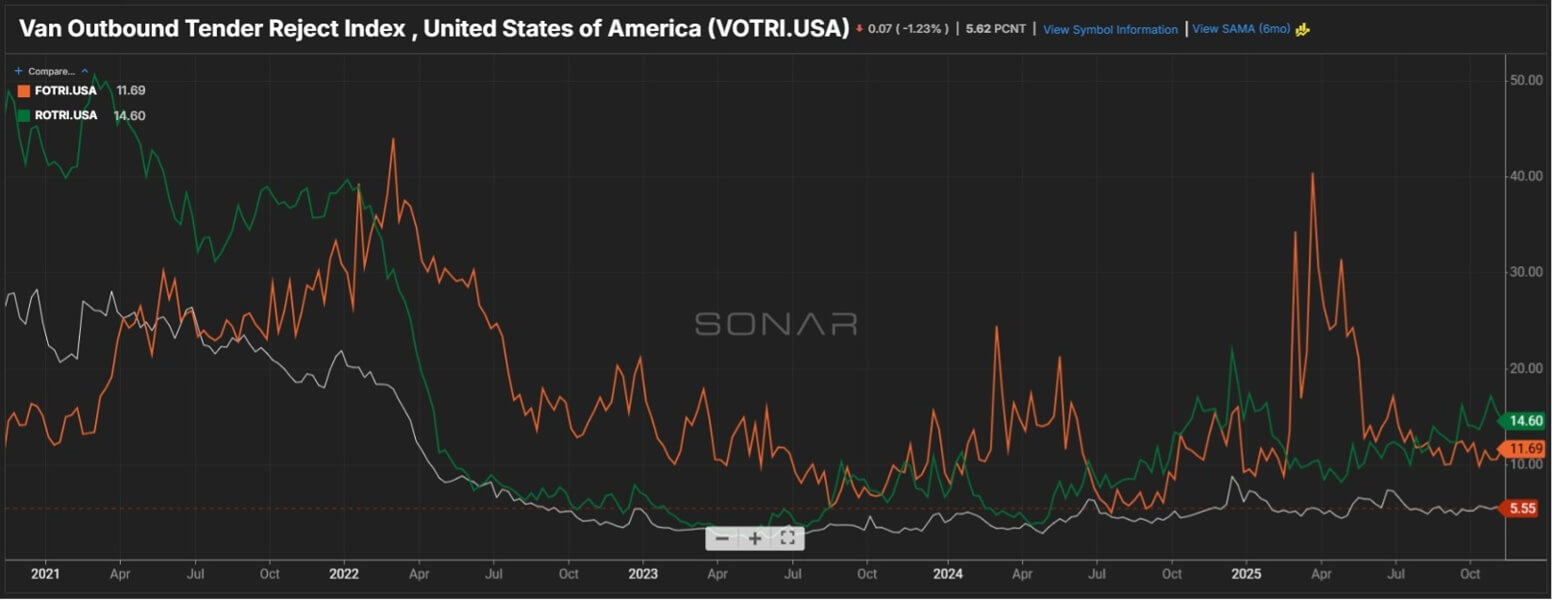

Outbound Tender Reject – by Mode

- Orange Line – Flatbed: Rejections trend along with last year at this same time.

- Very important to keep a close eye on the overall outbound volume to ensure you are securing capacity in this market.

- Green line – Reefer: Rejections for Reefer up slightly this month vs. last month.

- Similar to flatbed, increased outbound volume will have a significant impact on capacity in the Reefer space.

