March 2025

Market Update

Transportation Trends

General Outlook

- Inflation cooled slightly in February, but uncertainty remains due to the new tariffs on Chinese, Canadian, and Mexican goods.

- In February, 151,000 jobs were added, and the unemployment rate came in at 4.1%.

- Government employee cuts could push the unemployment rate higher, but it’s not expected to cause a major labor market shift.

- Manufacturing showed some short-term growth, but there are concerns over inflation.

- New orders have dropped, and uncertainty around trade policies remains.

- Overall freight demand stabilized, but tariffs could cause a spike in spot rates.

- Trucking capacity is also showing signs of shrinking.

LTL

- Roadrunner added new lanes to its long-haul network.

- Atlanta, Cleveland, Detroit, Grand Rapids, and Nashville are some of the new coverage areas.

- Duie Pyle plans on expanding its Ohio coverage with three new service centers that will open in the upcoming months.

- The National Motor Freight Traffic Association (NMFTA) plans to roll out a density-based classification requiring shippers and their 3PLs to know the weight and dimensions of all handling units. A vote in March will finalize the new NMFTA rules.

- Organizations can prepare for this change by ensuring they have the proper dimensions and weights for all their LTL products.

- LTL shippers should always include the following key information when requesting pricing: dimensions, class, NMFC numbers, and weight.

