September 2025

Market Update

Transportation Trends

General Outlook

- Limited volatility in the market is expected until mid/late October.

- Demand will remain stable to slightly down until we get closer to the holiday season.

- U.S. – China trade talks continue.

- Retail sales rose 0.6% in August which was stronger than expected.

- Rising operating costs could likely put pressure on carriers to increase rates.

- The Middle East tension has caused some concerns around the oil volatility in the market.

- Labor market is still weak: Only 22,000 jobs added in August.

- Unemployment ticked up to 4.3%.

- 30-year fixed mortgage is sitting at 6.35% in September.

LTL

- Dayton Freight is relocating in Illinois to a larger facility with additional doors.

- 32 door center in Mt. Vernon, IL

- CASS data shows LTL volume down in 2025 vs. previous years.

- 7% volume decrease y/y in September.

- Several key LTL carriers also reported tonnage decline in September and year-over-year.

- FedEx Freight extends new class rules changes to December 1st

- Key Information for LTL shippers when requesting pricing.

- Dimensions, Class, NMFC numbers, and weights are critical to obtain correct pricing on the front end of your shipment.

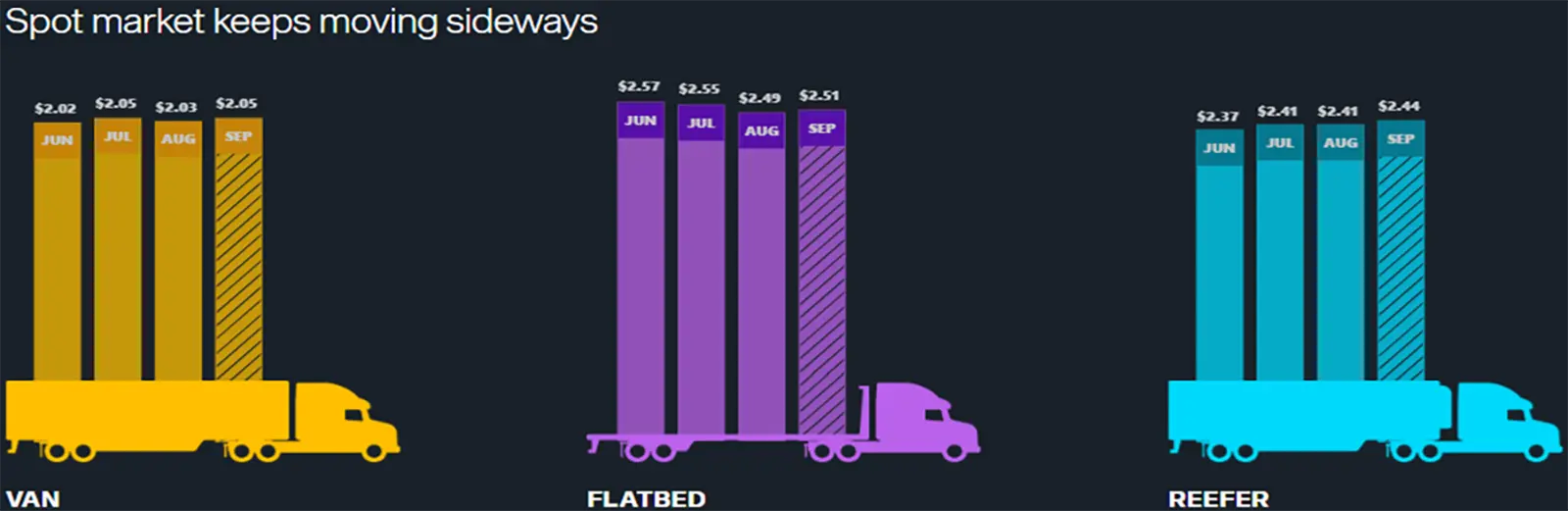

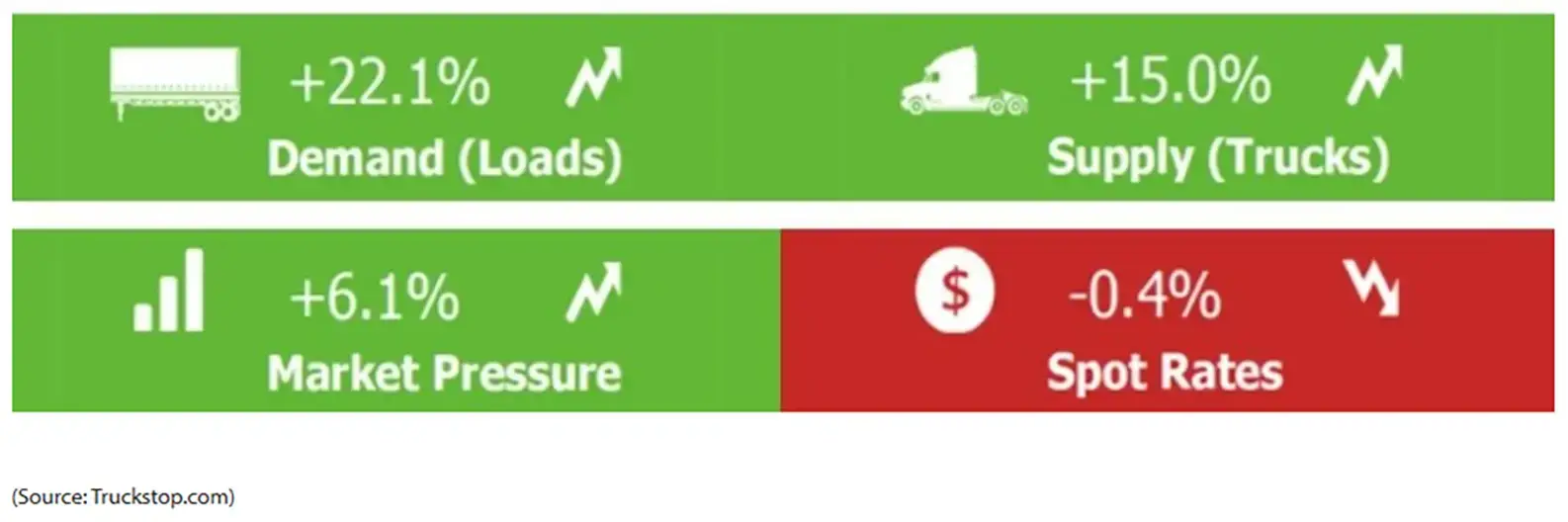

Truckload

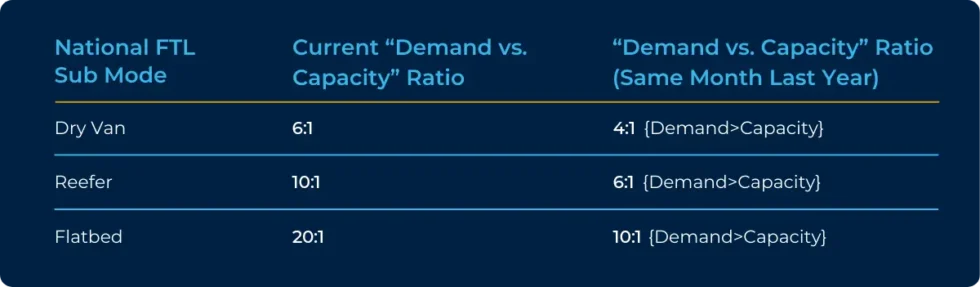

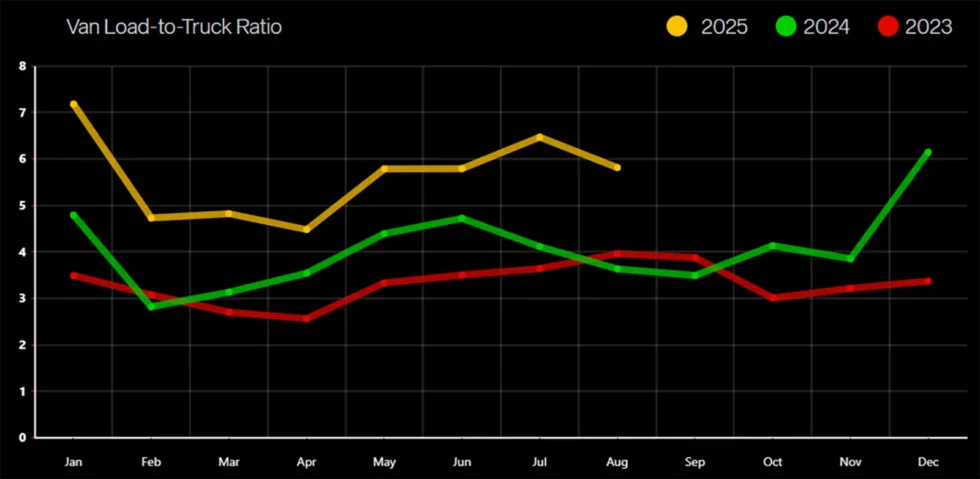

- Van spot rates were increased (1.0%) vs. this same time last year but down slightly (0.5%) vs. last month.