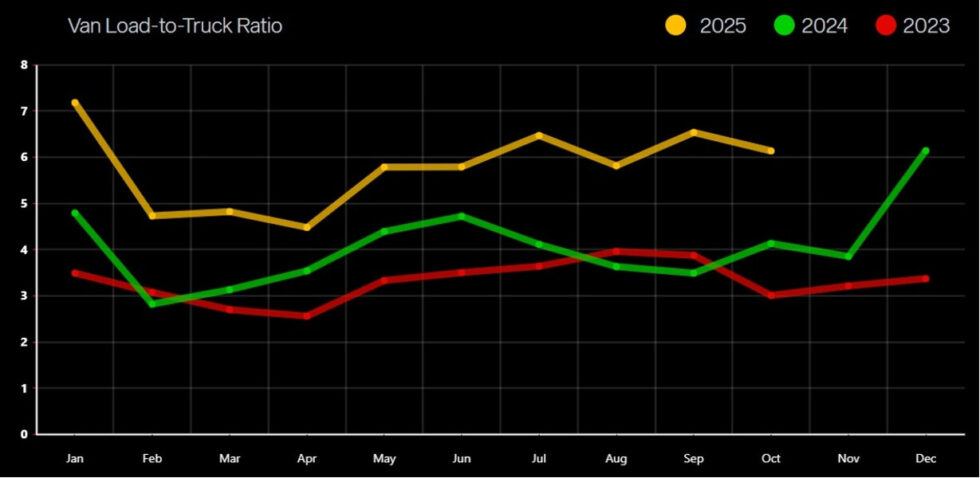

- White line – Van: Van Rejections up this month vs. last month.

- Rejections continue to fluctuate month- over-month but still remain flat since the start of this year.

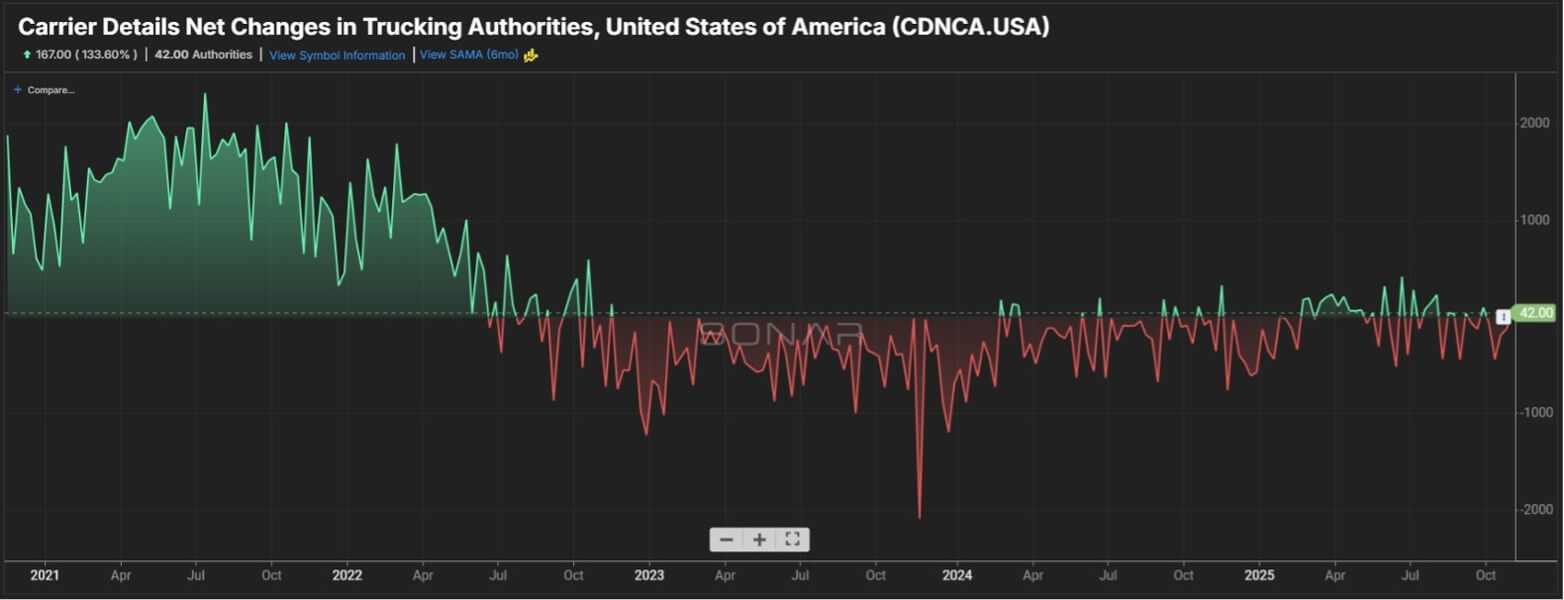

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Authorities continue to drop which is causing rejections to increase despite the overall volume decrease compared to 2024.