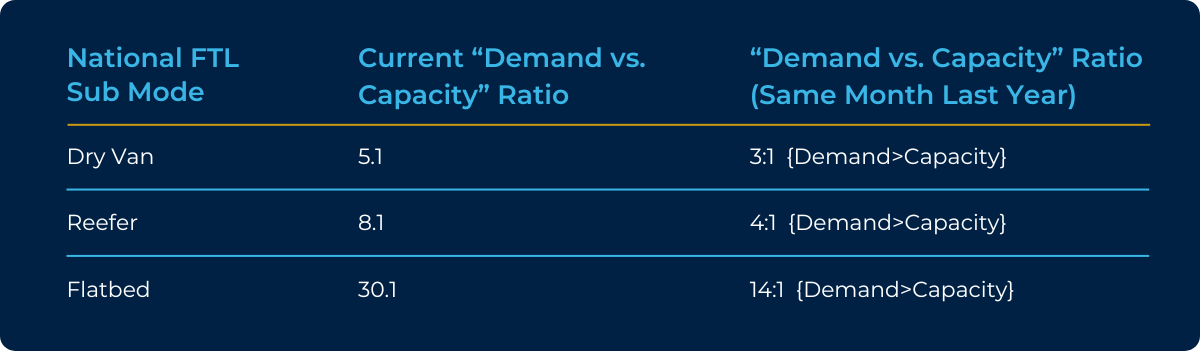

Truckload

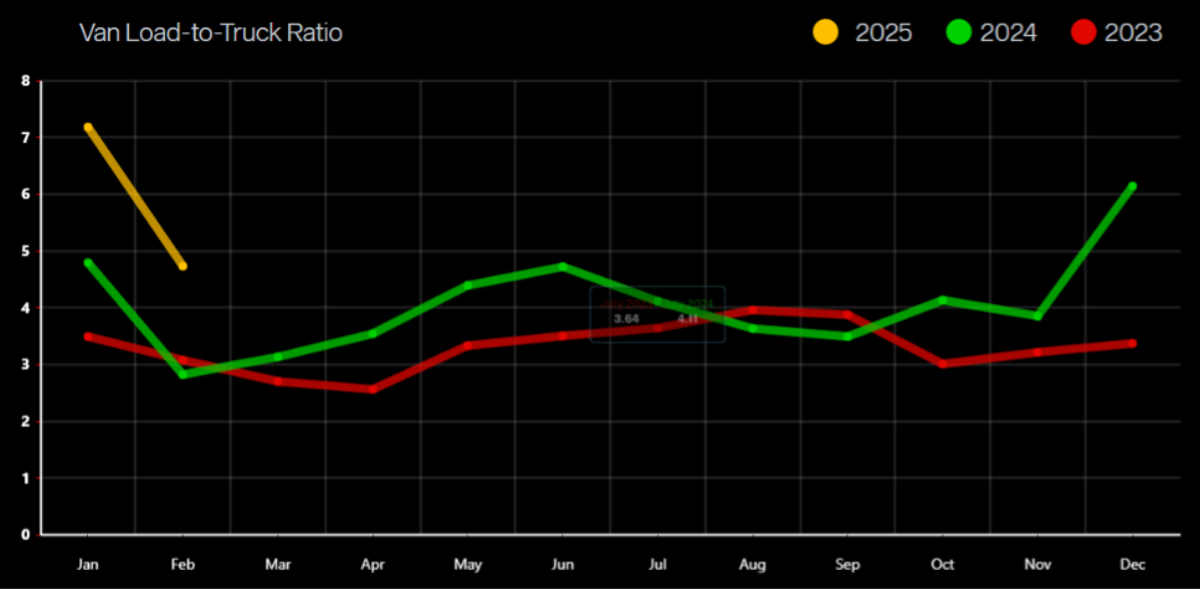

- Van spot rates were up slightly (0.5%) vs. this same time last year and down slightly (0.5%) vs. last month.

- Capacity grew tighter by 67.5% compared to last year but improved 34.1% compared to last month.

- March Van contracted pricing is up $.42 per mile over the spot market.

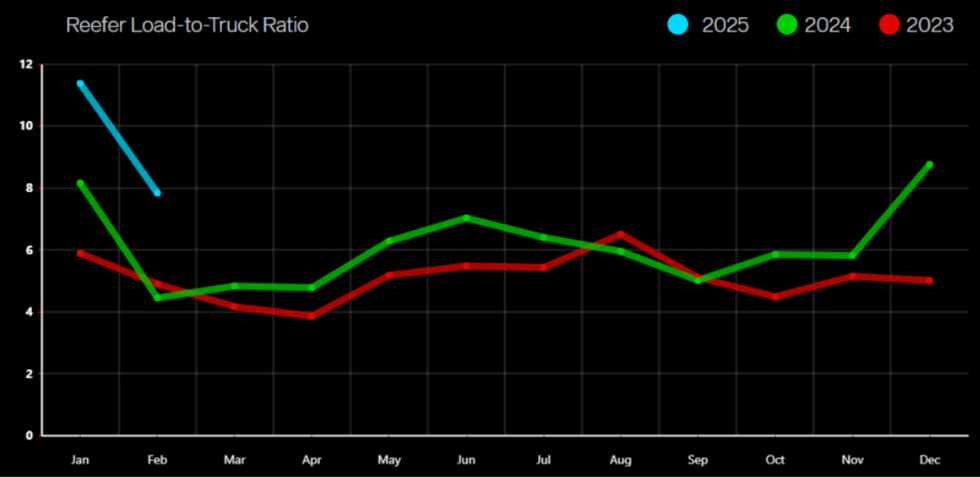

- Reefer spot rates decreased (2.1%) vs. last year and (0.9%) vs. last month.

- Capacity grew tighter by 75.9% vs. last year but improved 31.1% vs. last month.

- March Reefer contracted pricing is tracking $.44 per mile over the spot market.

- Flatbed spot rates are up (0.4%) vs. last year and down (0.8%) vs. last month.

- Capacity decreased by 120.6% vs. last year and by 27.8% over last month.

- March Flatbed contracted pricing is tracking up $0.54 per mile over the spot market.

- Capacity decreased by 120.6% vs. last year and by 27.8% over last month.