- Capacity grew tighter by 60.3% compared to last year but down 10.1% compared to last month.

- September Van contracted pricing is up $.37 per mile over the spot market.

- Reefer spot rates increased (0.4%) vs. last year but decreased (0.9%) vs. last month.

- Capacity grew tighter by 74.0% vs. last year but improved 12.2% vs. last month.

- September Reefer contracted pricing is tracking up $.32 per mile over the spot market.

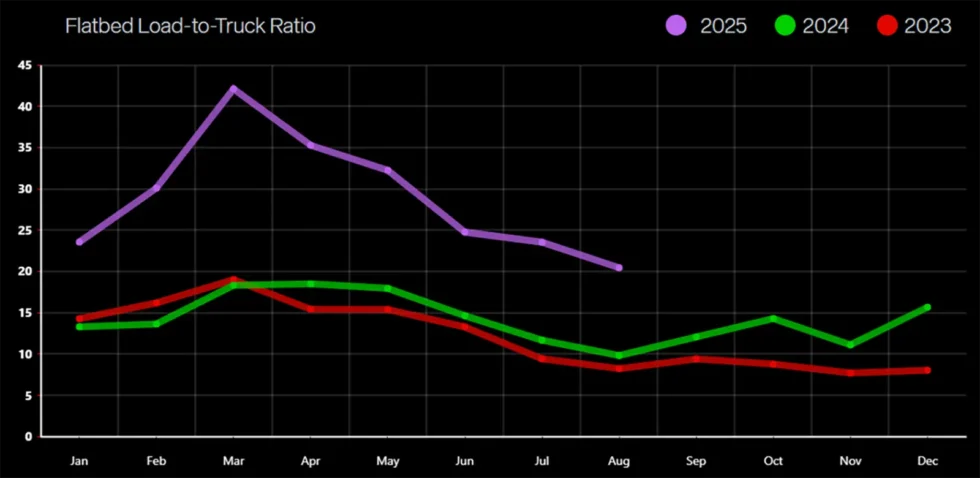

- Flatbed spot rates were down (0.4%) vs. last year and (0.9%) vs. last month.

- Capacity grew tighter by 108.0% vs. last year but improved by 13.1% over last month.

- September Flatbed contracted pricing is tracking up $0.57 per mile over the spot market.

