November 2024

Market Update

Transportation Trends

General Outlook

- The Federal Reserve is expected to cut interest rates by 50 basis points by the end of 2024.

- 1% unemployment rate as we head into the end of the year.

- Inflation remains above 2%, rate cuts could help boost consumer spending heading into the holiday season.

- Industrial production fell 0.3% in September, which was impacted by weather and job strikes.

LTL

- LTL carriers are still looking to expand by acquisition as we head into the end of 2024.

- Mergers are likely to occur like the Knight-Swift purchase of Dependable Highway and Moran Transportation buying RMX Freight.

- Old Dominion announced on Monday, November 18th their 4.9% general rate increase across multiple tariffs.

- Other Key LTL carriers that implemented a general rate increase:

- ArcBest 5.9% (September 2024)

- Saia 7.9% (October 2024)

- FedEx 5.9% (First Monday of 2025)

- The National Motor Freight Traffic Association (NMFTA) will be rolling out density-based classification for 3PLs.

- Shippers will soon have to know the weight and dimensions of all handling units.

- Proposed change will be issued in January of 2025, potentially beginning in May 2025.

- Key Information for LTL shippers when requesting pricing:

- Dimensions, Class, NMFC numbers, & weights are critical to getting the correct price on the front end of your shipment.

- Shippers will soon have to know the weight and dimensions of all handling units.