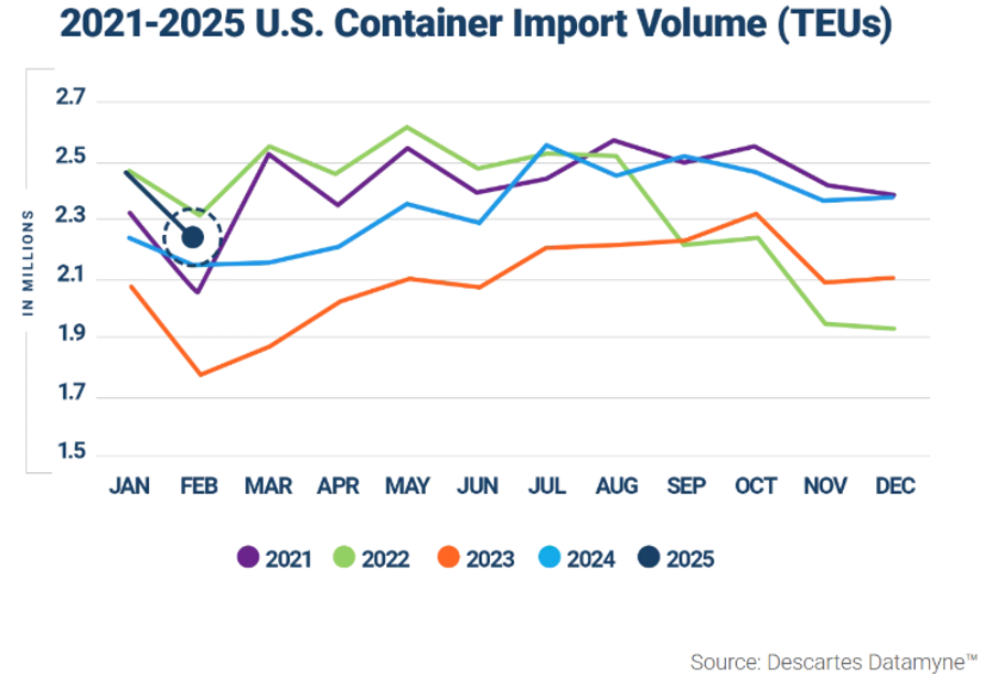

Massive pull-forward of imports to avoid tariffs

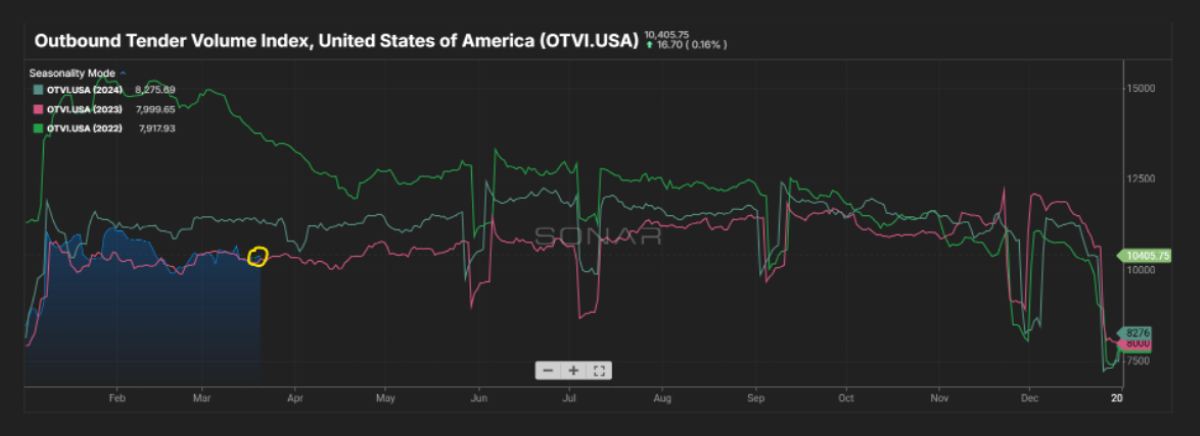

Outbound Tender Volume - All Modes

- Outbound tender volume is lower than 2024 but still trending slightly above 2023.