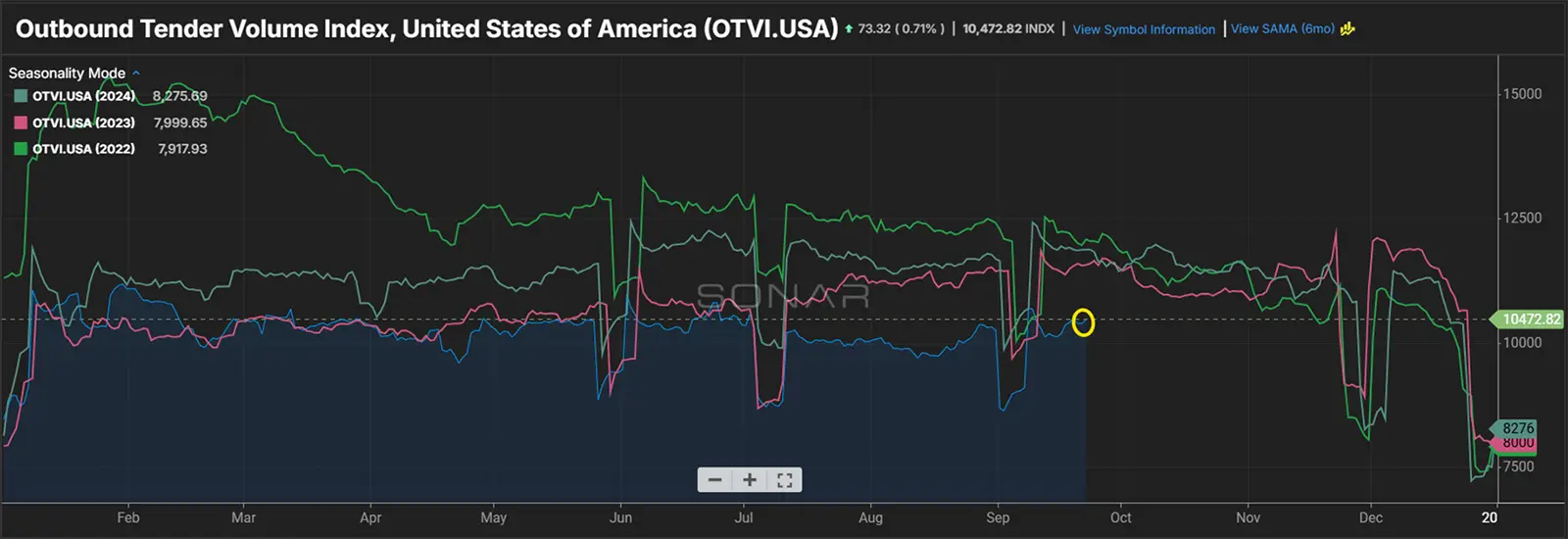

Outbound Tender Volume - All Modes

- Outbound tender volume dropped back down this month and is still trending below both 2023 and 2024 volumes. Market should see an uptick in volume as we get closer to the holiday season.

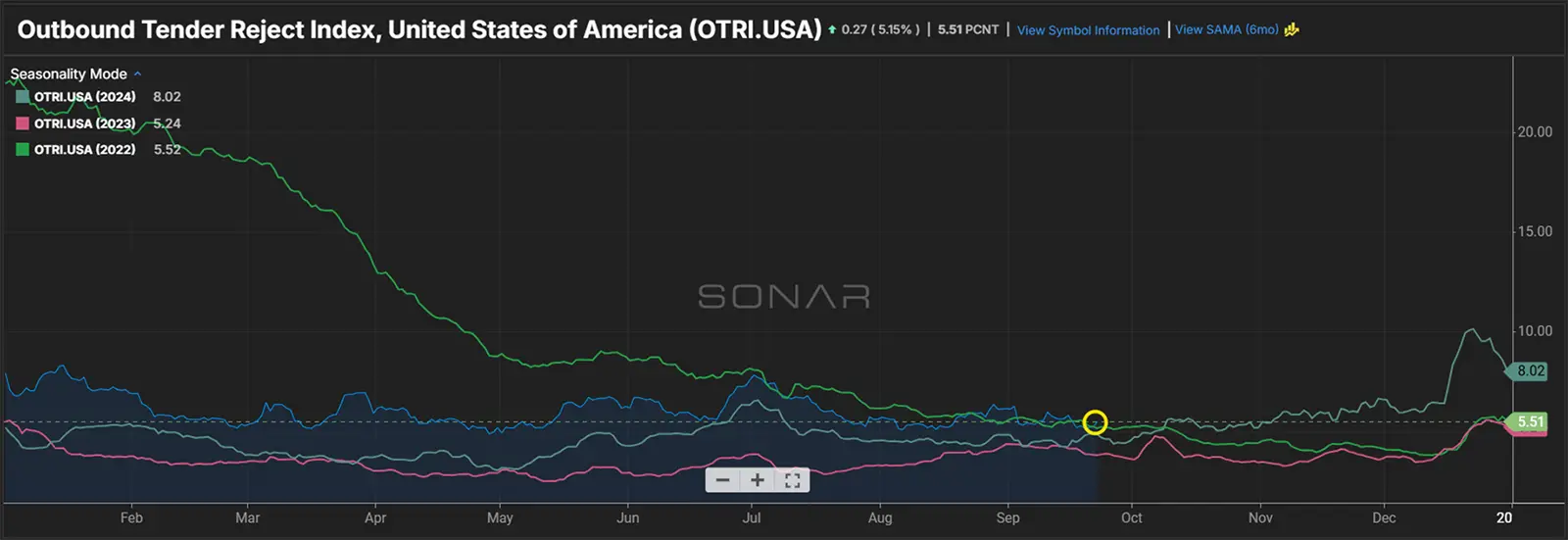

Outbound Tender Reject - All Modes

- Overall Rejects continue to remain higher than 2023 and 2024.

- Capacity still reflects a tighter market over 2024, but the overall demand of freight is still low.