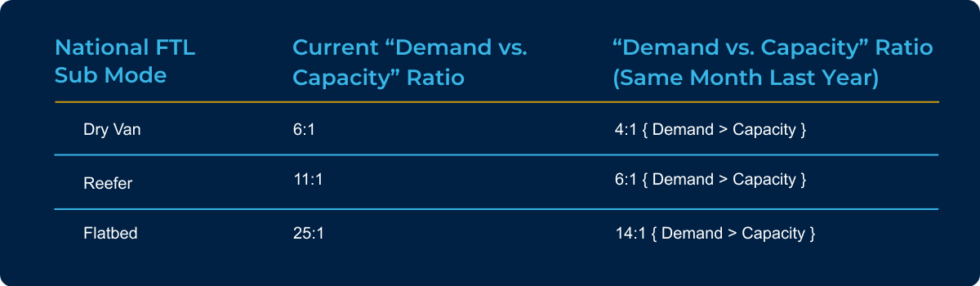

Demand vs. Capacity Metrics - October 2025

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

International

- Current Market

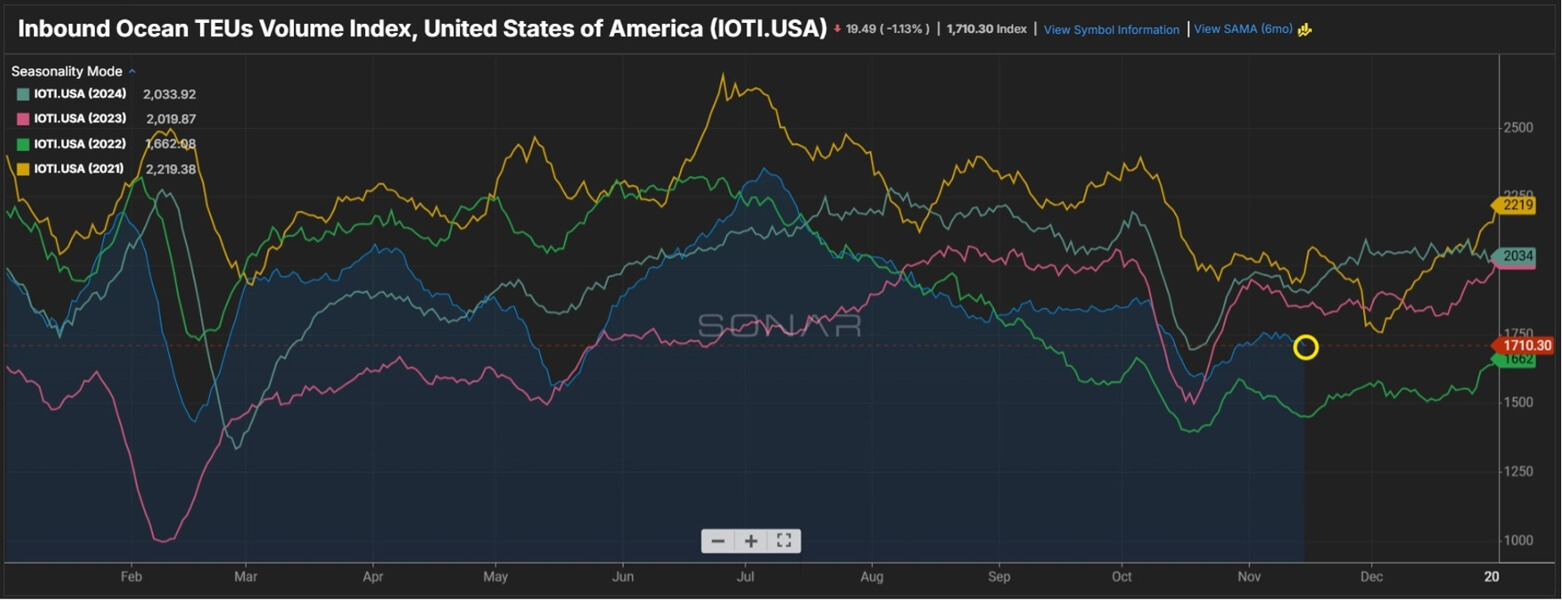

- U.S. imports are expected to fall in the double digits in Q4.

- Capacity improved by 7%, but still down 15% year-over-year.

- Ocean rates rebounded in October by 39% but remain 44% below last year.

- U.S. – China tariffs have had a significant impact on eastbound volumes.

- TEU volume down 0.1% vs. September, but down 7.5% year-over-year

- Key Takeaways

- Secure space early when moving ocean freight to help control the cost.

- Consider mini bids to help control the volatility of the market.

