August 2024

Market Update

Transportation Trends

General Outlook

- Labor market continues to add jobs.

- Jobless claims dropped 17k indicating some stabilization in the market.

- Inventory levels for customers remained jumped slightly over what we saw from June to July.

- Overall import volume increased, as we get closer to Q4.

- The Federal Reserve: Inflation still tracking to the 2% target, goal is to potentially cut interest rates in September if we keep on the same track.

LTL

- Saia looks to reopen 6 former Yellow terminals.

- Saia on pace to open 18 to 21 new facilities across the country this year.

- Roadrunner expands Canadian cross-border LTL service.

- In August the National Motor Freight Traffic Association (NMFTA) will be rolling out density-based classification for 3PLs.

- Shippers will soon have to know the weight and dimensions of all handling units.

- Proposed change will be issued in January of 2025 potentially to begin in May of 2025.

- Key Information for LTL shippers when requesting pricing.

- Dimensions, Class, NMFC numbers, & weights are critical to getting the correct price on the front end of your shipment.

- Shippers will soon have to know the weight and dimensions of all handling units.

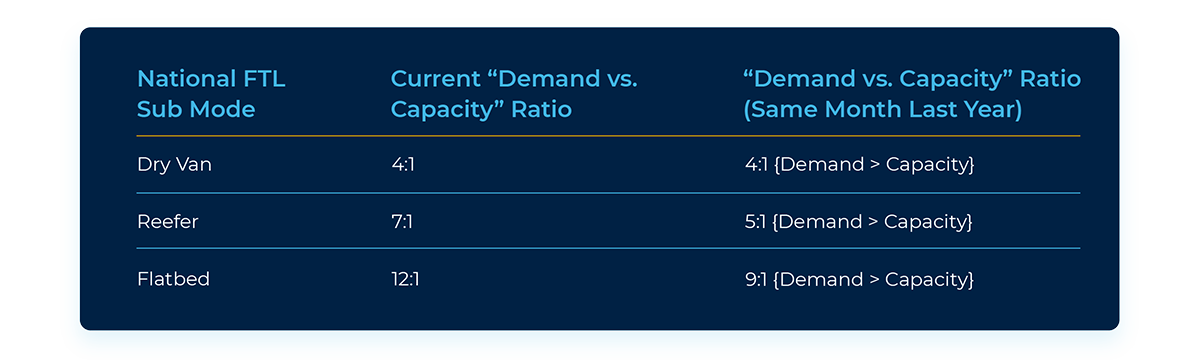

Truckload

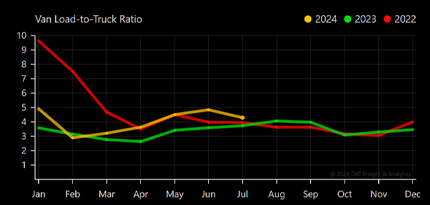

- Van spot rates were down 0.2% vs. this same time last year but up slightly 0.1% vs. last month. Capacity improved from last year same time by 14.9% and tightened by 11.5% vs. last Month. August Van contracted pricing is up $.38 per mile over spot market.

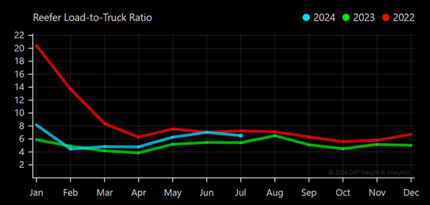

- Reefer spot rates increased slightly by 0.4% vs. this same time last year but remained flat 0.0% vs. last month. Capacity increased from last year this same time by 19.8% but decreased by 7.3% vs. last month. August Reefer contracted pricing is tracking up $.35 per mile over spot market.

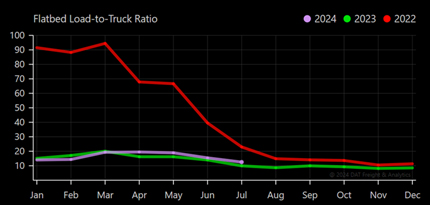

- Flatbed spot rates are down 2.6% vs. this same time last year, and down 1.4% vs. last month. Capacity increased by 25.4% vs. this same time last year but decreased by 18.9% over last month. August Flatbed contracted pricing is tracking up $0.67 per mile over spot market.