- Import volumes remain elevated, so we will be keeping a close eye on tender volume as we head into April.

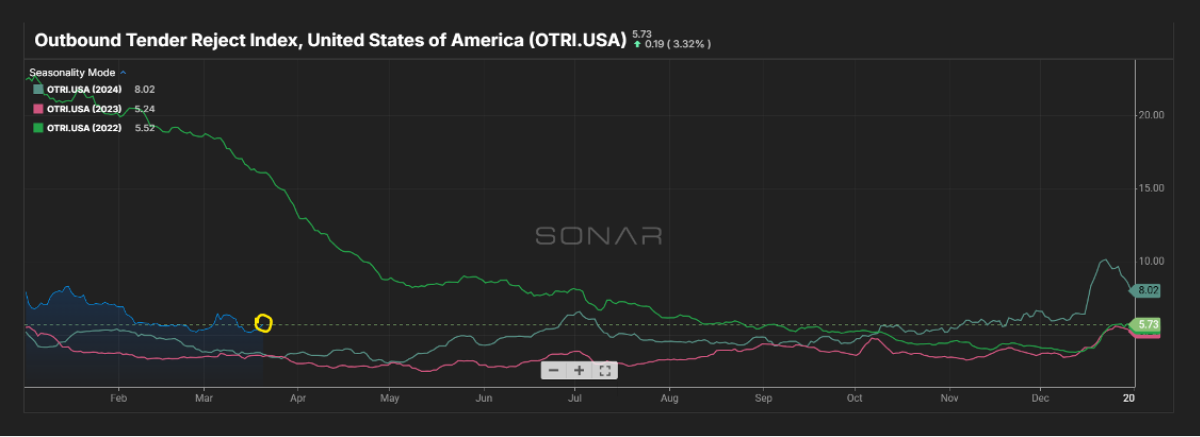

Outbound Tender Reject - All Modes

- Overall rejects continue to remain higher than 2023 and 2024.

- Capacity remains tight, which is causing reject volume to stay up during Q1 of 2025.

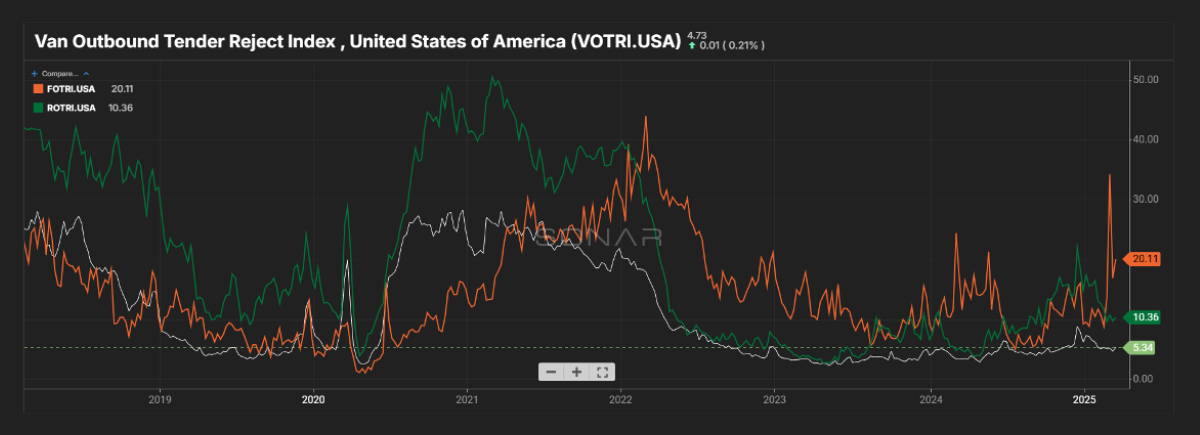

Outbound Tender Reject – by Mode

- Orange Line – Flatbed: Rejections are around the same rate that we experienced in 2024.