- Factor in tariff-driven costs that are having an impact on heavy international lanes.

- Secure space early when moving ocean freight to help control the cost.

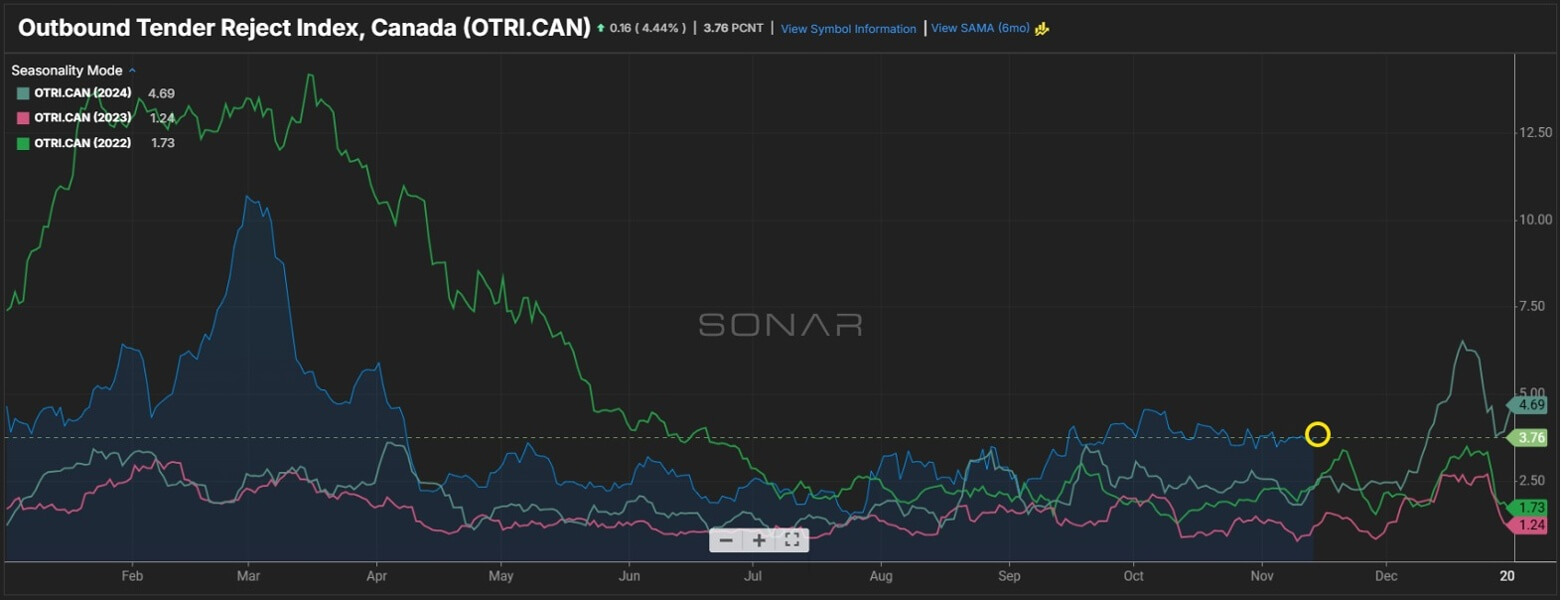

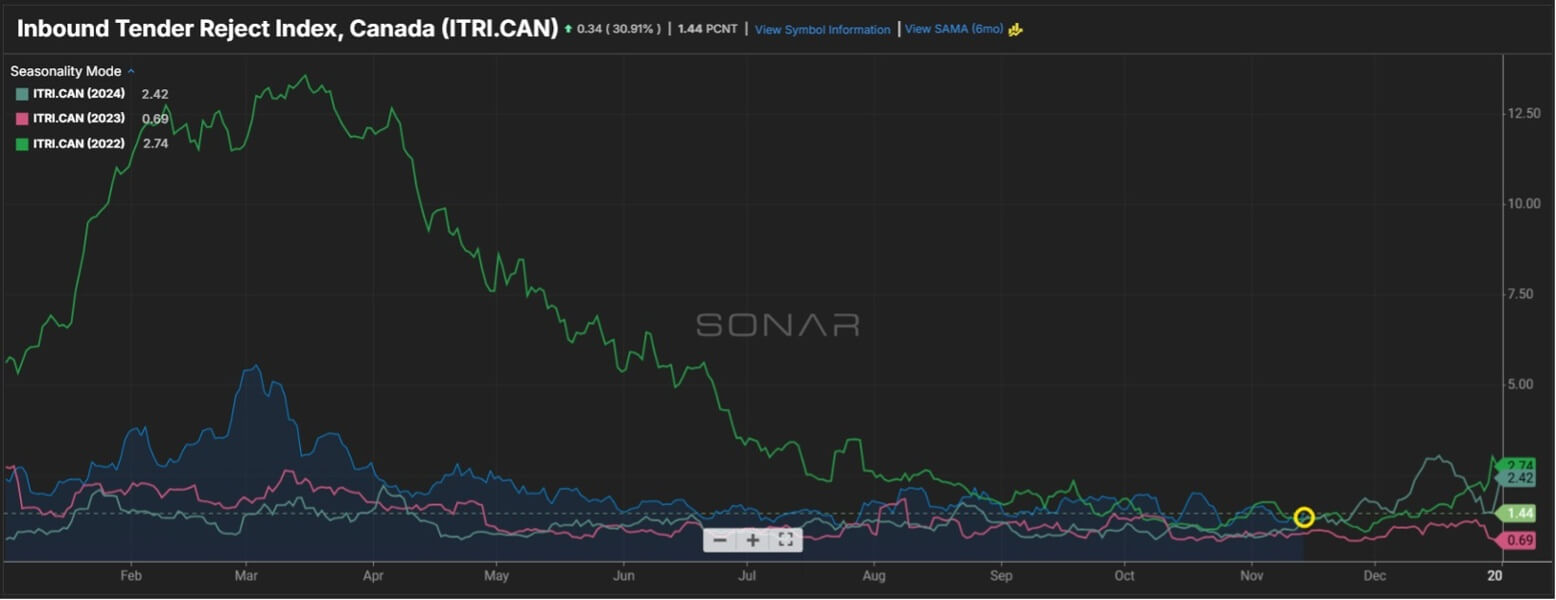

Cross Border

- Mexico exports to the U.S. have surged 13.8% year-over-year

- Inbound to Canada stronger than outbound; cross-border freight accounts for 65% of all Canadian spot posts.

- Rates generally stable, but demand still down based on a weaker U.S. retail and manufacturing productivity.