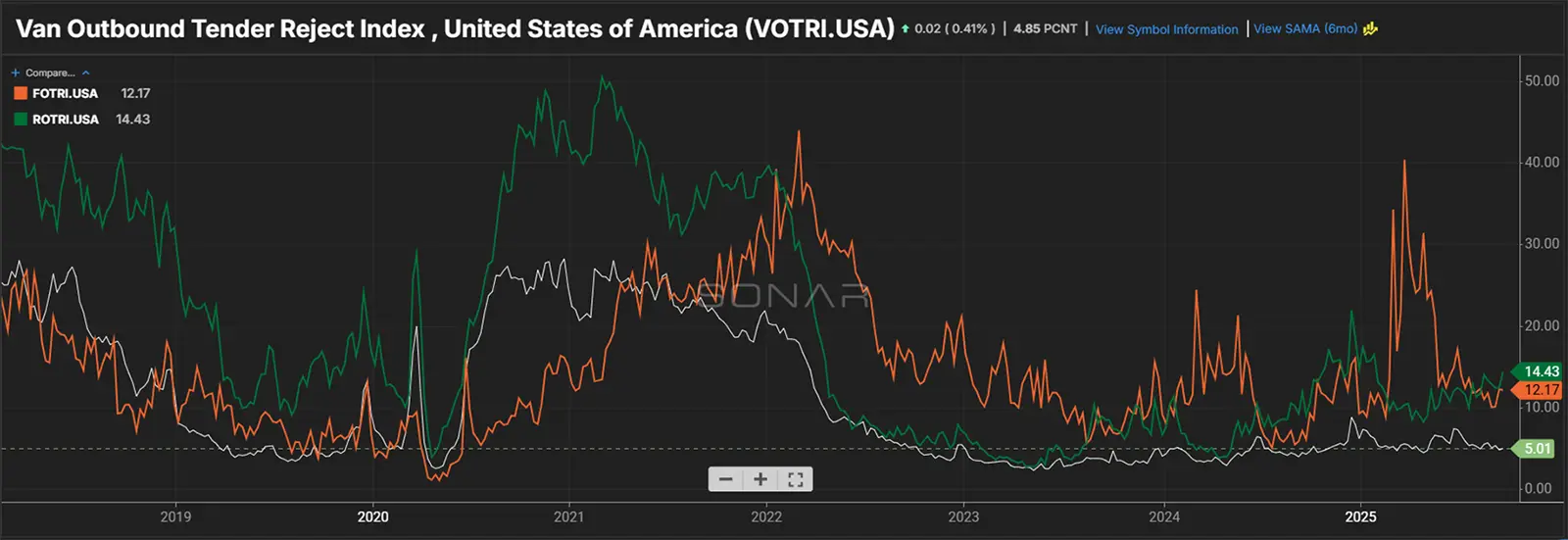

Outbound Tender Reject – by Mode

- Orange Line – Flatbed: Rejections are down slightly vs. this same time last year.

- Rejections fluctuated based on the unknows the current market is facing.

- Green line – Reefer: Rejections for Reefer are improving, but still higher than this same time last year. Rejections for Reefer jumped over Flatbed this month.

- Keep a close eye on your carrier capacity as we creep closer to the holiday season.

- White line – Van: Van Rejections remain slightly vs. 2024 but still are not having a large impact on capacity and rates.

- Rejections continue to fluctuate month-over-month but still remain flat since the start of this year.