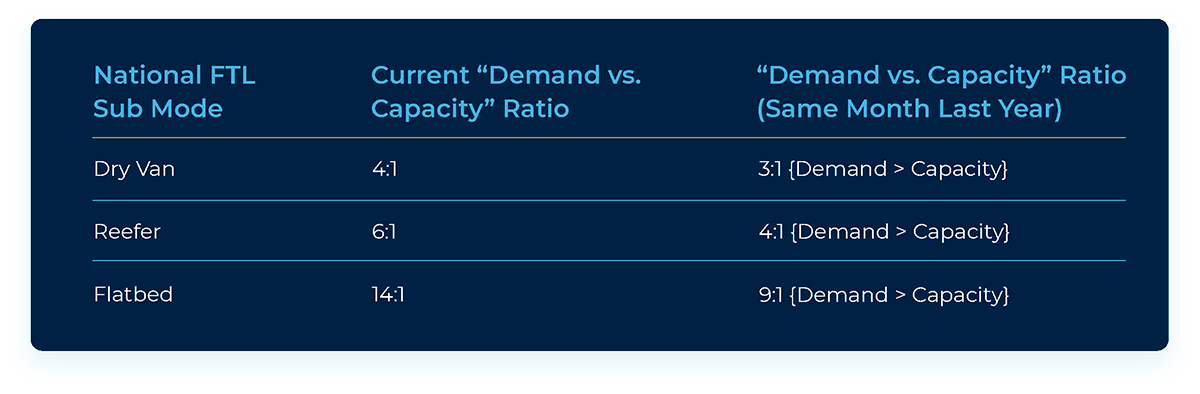

Truckload

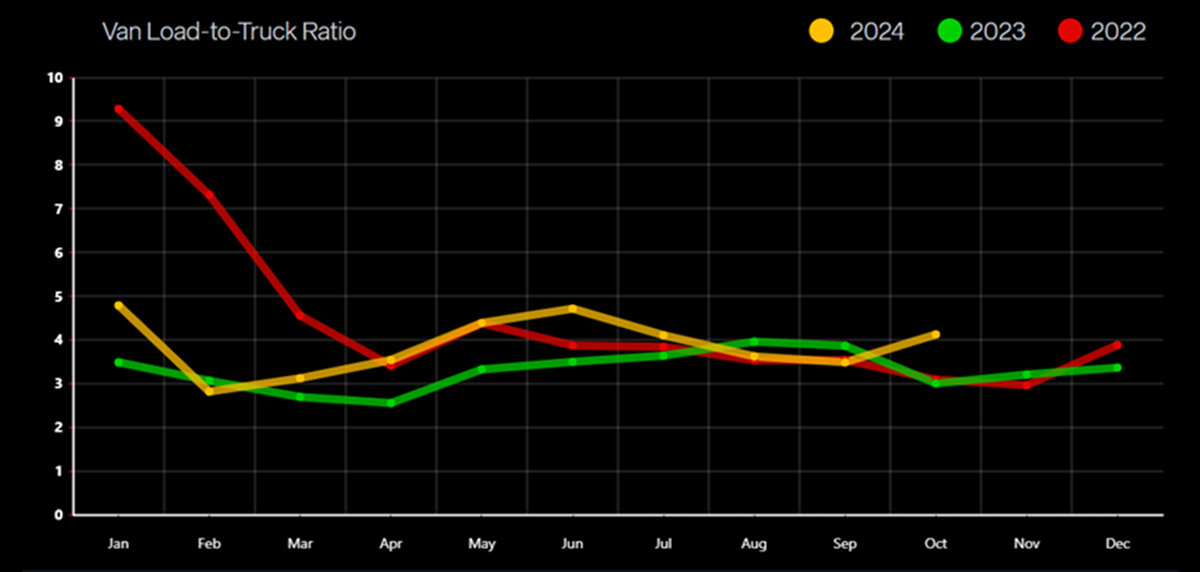

- Van spot rates were slightly up 0.5% vs. this same time last year but Flat 0.0% vs. last month. Capacity grew tighter this same time last year by 37.3% and by 18.1% vs. last Month. November Van contracted pricing is up $.38 per mile over the spot market.

- Reefer spot rates remained flat vs. this same time last year but dipped slightly 2.1% vs. last month. Capacity decreased from last year this same time by 30.3% and decreased by 16.6% vs. last month. November Reefer contracted pricing is tracking up $.30 per mile over spot market.

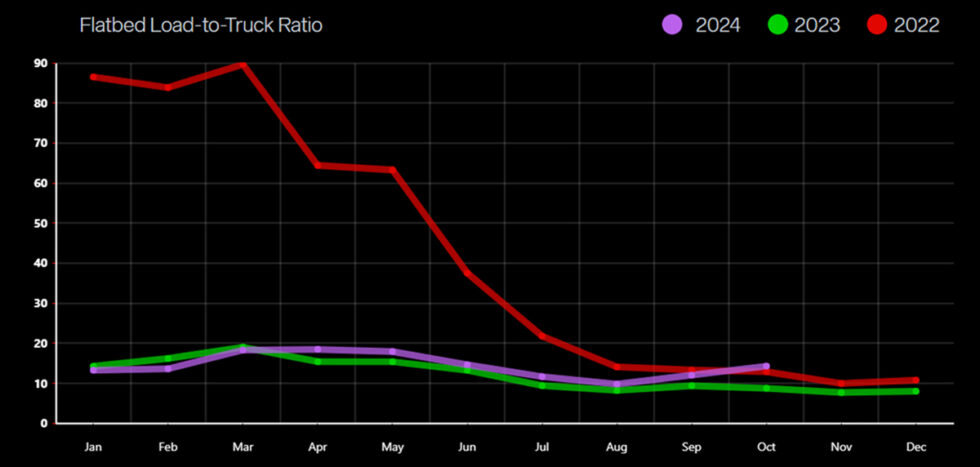

- Flatbed spot rates are up 3.2% vs. this same time last year, but down 0.4% vs. last month. Capacity decreased by 62.8% vs. this same time last year and by 18.5% over last month. November Flatbed contracted pricing is tracking up $0.65 per mile over spot market.