- Rejections dropped as we headed into March but continued to remain up over the last half of 2024.

- Green line – Reefer: Rejections remain slightly higher compared to 2024.

- After weather issues at the beginning of the year, the rejection rate has significantly improved.

- White line – Van: Rejections are up slightly compared to 2024 but still are not having a large impact on capacity and rates.

- Rejections have remained steady so far in 2025.

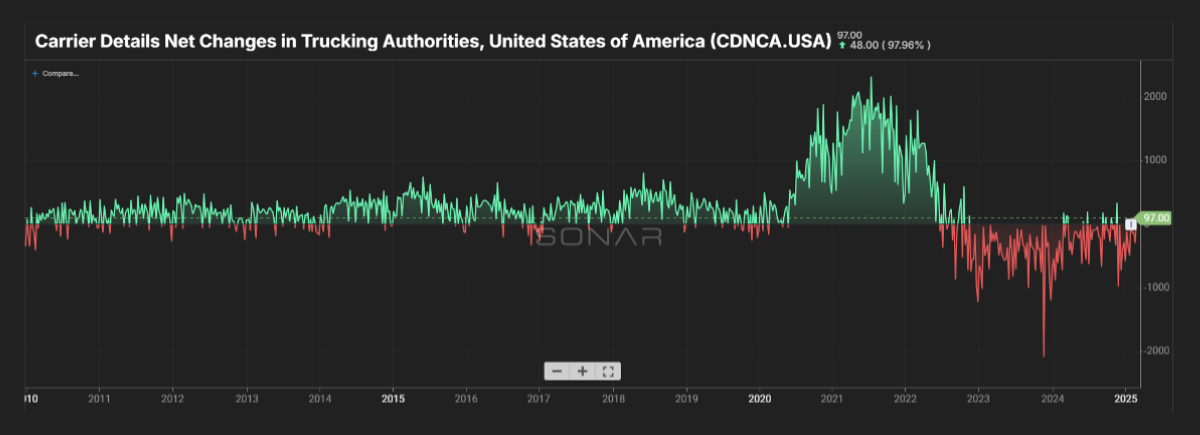

Carrier Authorities

- This graph indicates that we have fewer transportation companies coming into the market based on the current demand.

- We are still trending below the number of Authorities leaving the market.

- As capacity goes, so does the number of carriers in the transportation space.

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

International

- Inbound TEUs remain up over 2024.

- Volumes were strong in February as importers prepared for the impact the tariffs could have on the market.

- Ocean spot rates have dropped due to the increase in capacity.