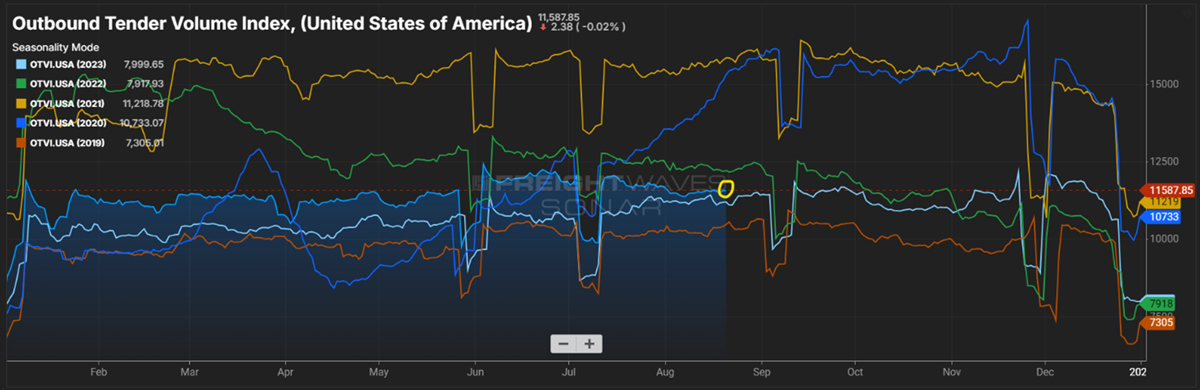

Outbound Tender Volume - All Modes

Demand still showing up vs last year. It’s important to keep a close eye on the outbound volume as we head into the start of Q3, Holiday season is right around the corner.

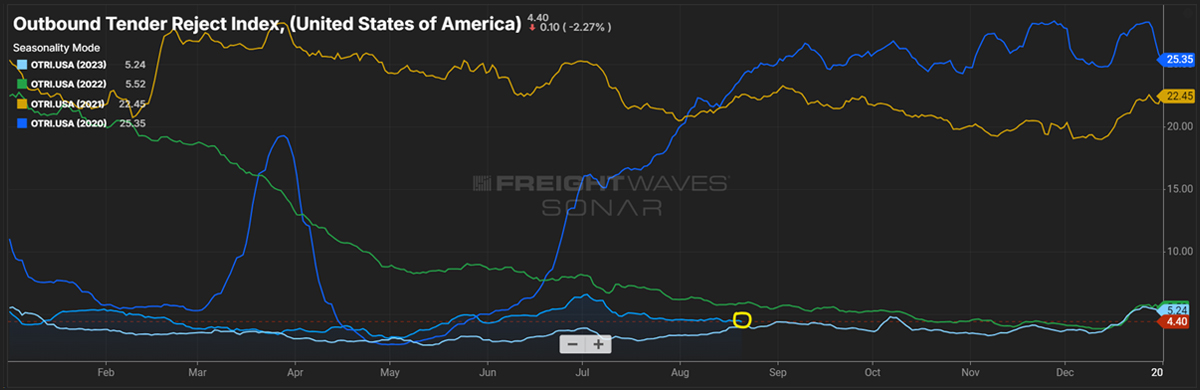

Outbound Tender Reject - All Modes

Overall Rejects still up over 2023 during this same time, but currently down in August 2.2% vs. July.

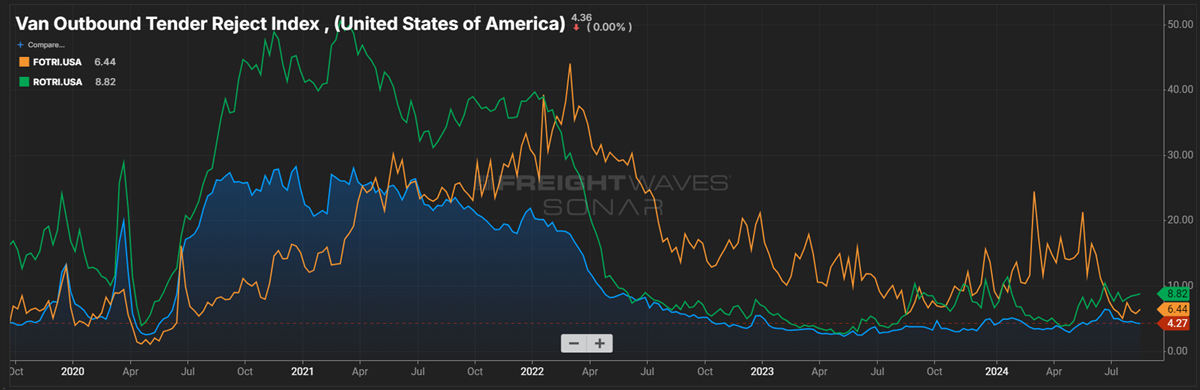

Outbound Tender Reject – by Mode

- Orange Line – Flatbed – Rejections have maintained steady through July into the 3rd week of August. Currently tracking well below the 21’/22’ rejection rate.