Van and Reefer rates take a step back

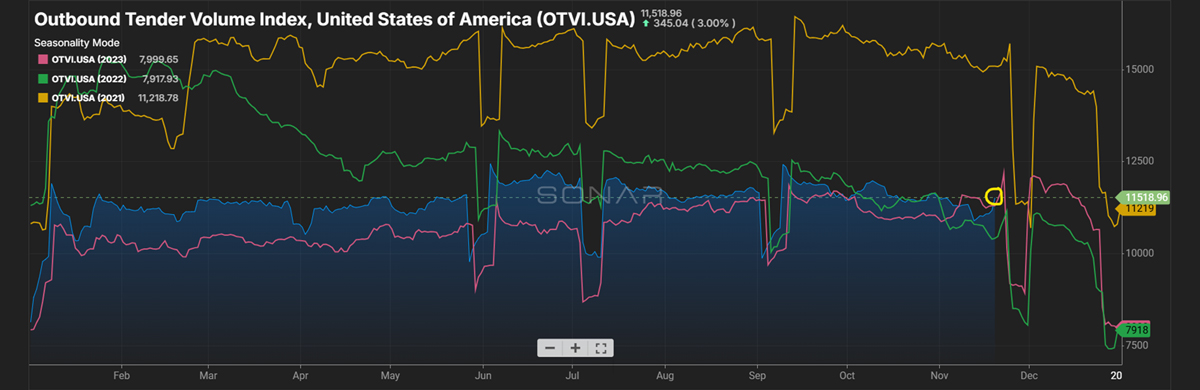

Outbound Tender Volume - All Modes

Demand showing up vs last year, as well as 2022. As we head into the Holiday season it will be important to secure capacity in

advance when applicable.

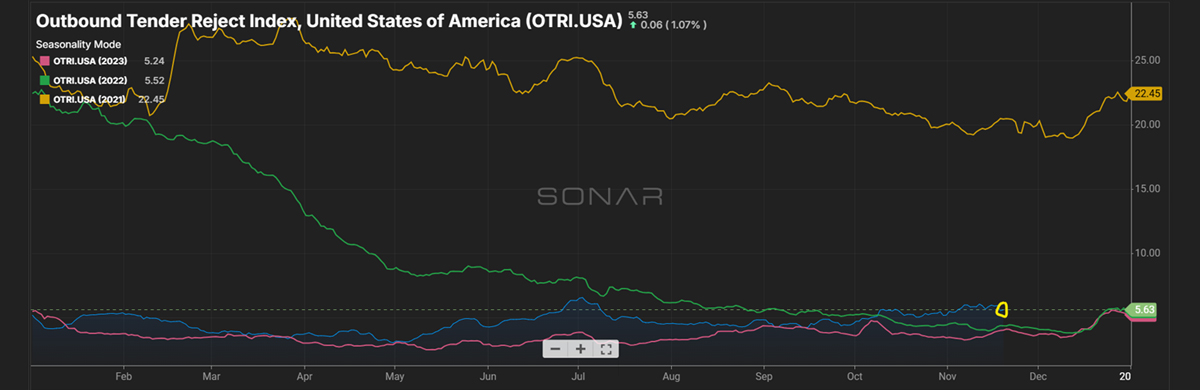

Outbound Tender Reject - All Modes

Overall Rejects continue to remain higher than 2023/2022. Keep an eye on your loads related to p/u and delivery dates as we head into the Holiday. Window on capacity could get tight as we head into the winter months.