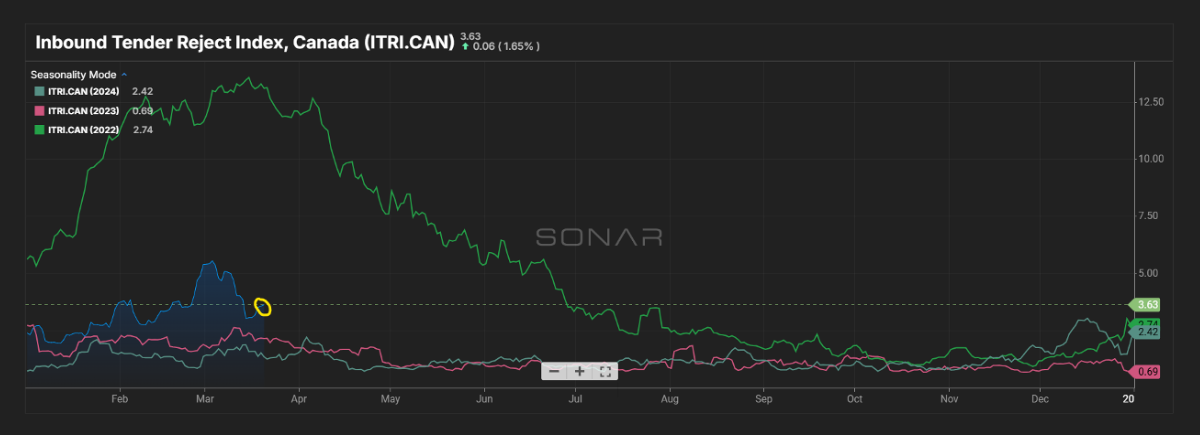

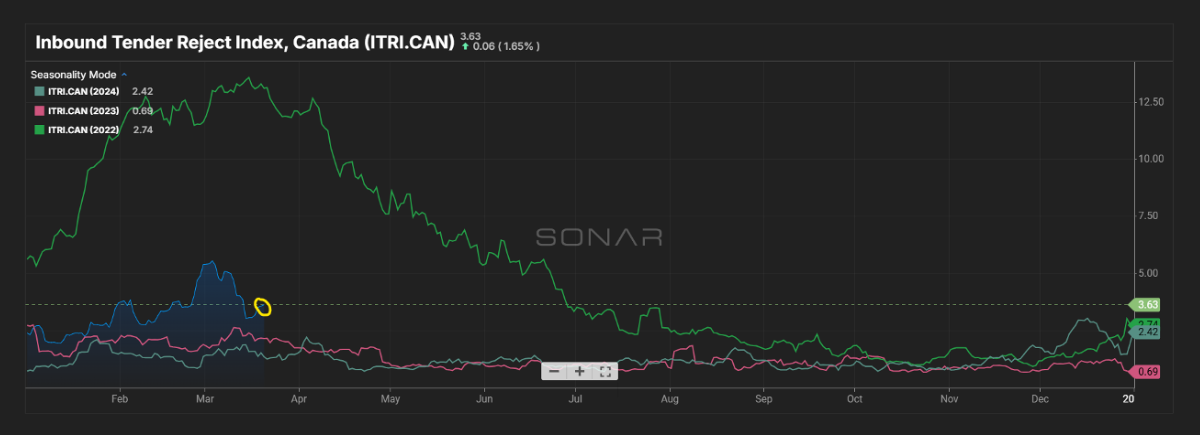

Canadian News

- Inbound and Outbound rejections declined in March.

- Early March rates jumped significantly as shippers rushed freight across the border before tariffs went into effect.

- Rates came back down, compared to mid-February levels, after the tariffs were delayed.

- Inbound tender rejects remain elevated compared to 2023 and 2024 levels.

- Outbound tenders are also up compared to 2023 and 2024.