- Weather will continue to be a major factor in Canada as we get closer to winter.

Total Spot Rates

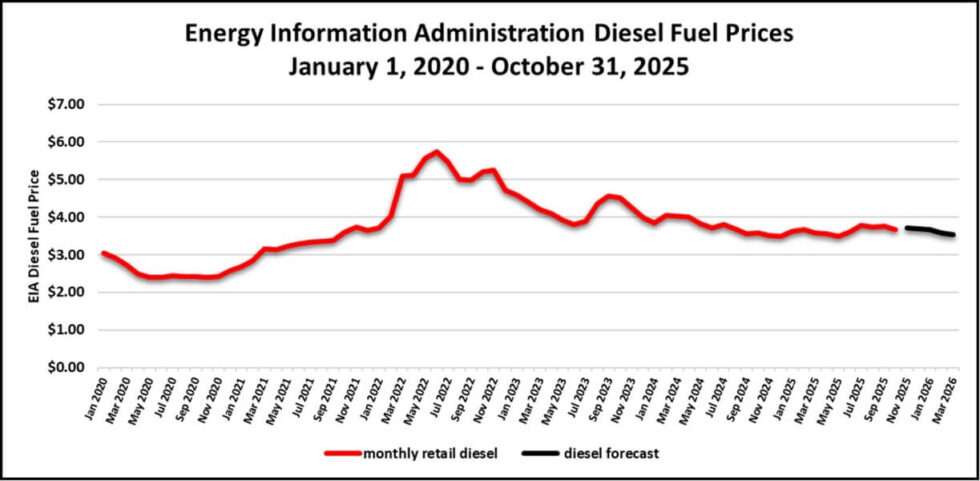

Fuel Forecast - DOE

- 2024 diesel fuel retail prices averaged $3.761/gallon through Q4 2024 and Q1 2025 finished lower at an average $3.631/gallon, and Q2 finished at $3.555/gallon.

- Fuel for Q3 finished at $3.757/gallon and Q4 is tracking $3.694/gallon to close out 2025.

Energy Information Administration Diesel Fuel Prices January 1, 2020 - September 31, 2025