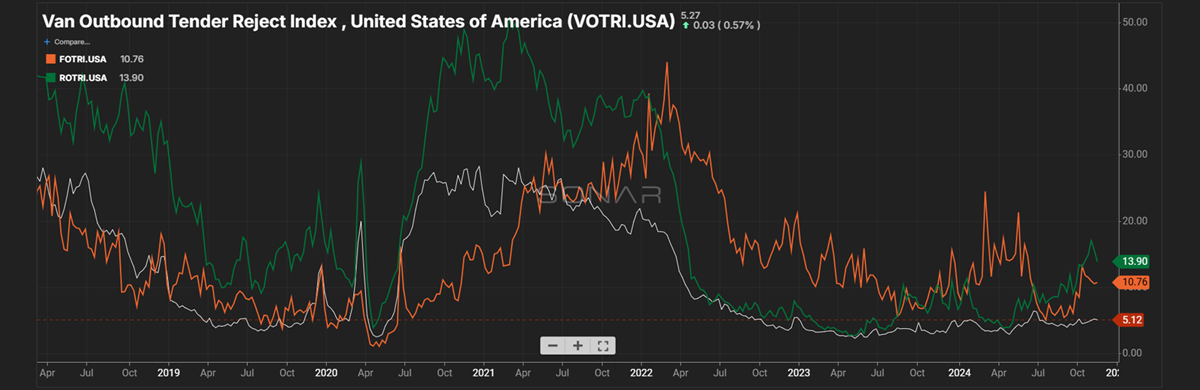

Outbound Tender Reject – by Mode

- Orange Line – Flatbed: Rejections dropped back down after spiking in October.

- Green Line – Reefer: Rejections are still up over what we saw at the beginning of the year. As we get closer to colder temperatures, expect rejections to increase.

- Blue Line – Van: Rejections have remained relatively flat over the last 2 months

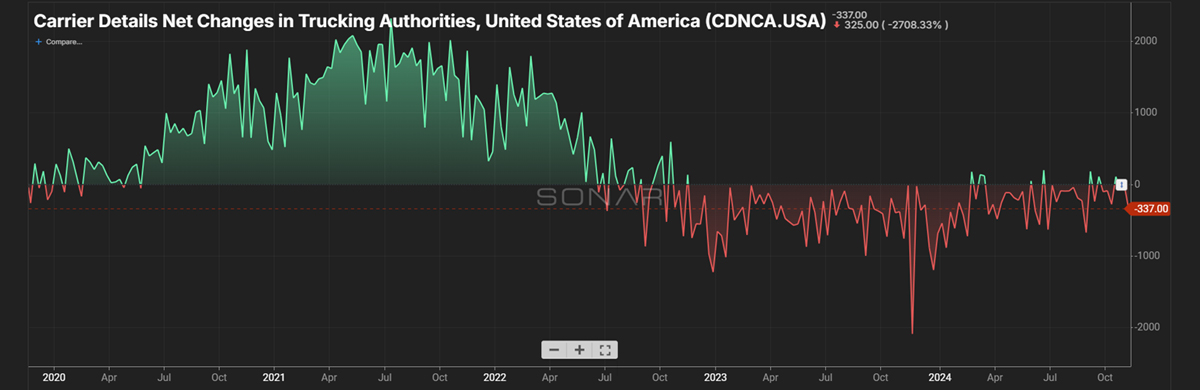

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Carrier Authorities gone up and down by remain below the line. As the market increases its overall outbound volume, you will see this start to trend up.