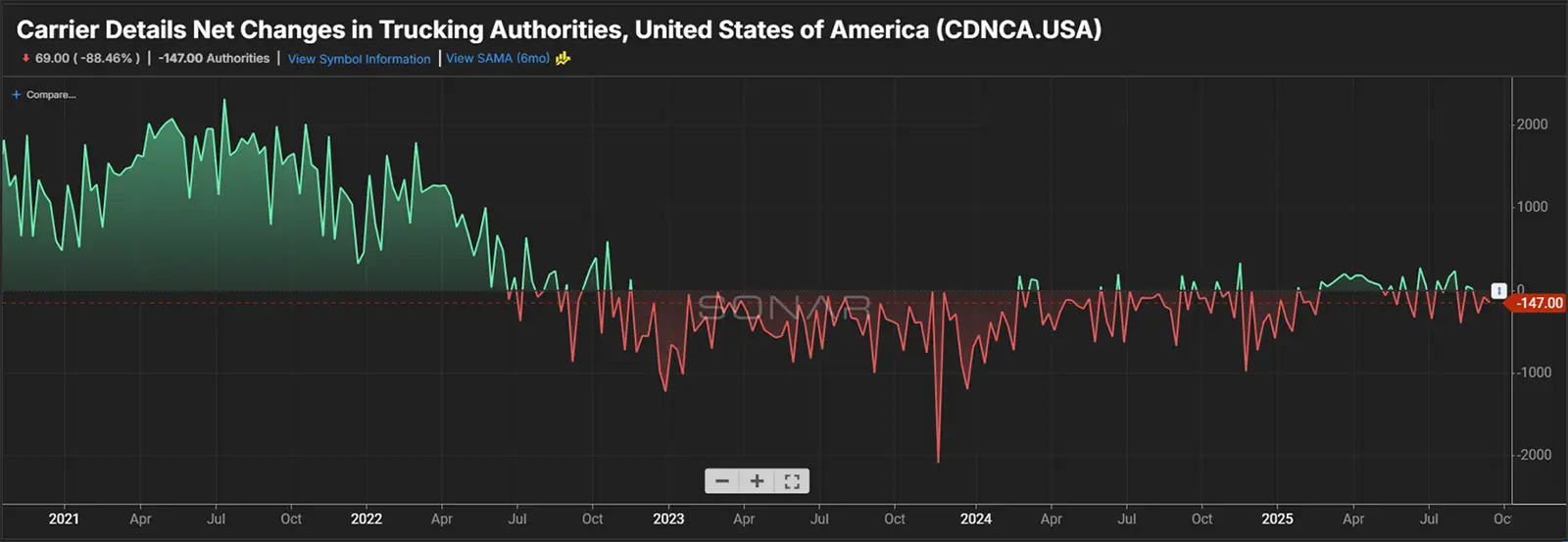

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Authorities are down vs. this same time last year and remain down month-over-month.

Demand vs. Capacity Metrics - August 2025

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

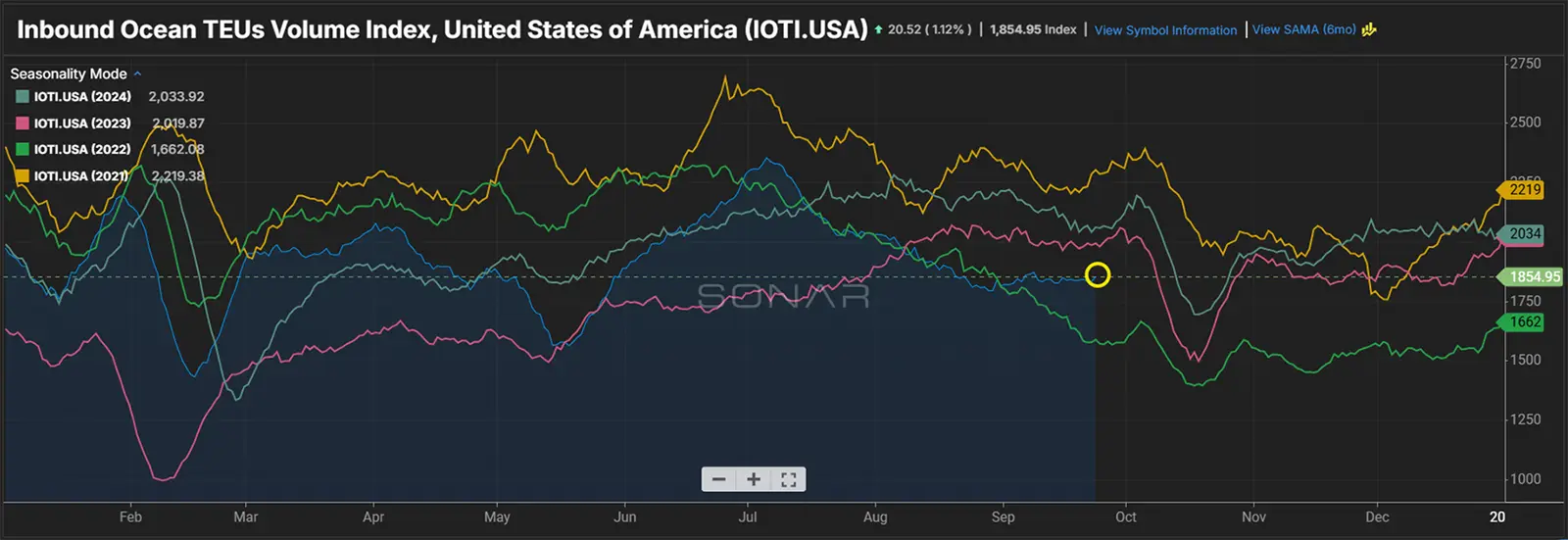

International

- Import Volumes peaked in July; we are now trending 10% below 2024 levels.

- Ports expected to be moderate in Q4, no anticipated surge before Golden Week.

- Ocean spot rates trend downward based on weaker demand.

- Shippers should look to add lead time to loads moving international to avoid overpaying with temporary spikes.

- S. Container import volume increased in August over July. September showed flat to as slow decline as we head into the last week.