- Green line – Reefer – Rejections continue to climb slightly, which is to be expected during the summer months. Overall, the market remains stable with available capacity vs. previous years.

- Blue – Van – Van Rejections took a slight jump in June/July but have started to flatten out as we head into the 3rd week of August.

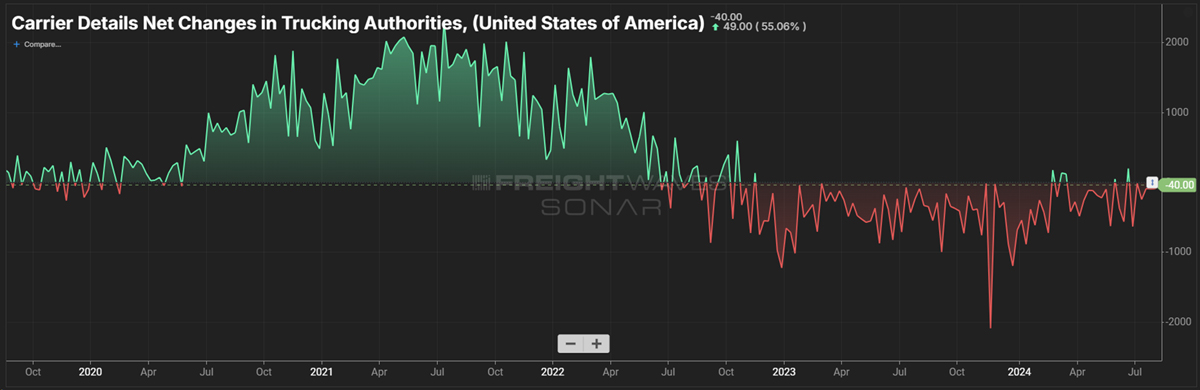

Carrier Authorities

- This graph indicates we have less transportation companies coming into the market based on the current demand.

- Carrier Authorities continue to drop into the summer months, which could have a negative impact if the overall outbound volume continues to climb into Q4 or Q1 of 2025.