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

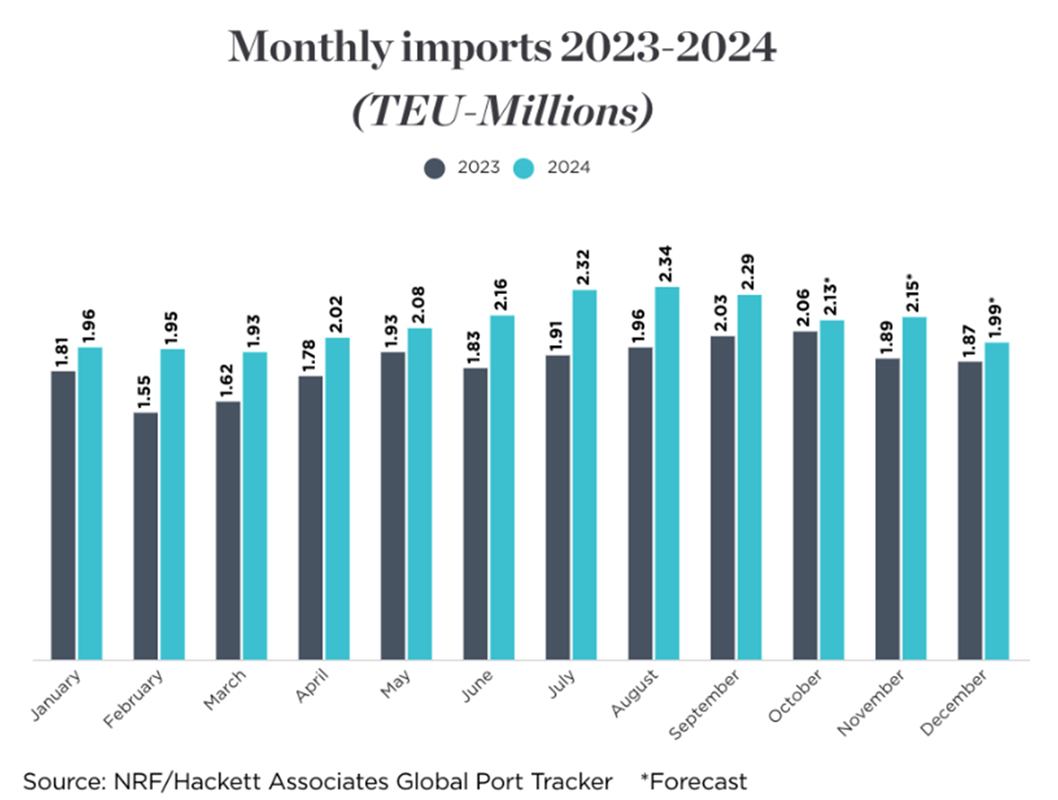

International

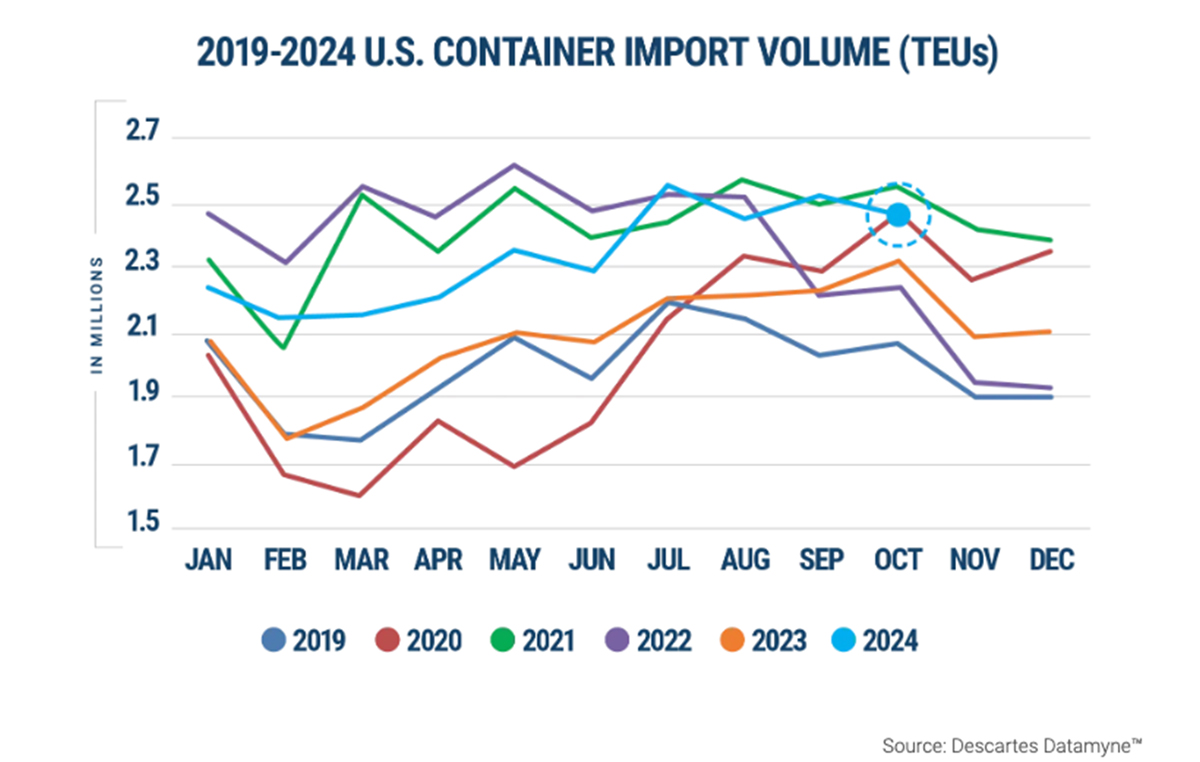

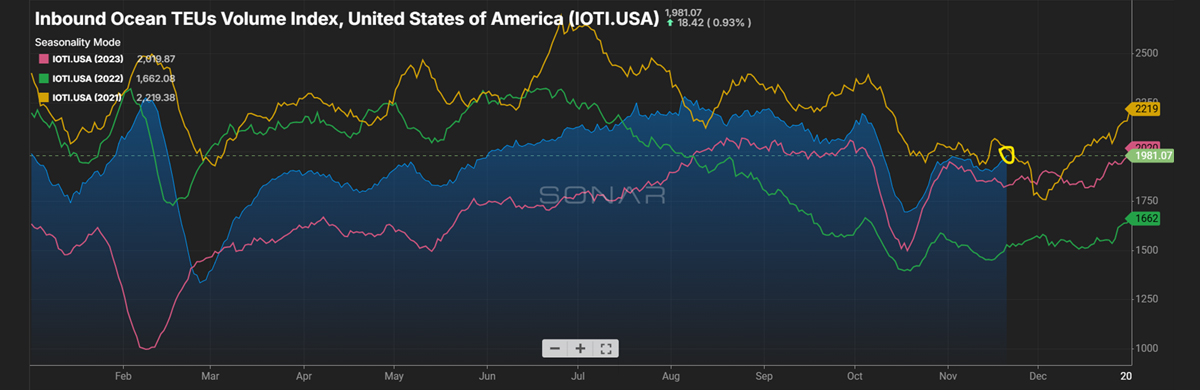

- Inbound TEU volume climbed back up as we head into the last few weeks of the year.

- Import forecast remains strong for November and December, both months calling for over 2 million TEUs.

- ILA port strike is put on hold until January 15th.

Canadian News

- Canada’s Minister of Labour intervened to end the Vancouver and Montreal port strikes. Unions plan on challenging the ruling but will most likely be unsuccessful.

- Inbound freight is surging with demand as well as rates are down, leading to an increase on the outbound rate side.

- Winter weather could lead to likely distribution in the upcoming months, that could cause re-routed shipments.