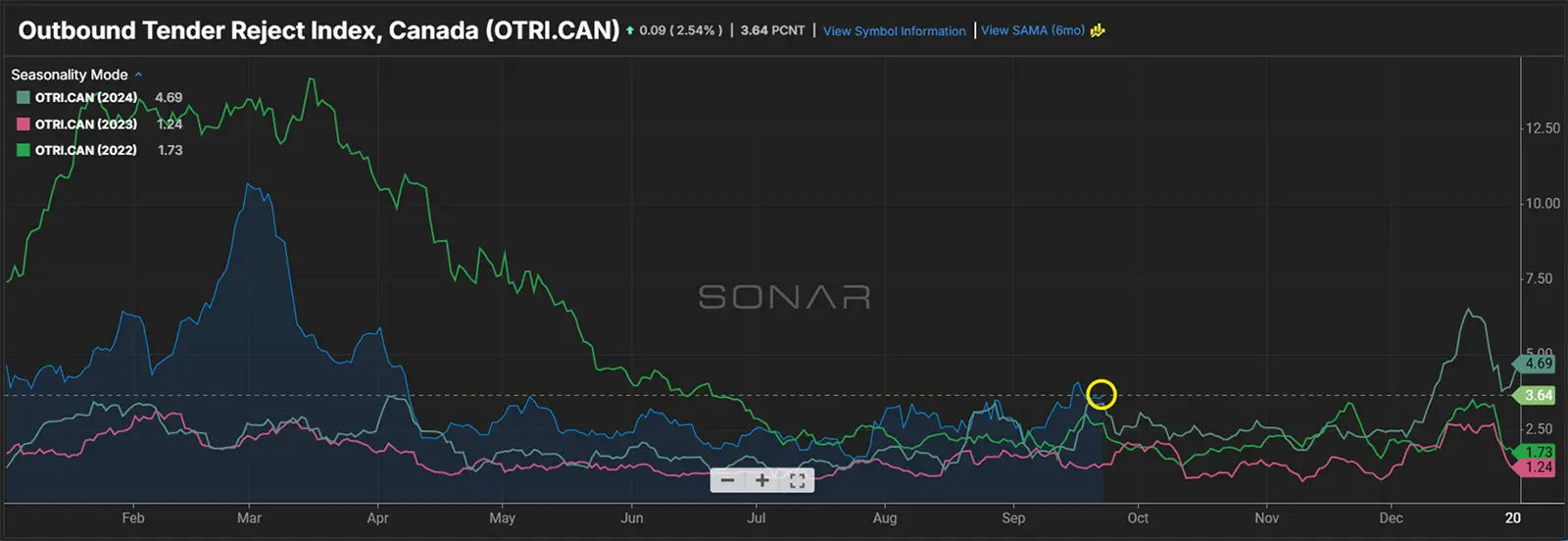

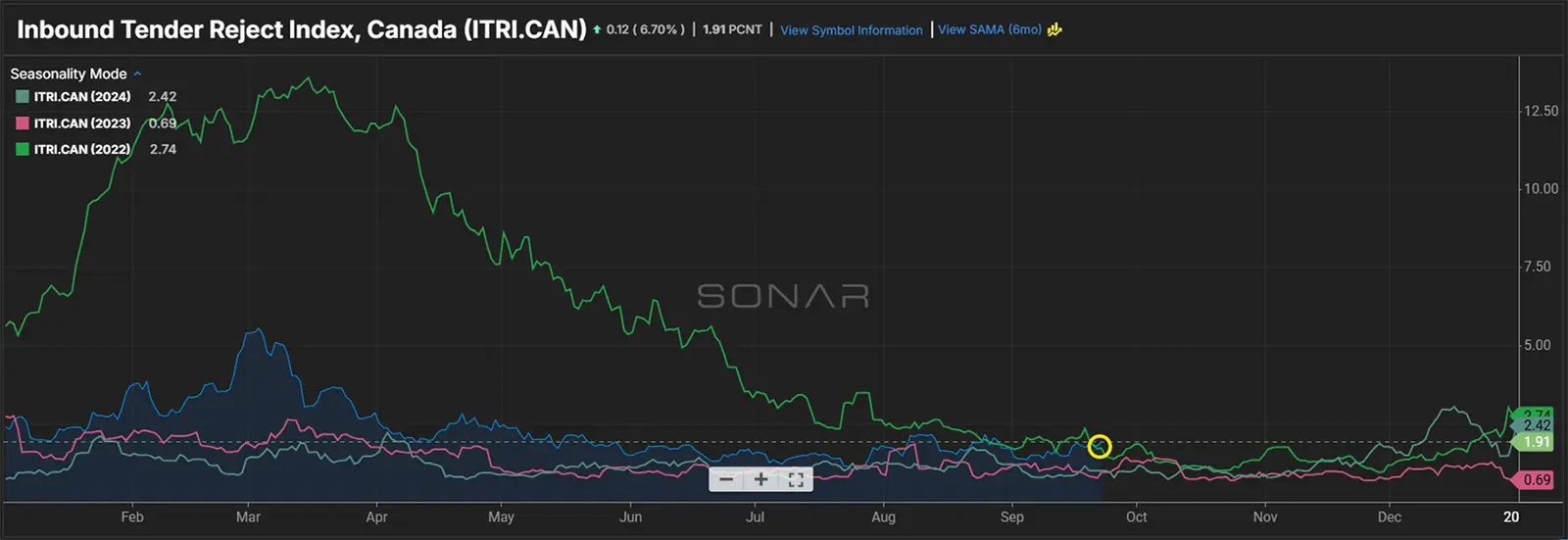

Canadian News

- Outbound tender rejects increase as we head into the end of August. Rejections are still low vs. historical trends, but something to keep an eye on.

- Inbound tender rejections were up in August over July.

- Truck orders jumped up in June over May.

- Spot rates also jumped slightly (1.7%) vs. May.

Spot Market Insights

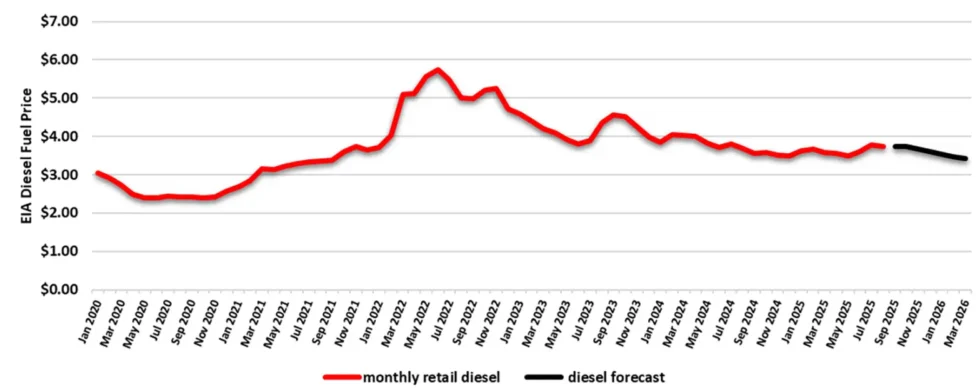

Fuel Forecast - DOE

- 2024 diesel fuel retail prices averaged $3.761/gallon through Q4 2024 and Q1 2025 finished lower at an average $3.631/gallon, and Q2 finished at $3.555/gallon.