Van Load-to-Truck Ratio

Reefer Load-to-Truck Ratio

Flatbed Load-to-Truck Ratio

International

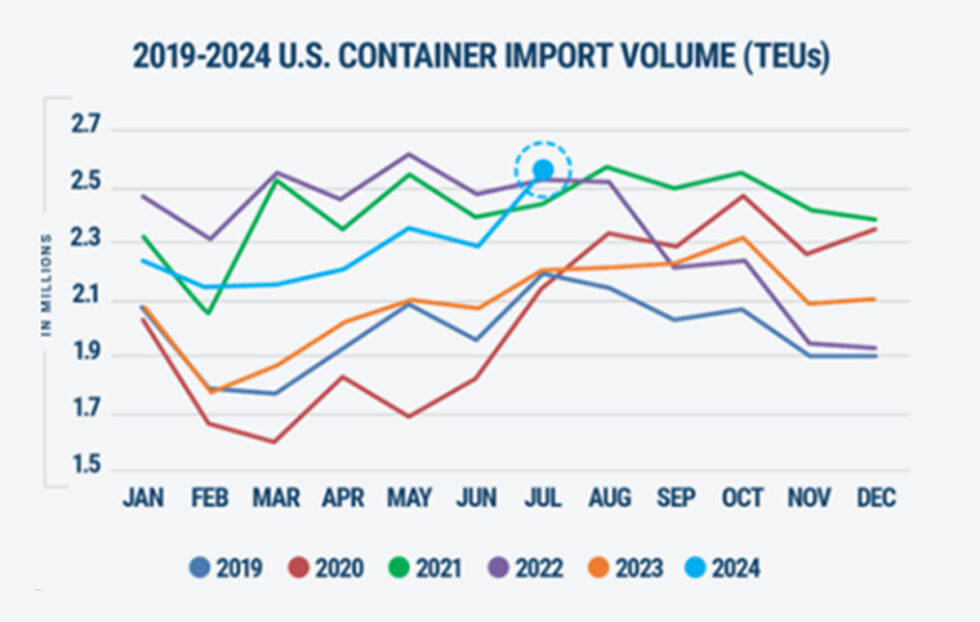

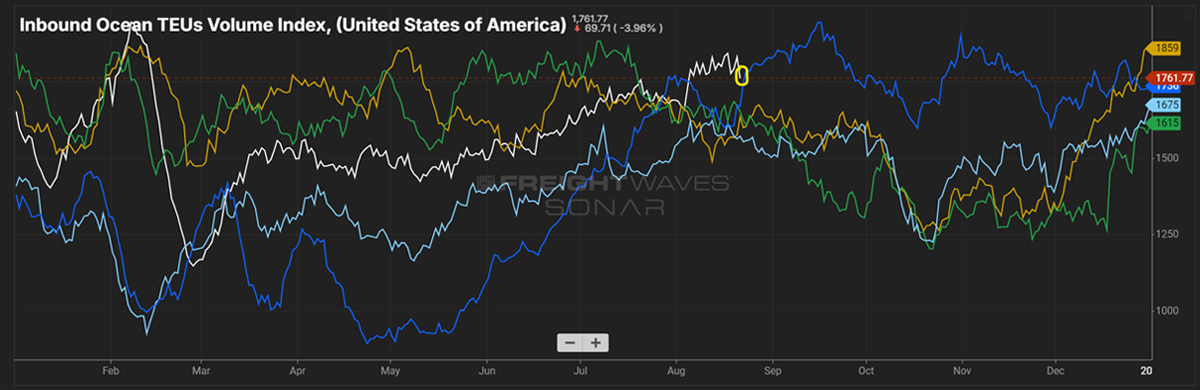

- US container import volume jumped up 11.2% in July over June and continue to climb in August. The spike in July is a 16.8% growth over July of 2023.

- Spot rates on the ocean side continue to remain high outbound of China.

- Weather and container capacity have been the biggest impact to the pricing.

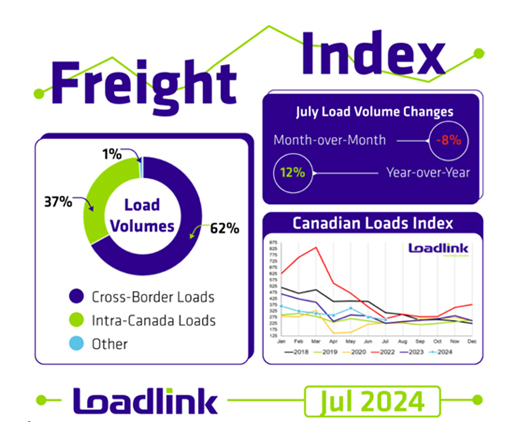

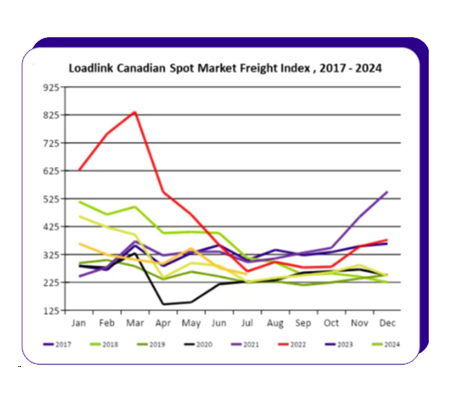

Canadian News

- Volume dropped 8% over last month, but still remains up 12% Year-over-Year

- Spot rates dropped slightly over last month by 1%.

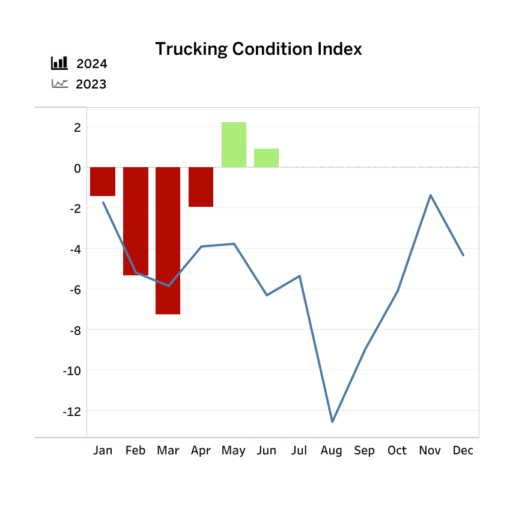

- Trucking index conditions (TCI) dropped from 2.24 in May to 0.95 in June.