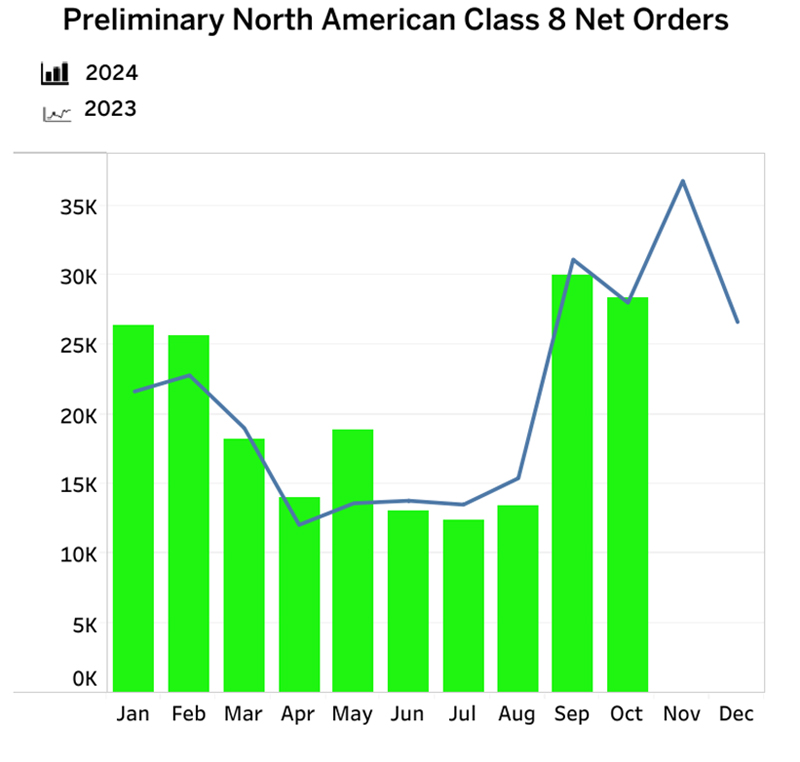

- Class 8 orders were down 14% in October vs. September.

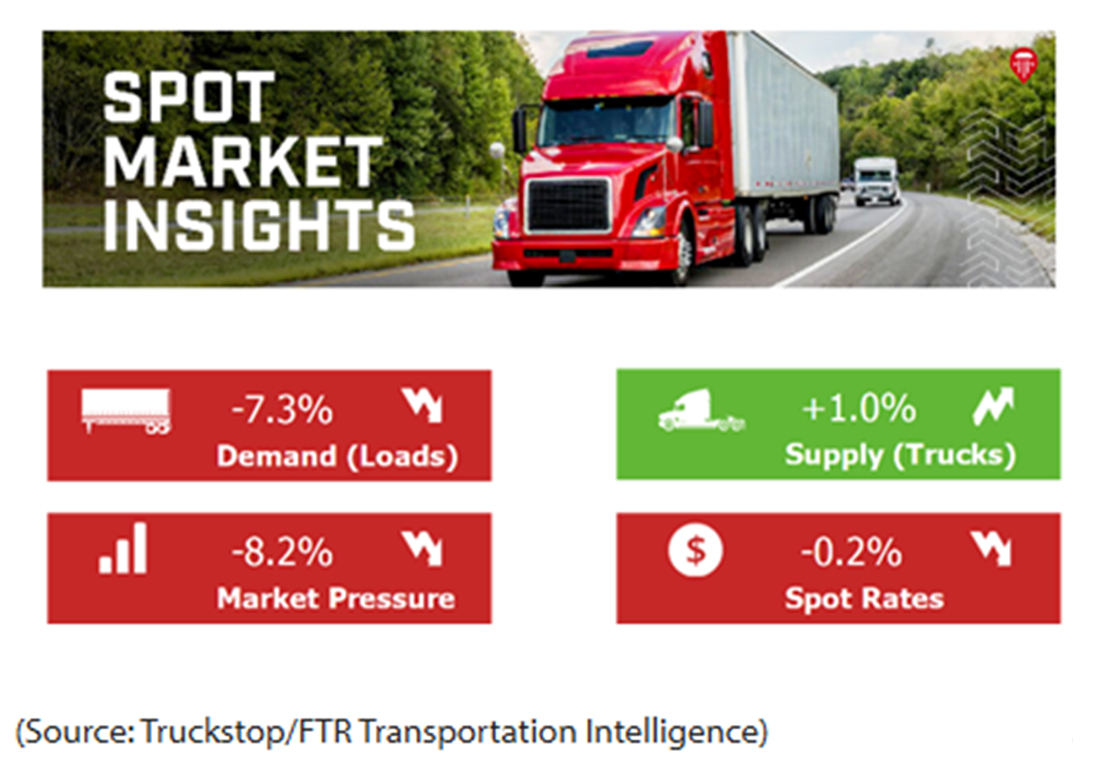

- Spot market rates remained relatively flat in October.