- Fuel for Q3-Q4 of 2025 is forecasted at an average of $3.711/gallon.

Energy Information Administration Diesel Fuel Prices January 1, 2020 - August 31, 2025

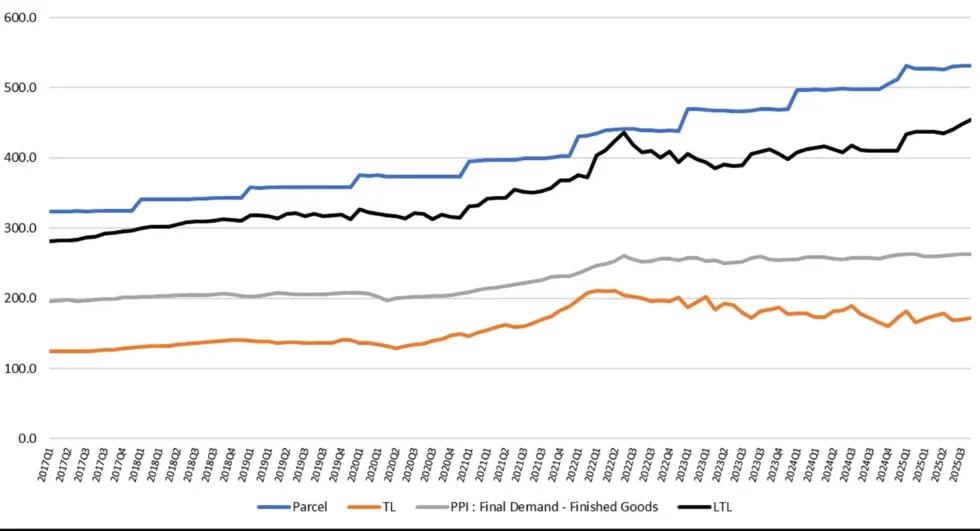

Price Index Performance: 2017 -2025, By Quarter, Through August Q3 2025

State of the U.S. Transportation Market

What Does This Data Mean?

The Producer Price Index (PPI) is a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time. PPIs measure price change from the perspective of the seller. In other words, the PPI measures the trend of the cost of everything manufactured in the United States.