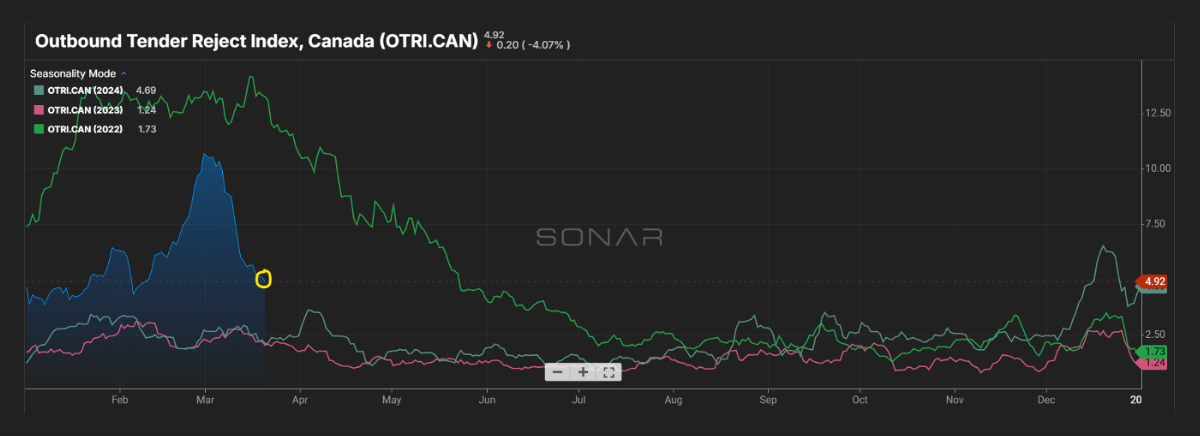

Fuel Forecast - DOE

- 2024 diesel fuel retail prices averaged $3.761/gallon through Q4 2024 and Q1 2025 is forecasted to finish slightly lower at an average $3.652/gallon.

- Fuel for Q2-Q4 of 2025 is forecasted at an average of $3.624/gallon.

Energy Information Administration Diesel Fuel Prices January 1, 2020 - February 28, 2025

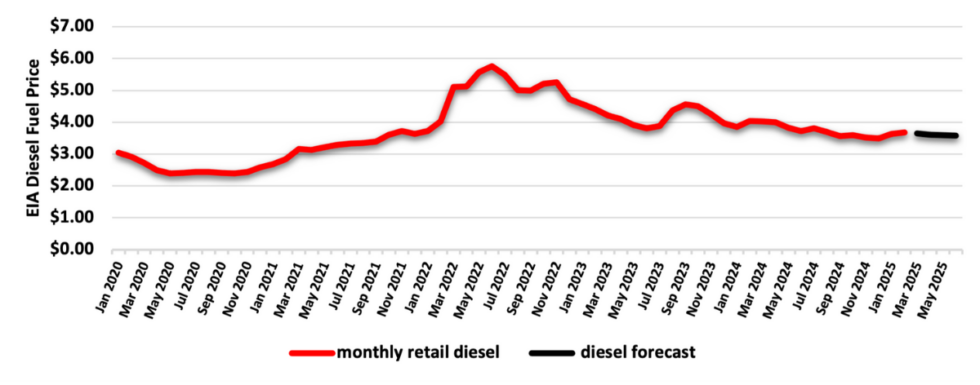

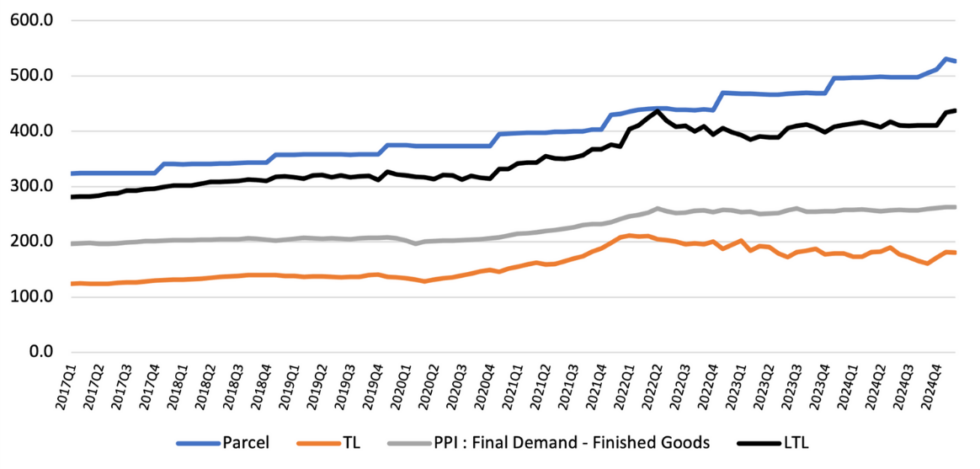

Price Index Performance: 2017-2025, By Quarter, Through February Q1 2025

State of the U.S. Transportation Market

What Does This Data Mean?

The Producer Price Index (PPI) is a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time. PPIs measure price change from the perspective of the seller. In other words, the PPI measures the trend of the cost of everything Manufactured in the United States.