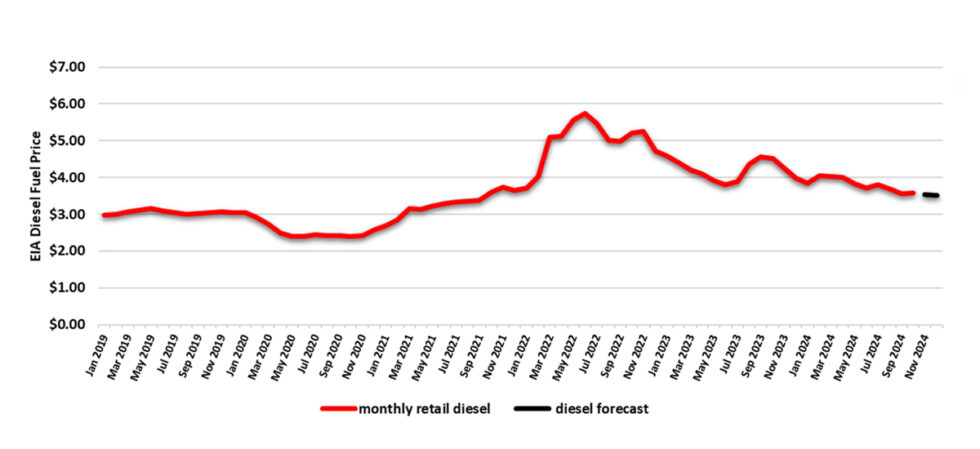

Fuel Forecast - DOE

Average diesel fuel retail prices for 2023 averaged at $4.214/gallon through Q4 2023 and Q1 2024 fuel finished at an average $3.973/gallon. Fuel for Q2 finished at $3.849/gallon & Q3 averaged $3.689/gallon. Q4 is forecasted to come in around $3.544/gallon.

Energy Information Administration Diesel Fuel Prices January 1, 2019 - October 31, 2024

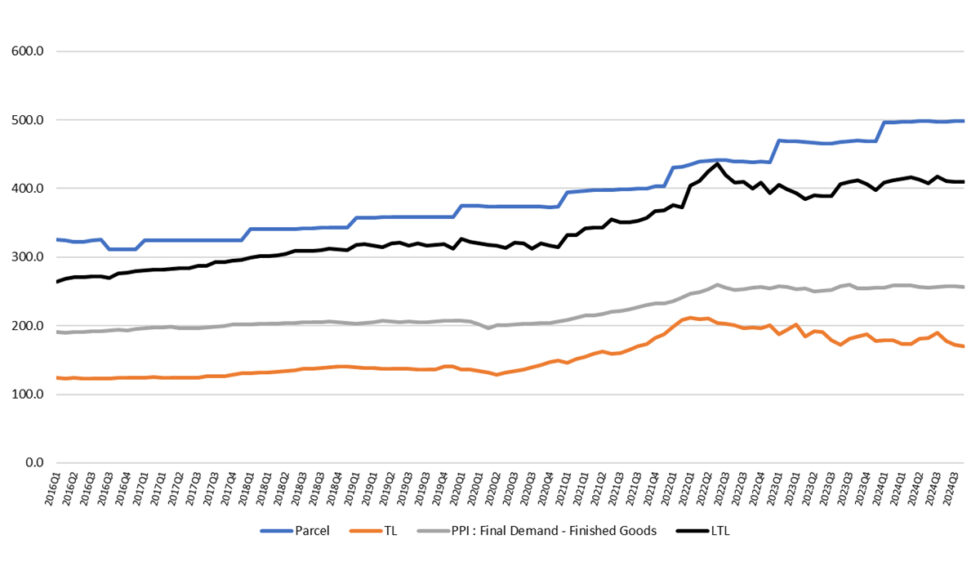

Price Index Performance: 2016-2024, By Quarter, Through October Q4 2024

State of the U.S. Transportation Market

What Does This Data Mean?

The Producer Price Index (PPI) is a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time. PPIs measure price change from the perspective of the seller. In other words, the PPI measures the trend of the cost of everything Manufactured in the United States.