- Higher financial cost and lower fuel offset the improving freight conditions.

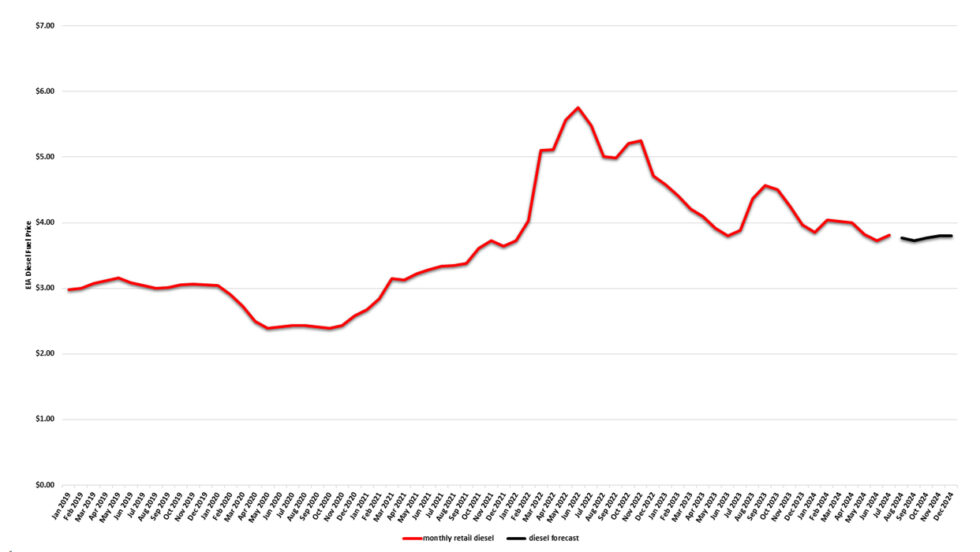

Fuel Forecast - DOE

Average diesel fuel retail prices for 2023 averaged at $4.214/gallon through Q4 2023 and Q1 2024 fuel finished at an averaged $3.973/gallon. Fuel for Q2 finished at $3.849/gallon, Q3 is currently averaging $3.769/gallon, and Q4 is forecasted to come in around $3.790/gallon.

Energy Information Administration Diesel Fuel Prices January 1, 2019 - July 31, 2024

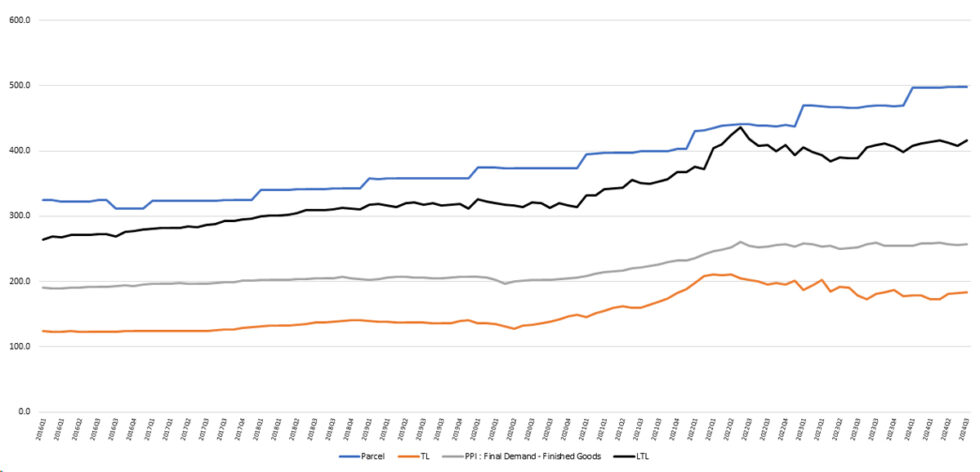

Price Index Performance: 2016-2023, By Quarter, Through July Q3 2024

State of the U.S. Transportation Market

What Does This Data Mean?

The Producer Price Index (PPI) is a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time. PPIs measure price change from the perspective of the seller. In other words, the PPI measures the trend of the cost of everything Manufactured in the United States